The Jobs Issue: Outlook ’17

Steady. Modest raises, tight workforce

PERRY BEEMAN Nov 11, 2016 | 12:00 pm

9 min read time

2,244 wordsAll Latest News, Business Record Insider, Economic DevelopmentSteady.

That’s about as short a synopsis as we can give for the 2017 jobs outlook after speaking with employment agencies, economists, the Iowa Business Council and others.

Most expect to see pay raises in the 3 to 4 percent range across many industries. There might be pressure to offer more in technical fields, but even in those job hunts, the negotiations might be more about offering flex hours, or work-at-home or a shorter workweek. Many employers now are deciding to send even more information technology jobs to foreign contractors rather than get into bidding wars for workers here.

“It’s going to be steady as she goes,” said Craig Jackman, president of Paragon IT Professionals.

Iowa State University economist David Swenson said he expects solid manufacturing levels with little growth, a continued soft ag market, and typical slow-growth economy in Iowa.

“In Iowa, since mid-2013 the economic growth rate has slowed somewhat from the national average,” Swenson said. “We kind of tailed off. We are just rigged to grow more slowly. And the ag market affected that. There is a little softness in Iowa.”

One thing is clear: Employment firms are going to stay busy, and some are close to record levels.

“It’s a whirlwind out there,” said Mike Gremmer, regional vice president at Robert Half. “It continues to be a really candidate-driven market. We have an excess of job orders and a continued talent war in finance and information technology.”

David Leto, executive vice president at Palmer Group, said his company was on track to threaten business records as 2017 approached.

The Iowa Business Council expects a climate that favors workers in negotiations.

“Generally there is still a strong need for workforce, with the ‘seller’ being in charge here,” said Elliott Smith, executive director of the Iowa Business Council, which represents the largest Iowa companies. The CEOs will say workforce needs will start the year on a fairly strong level. To attract staff, employers need to maintain if not improve compensation and benefits.

Smith agrees that the agricultural economy will continue to be a drag on things in general.

“The ag-related companies are feeling it a little bit more after two or three years,” Smith said. “That is producing a softening of their markets. Overseas sales activity is soft due to the strong dollar. There have been some layoffs and level employment.”

Included in those layoffs have been a workforce cut of at least 10 percent at DuPont Pioneer as DuPont prepares to merge with Dow Chemical Co. The owner of The Des Moines Register just cut another 2 percent of its workforce nationally, which included cuts in Des Moines.

Jackman is betting on the steady, modest growth we’ve seen lately.

“I think we’ll see the incremental growth we’ve been seeing,” he said. “I think the salaries will go up. The labor shortage is the biggest issue. One of the solutions to the labor shortage is to pay more. Our clients see that every day. They aren’t negotiating down — let’s put it that way.”

He added: “We are taking a more active role in educating them on what they should do. We know what their competition is out there. What are our clients doing to succeed? I’ve had them ask, ‘Who is doing this best, and how?’ ”

Raises

Palmer expects many firms to give raises in the 3 to 4 percent range, based on its annual salary survey, said Leto. The percentage of companies giving no raises is expected to fall, while the share of raises that are in other ranges most likely will rise.

Specifically, Palmer’s survey found that 57.3 percent of employers plan to give raises of 3 to 4 percent in 2017, up nearly 2 percentage points from this year. Another 10.3 percent, up more than a percentage point, plan to give 5 percent raises or more. The percentage planning 1 to 2 percent raises gained slightly, to 26.4 percent. Those expecting to give no raises stood at 6 percent, down 3.6 percentage points.

“In the tight labor market that exists in central Iowa, technical and nontechnical disciplines are in demand, especially midlevel roles,” Palmer reported after its survey. “The feedback Palmer Group has received from those that completed our 2017 salary survey is that their focus for 2017 is to reward top performers at a much higher level of salary increase than they may have provided in years past.”

Mark Craiger, director of business development at Paragon, expects some variety.

“Every company is different,” Craiger said. “There are companies in Des Moines that make billions of dollars in profits and only give a 2 percent raise, and there are companies that break even and give a 4 percent raise. That’s a challenging question.”

Said Jackman: “We aren’t seeing what we did in ’99 or 2000 when people were getting raises all the time. We haven’t seen a lot of sign-up bonuses. I think we’ll see 2 to 4 percent raises.”

ISU’s Swenson said urban areas such as Greater Des Moines are seeing solid employment, with some strong competition for workers. “The first two quarters showed we are getting real gains in wages,” he said. “They are at or better than inflation. The market has tightened up enough in some sectors that we are seeing bidding up of salaries, especially for highly skilled workers.”

Robert Half’s national survey predicts that some of the biggest jumps in salary will be for data scientists, at 6.4 percent; big-data engineers, 5.8 percent; and network security engineers, 5.7 percent. Also looking at increases of 5 percent or more will be database and software developers, web designers, data security analysts, and software engineers.

Hiring

“Companies will continue to expand,” Palmer’s Leto said, noting one possible exception. “Companies in ag will be careful still. Crop prices are still low.”

Demand for skilled construction workers and engineers will be up, he added. With construction booming in Greater Des Moines, we’ve heard often that it’s tough to hire enough electricians, plumbers, carpenters and the like. Leto hears it all the time.

“People are driving one to two hours to work labor jobs here” because companies are looking out of town for help, Leto said.

In Palmer’s salary report, Leto wrote: “Organizations are seeking ways to retain talent as turnover of key employees is expensive to the bottom line and the overall morale in the office. These retention strategies are not new to our market, but they are becoming more typical with work from home time, reduced schedules, and additional training and development being offered.”

With low unemployment, job orders are rising, as are placements. New companies are calling Palmer.

At Paragon, the staff is seeing some companies decide to send more jobs out of the country rather than get into a workforce bidding war.

There seems to be some reluctance to get out the checkbook, even in the face of worker shortages.

ManpowerGroup’s national research found that 46 percent of employers are having a hard time filling vacancies, the highest percentage since 2012, when 49 percent reported difficulty.

The toughest fields in which to hire are the skilled trades (electricians, carpenters, welders, plumbers, etc.), drivers, sales representatives, teachers, and restaurant and hotel staff, ManpowerGroup reported. The biggest share of respondents, 23 percent, said the problem is a lack of applicants, with 18 percent citing lack of experience among job-seekers, and 16 percent noting a lack of technical skills.

With that kind of trouble, it’s no surprise that 48 percent of respondents told ManpowerGroup they are trying to train existing employees to fill open positions, and 44 percent are recruiting outside the talent pool. Interestingly, just 22 percent said they offer better pay to persuade recruits, and 19 percent offered better benefits.

Retention

Leto said for many companies the focus is going to be on retention as much as on hiring. With competition fierce in some categories, look for more flex time, work-at-home arrangements and liberal sick time.

“Companies are going to be focused on keeping people,” Leto said. Palmer’s report said this about the information technology field: “Companies have never worked harder to attract and retain their top technical talent.”

Leto said he expects to see a moderate increase in median incomes, “but nothing crazy.” He expects more contract and temporary positions than before.

Some companies are trying to sidestep the talent wars by moving even more jobs out of the country, Leto said. Another technique: hiring interns.

For example, “The demand for (information technology) workers is high, but not as high as it was last year,” Leto said. “Companies are watching their cash. Still, developers who are U.S. citizens could expect multiple offers, and contract work could increase significantly, he added.

Jackman, from Paragon, said the heat on the workforce will continue the pressure to ease immigration laws. “We aren’t producing enough of the technical professionals. We have not yet found the solution to providing more computer science people at high schools and colleges.”

“Creating ways to keep people is important,” Jackman said. “Freelancers are important. The labor shortage is about a skills gap. Technology is changing. Keeping skills up is the most challenging thing to do. Boot camps may be important.”

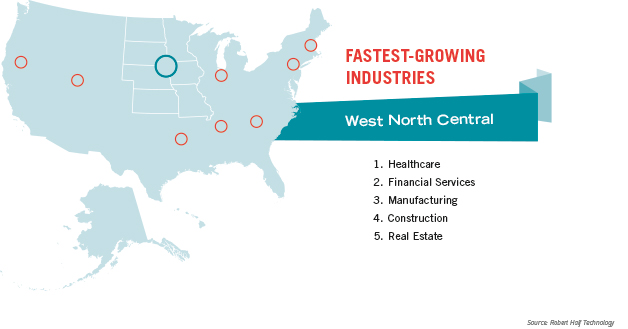

Robert Half reported that companies in Iowa, Minnesota, the Dakotas, Nebraska, Kansas and Missouri will be particularly in the market for .NET developers, web developers, systems administrators, software developers and help desk workers among technology fields.

These, Robert Half reports, will be the fastest-growing industries: health care, financial services, manufacturing, construction and real estate.

Perks

Expect some slightly increased spending on training and development, work at home arrangements, and shorter workweeks, Leto said.

Said Jackman: “I think the health care thing has been a real challenge; that’s going (down). So you see other perks like flextime, remote work. I think the employers are trying to be creative with how to attract and retain workers. Employee stock ownership programs is another perk that is growing.

Added Bill Dotson, Paragon’s account executive: “We still have employers who are resistant to remote work. They just want to see the whites of their eyes. I don’t know if it’s trust so much, but it’s the Iowa values and being able to meet people face to face and see them on a daily basis. That gets lost sometimes. Some people aren’t there yet. But across the country I think you are seeing more and more employers being open to remote employment because attracting top talent — sometimes the talent’s not here and we have to go outside of the market to find it, and sometimes that will lead to that discussion.”

“In the last 10 years, we’ve probably seen that people have done flextime and casual dress,” Jackman said. “We’ve done kind of the low-cost, high-value things. Now we are looking for more, and there really isn’t much more to give.”

Some Des Moines-area companies have looked at shortening the workweek, Jackman added.

Jobs insight from Iowa Business Council’s third quarter survey

The Iowa Business Council’s third-quarter survey of top executives of Iowa’s 21 largest businesses, representing 250,000 employees, found that 63 percent listed “attracting and retaining a quality workforce” as a primary challenge. And more than half, 53 percent, listed “unfavorable business climate,” including taxes and regulations. Those were by far the top two. Other concerns were a weak economy, cost of inputs, health care costs and access to capital.

Overall picture

Members of the Iowa Business Council were 2 percentage points less optimistic about economic activity than they were a year ago, with an index of 57. The historic high was 68 in 2012, and the low was 35.3 in 2009.

Capital spending

Capital spending sat at 56 on the business council’s index in the third quarter, six points behind the previous quarter and three points lower than in that period last year.

More than a third of the council’s corporate members expect higher capital spending in early 2017. Another 19 percent expect decreased spending.

Employment

The business council’s employment index was 56 in the third quarter, five points behind this time last year. Though no one expected substantially higher hiring, 38 percent expected some level of added hiring. Another 19 percent expected lower employment.

Sales

The Iowa Business Council survey found that 43 percent of respondents expected higher sales into early 2017, while 48 percent expected no change and 10 percent predicted lower sales. Those numbers were down significantly from the second quarter. A total of 43 percent expected higher sales over the next six months.

“It wasn’t a matter of red flags going up,” said Elliott Smith. “Mostly it was because of the strong dollar,” which hurt overseas sales.

Manufacturing

Smith said the Iowa Business Council expects less than a banner year. “In manufacturing, we see less aggressive production because of weaker international markets. The strength of the dollar is affecting goods sales overseas. There doesn’t seem to be an employment impact, except in agriculture.”

ISU economist David Swenson’s list of careers that gained from 2008 to 2015, based on federal statistics:

- Health care and social assistance

- Professional and technical services (IT, HR, accounting, etc.)

- Management

- Agriculture, forestry, fishing and hunting

- Transportation and warehousing

- Construction

- Accommodations and food services

Top losers:

- Manufacturing

- Information

- Wholesale and retail trade

- Arts, entertainment and recreation

Robert Half Career City Index:

No. 10: Des Moines’ overall rank

No. 6: Cost of living

No. 7: Quality of life

No. 11: Career prospects

No. 21: Cultural diversity