Working from home taking its toll on state’s Road Use Tax Fund

With fewer people commuting to work each day, local governments are closely watching their budgets, preparing for possible cuts or delays in projects should the work-from-home trend continue as the coronavirus pandemic wears on.

The reason? Fewer people driving means fewer people buying gas. Because they’re buying less gas, fewer taxes are being collected on that gas. And that means less money is going into the state’s Road Use Tax fund, where state gas tax collections make up the largest portion of the fund, at 39%. The rest of the fund is made up of annual vehicle registration fees (36%) and new vehicle registration fees (20%), the 5% paid when a new vehicle is purchased.

A recent report from the Iowa Department of Transportation to local city and county governments statewide showed a projected 10% reduction in Road Use Tax Fund allocations from June 2020 through October 2020, mostly from the decreased traffic on Iowa roads as more people stay home to work. From November 2020 through June 2021, the decrease is forecast to shrink to about 8%.

Stuart Anderson, director of the Iowa DOT’s planning, programming and modal division, said the state generally estimates about $1.7 billion a year in road funding. When things began to close down as the pandemic spread across Iowa, the volume of traffic that would help contribute to the road fund plummeted, he said.

“We saw a very dramatic drop in vehicle travel in the state of Iowa early on, in late March and April, as people stayed home and self-isolated,” Anderson said.

The DOT has 120 traffic counters across the state, providing real-time information on traffic counts.

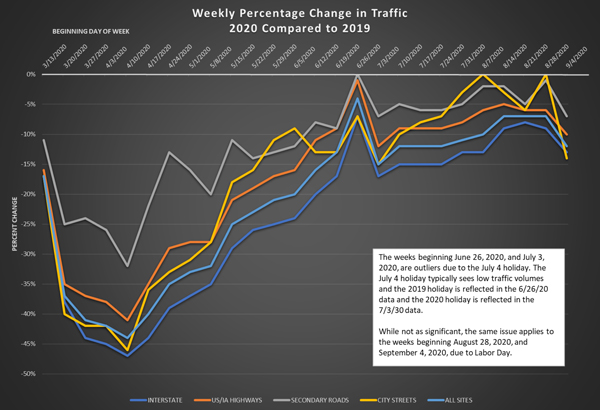

“So every day since the pandemic started, we’ve been updating our website showing how the previous day’s traffic was, compared with the equivalent day in 2019,” Anderson said. “This has been really helpful information to track how travel has been impacted by COVID-19. And not surprisingly, mid-April was the biggest drop in traffic; we were down 44% from the equivalent week in 2019.”

Since then, traffic counts have steadily increased but have leveled off in recent weeks, Anderson said.

“In general I’d say we’re about 10% below 2019 levels, so that means we have a 10% reduction in fuel tax revenue,” he said.

Iowa drivers pay a tax of 30 cents a gallon for gasoline and ethanol blends less than E15, and 24 cents per gallon for E15 gas.

Anderson said that 10% decline isn’t uniform across the state, with interstate highways seeing greater declines in traffic.

“In particular, some of our commuter routes have seen sustained significant drops in traffic, and (Interstate) 235 is a good example of that,” he said. “We have one traffic corridor on 235, and their traffic has stayed pretty consistently about 20% below 2019 levels, which, again, that’s not necessarily surprising as a lot of the workers downtown are still remote working.”

According to Anderson, the decline in traffic counts is tied entirely to passenger vehicles.

“The semi trucks, those traffic levels have stayed relatively consistent or even higher than 2019 levels,” he said. “So that definitely means that freight is continuing to move across the country.”

Another factor in the decline in Road Use Tax Fund allocations is the registration fees when a new vehicle is purchased.

“They really dropped dramatically in April,” Anderson said. “In April, they were down over 50%. Now what we subsequently have learned is that was a combination of vehicle sales being lower than 2019, but also that the counties weren’t processing vehicle transactions that occurred in April as quickly as they normally would because their workforce was impacted by the COVID-19 restrictions. So we saw a little bit of a double whammy, both in the actual drop in vehicle sales and then a slowdown in processing transactions.”

Anderson said those numbers spiked in June way above prior-year levels as counties began to catch up.

“When you smooth out those anomalies, we’re down a little less than 20% from 2019 levels,” he said. “That’s a 20% drop in a revenue stream that makes up about 20% of the Road Use Tax Fund.”

The annual vehicle registration fee wasn’t significantly affected by the pandemic, he said.

For some local governments, the decline in Road Use Tax Fund allocations has officials watching their budgets in case adjustments need to be made.

In Warren County, the 10% reduction translates into between $400,000 and $500,000.

County Engineer David Carroll said it’s possible that a couple of bridge replacement and bridge repair projects, and some equipment purchases, may have to be delayed until next fiscal year if things don’t improve.

Carroll said staff will have to remain flexible in case other events develop that would cause a strain on the budget.

“I think you hope for a good year weather-wise, where we don’t have flooding or major snow events that would be an additional detriment to the budget,” he said. “We don’t want these things to stack onto each other this year, because there might not be a lot of leeway to shift things around.”

Polk County Engineer Kurt Bailey said the reduction in Road Use Tax Funds for Polk County would be about $600,000. The effect on Polk County would likely be minimal because favorable bid results on various projects would likely offset the difference, he said.

Anderson said, “The $64,000 question is, how long does this continue?

“I think we were expecting reduced travel for quite some time,” he said. “A lot of people are continuing to remote work, and that may just be permanent in a lot of situations. So I think we’re expecting a sustained reduction, but that reduction won’t be as significant as we initially feared.”

Anderson, who has worked for the Iowa DOT for 29 years, said while there have been other times in the past where Road Use Tax Funds have been affected, “nothing has come close to this.”