Global Gridlock

Iowa looks for international trade rebound

PERRY BEEMAN Mar 7, 2019 | 5:42 pm

5 min read time

1,286 wordsBusiness Record Insider, Economic DevelopmentThe next few years will be critical to Iowa’s solid but perhaps underdeveloped export markets, and to shoring up international relations, export watchers said.

“The international markets are crucial to Iowa,” said Peggy Kerr, the Iowa Economic Development Authority’s International Trade Office team leader. “It’s important that relations [with trade partners] are maintained.

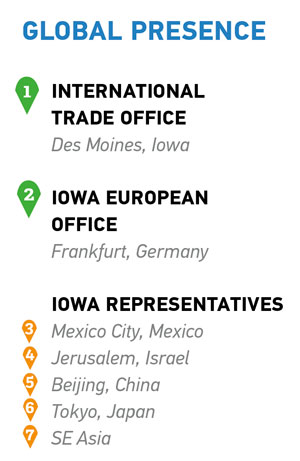

See story image for corresponding numbers and locations

“Business continues, regardless of the political climate,” Kerr said. “At the state level, we work to maintain and strengthen the sub-nation dialogue through continuous conversations with governments, consulates and international partners. It is extremely important to consistently show that Iowa is open for business. We continue to coordinate trade events and host delegations and routinely assist Iowa companies interested in doing business internationally.”

“We hope to increase our exports,” Kerr said. “We are a high-productivity and low-consumption state. We need to find corn importers in emerging markets.”

Kirk Leeds, CEO of the Iowa Soybean Association, said he is more optimistic now about reaching some kind of trade agreement with China and boosting exports in places like India and Egypt. But the trade war has done damage that won’t be completely reversible, he added.

“We are definitely looking for something more stable,” Leeds said. “This is a very challenging time.”

On China, Leeds said it appears an agreement eventually will bring higher soybean orders, but not at the level growers saw before. And he doubts the U.S. can overturn China’s practice of making U.S. growers compete against state-run companies. There may be some progress on persuading the Chinese to stop demanding that intellectual property is handed over before a company can do business there, Leeds said, but he added: “How could you even enforce that?”

“I think there is a general consensus that there will be some politically acceptable resolution” to tensions with the Chinese, Leeds said.

“I don’t believe we will ever get back that market, but we might get 60 percent,” Leeds said of China. Brazil and countries in Africa and Europe have stepped up production to make up for the U.S. soy that is subject to tariffs.

Leeds said the key will be a new pact with Japan that might help U.S. meat exporters, and soybean demand in India, which may not buy U.S. grain but will cause shifting that may open markets for more U.S. soybeans. The Philippines and Vietnam will also be key markets for U.S. commodities, he added. Argentina is even buying, because its most recent crop was short.

Iowa has been heavily in the mix in the current trade wars in which the U.S. has sought better deals with the likes of China. That has set off a tariff fight that has harmed markets for some of Iowa’s hallmark agricultural products, including soybeans and farm machinery. The state has trade offices in Des Moines and Frankfurt, Germany, along with representatives stationed in China, Japan, Mexico, Israel and Southeast Asia.

It hasn’t been a complete disaster, Kerr said. “What we are seeing is exports that were going to China are finding other markets.” For example, Egypt has now risen to No. 8 on the list of Iowa’s top export markets, buying mainly corn and soy.

And even China boosted its imports of U.S. manufactured and value-added agricultural products by 7 percent in November, Kerr said. (Statistics leave out much of the grain that goes down the Mississippi in containers for exports, she noted.)

A lot is at stake. A new state report notes that the number of jobs supported by Iowa exports grew to 93,941 in 2016 from 89,308 a decade earlier, up 5 percent.

Kerr expects continued growth in markets for Iowa’s top export — machinery such as tractors, cranes and trucks. She looks for gains in the meat, animal feed and cereal markets, too.

“The markets will shift” as the nation gets past the current trade tiffs and solidifies agreements with trade partners in Europe, Japan and elsewhere, she added.

Iowa State University economist David Swenson said the next few years will mean trying to re-establish trade ties with countries that have learned to get their U.S. goods elsewhere. It will be a long slog, but the recovery begins with new trade pacts, he added.

“The system was mostly humming along, with a few bad actors, like the Chinese who were stealing intellectual property. Then the Trump administration dropped a wrench right in the middle of the works,” Swenson said. “We expected increase in demand for pork in Asia, especially China. All of that is gone right now. So re-establishing relationships with China should enhance soybeans and enhance meat products, especially pork.”

Swenson said he’s optimistic that at least some of the market lost during the tariff tiffs can be reclaimed, but it won’t easy and it will take years, he said.

“We will not re-establish favorable trade terms and customers that we had a year and a half ago just because everyone normalizes,” Swenson said. “We have lost access. We have lost some markets. We have been replaced by other markets. There have been huge shifts because of the tariffs and retaliatory actions.

“I’m not optimistic in the near term, but I am optimistic that we will have significant shifting, especially with China” if an agreement is negotiated, he added.

Ryan Carroll, international trade manager at the Greater Des Moines Partnership, said things “are a little bit tenuous now,” but there are some good signs with China making at least a token additional buy of U.S. soybeans.

But repairing damage to Iowa’s agricultural commodities and related manufacturing industry will take some work, he agreed.

“A lot of political differences are barriers in the present term, but we have to ultimately find a way to get around that,” Carroll said. “We are producing way more than we need in Iowa, and we need markets.”

The world has something like 300 free trade agreements, and the U.S. is involved in 20 or 30, Carroll said. New pacts need to be negotiated, in his opinion.

“Our organization is a big advocate for free trade agreements,” Carroll said of the Partnership. “We supported the Trans-Pacific Partnership, but it fell apart,” leaving Iowa meat producers at a disadvantage in Japan and other countries, he added. TPP guided trade in a dozen countries, but lost favor in the current administration’s work to ensure the United States is getting a fair shake from its trading partners.

“Scrapping the TPP was a net negative for Iowa,” Carroll said.

The top exports from Iowa are machinery, vehicles, meat, cereals, food waste and animal feed. Again, the data don’t include bulk grain shipments by river and sea.

Biofuels — another market for grains — are another promising product as Iowa looks to increase sales.

There is movement on value-added excavation equipment, too. “Some companies have broadened their landscapes,” Kerr said. “Some have started looking at small-scale farm equipment” for Third World applications.

Meat exports are facing concerns on tariff issues, and the U.S. faces challenges dealing with countries that have current trade agreements with Japan and therefore sidestep tariffs, Kerr said. The Trump administration withdrew from key trade agreements in hopes of negotiating better deals in that part of the world. Until new deals are struck, “U.S. meat is at a disadvantage.”

IEDA will continue to push for new markets through trade missions, Kerr noted. For example, a trip is planned to Vietnam and the Philippines for companies in manufacturing, meat products and agriculture March 15-23. IEDA notes South Asian markets are growing at more than 7 percent per year.

The state has plans for representation at events in China, Colombia, Panama, Jerusalem, Tokyo, Korea, Taiwan, London, Munich and Hanover, Zurich, Ukraine, and Canada.