Ag economy entering deja vu-light version of 1980s, economist says

If U.S. farmers haven’t experienced it yet, they might be near the point of tougher negotiations when trying to secure an operating loan, reports Successful Farming.

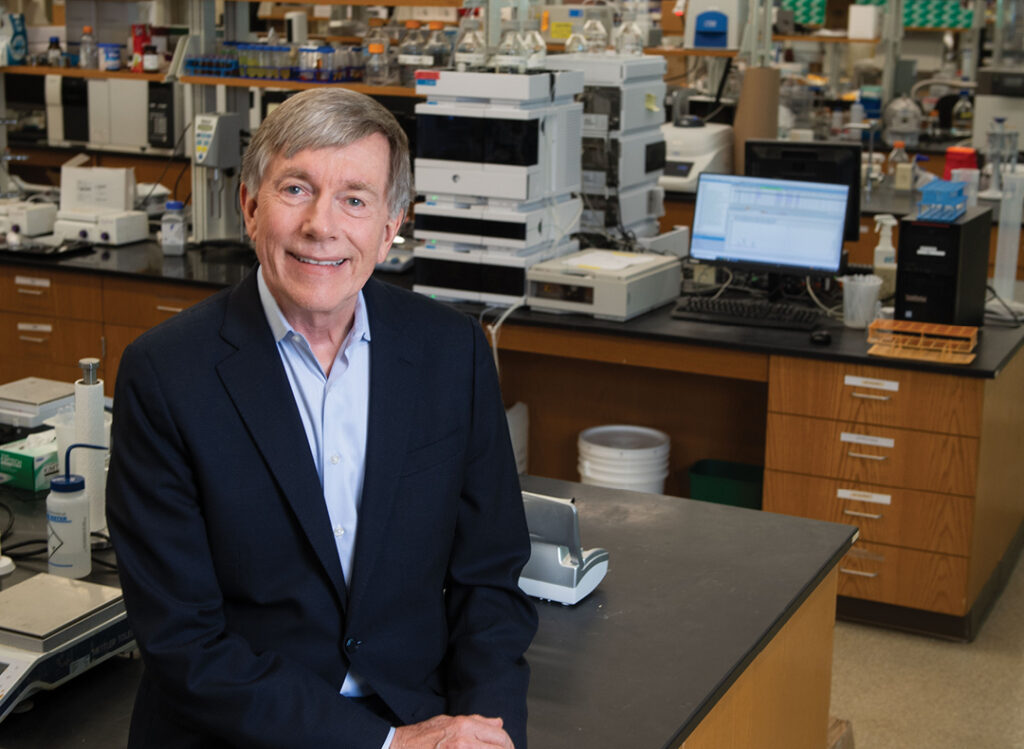

A former Federal Reserve Bank economist and current head of Purdue University’s Extension forecast a tough farm loan renewal season and a worsening trade and interest rate environment for agriculture at the National Agricultural Bankers Conference Tuesday in Omaha.

John Henderson sees similarities between today’s struggling farm economy and past farm crises.

The 1920s and 1930s farm bust followed higher interest rates to fight inflation after World War I and the Smoot-Hawley Tariffs of 1930 that triggered a global trade war. The farm credit crisis of the 1980s was fueled by record high interest rates and Russian trade boycotts. “I should have titled this presentation ‘Déjà Vu,’” Henderson joked.

Successful Farming also carried a report from Reuters that South American farmers plan to increase soybean production in a bid to take advantage of a curb on U.S. exports in the wake of an ongoing trade war with China, the world’s largest importer of soybeans.