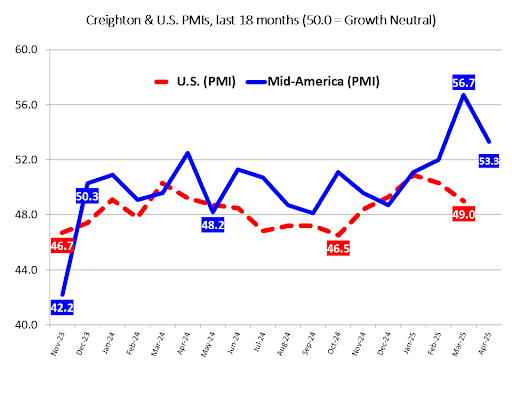

Mid-America business index down but above growth neutral

The Creighton University Mid-America Business Conditions Index came in at 53.3 for April, down from March’s 56.7. The index is above the growth neutral reading for the fourth consecutive month; in February it reached 52.0, in January it sat at 51.1 and in December was 58.7.

The index uses the same methodology as the Institute for Supply Management and ranges between 0 and 100, with 50.0 representing growth-neutral. The Creighton index is produced independently of the ISM and is based upon a monthly survey of supply managers in a nine-state region reliant on industries such as agriculture and energy. States included in the survey are Arkansas, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Oklahoma and South Dakota.

One supply manager surveyed was quoted in the report as saying, “The uncertainty [surrounding tariffs] is paralyzing.”

Of note from April’s report is the employment index, which fell to 44.9, the lowest it’s been since November. Meanwhile, the wholesale price index rose for the seventh straight month to its highest reading since May.

“The Creighton survey is recording significant volatility, much like other regional economic measures. Proposed and implemented tariffs are not only producing economic volatility but are damaging supply managers’ economic outlook and pushing input prices higher,” Ernie Goss, director of Creighton University’s Economic Forecasting Group and the Jack A. MacAllister chair in regional economics in the Heider College of Business, stated in a press release.

Goss expects no change in short-term interest rates at the Federal Reserve’s next meeting on May 6-7, as a result of slowing growth and upward inflationary pressures.

Regional data

The regional economy exported $14.7 billion in manufactured goods for the first two months of 2025, compared to $15.3 billion for the same period in 2024, for a 4.2% decline, according to U.S. International Trade Administration data.

Employment: The April employment index at 44.9 was down from 67.6 in March.

“First quarter employment was pushed higher due to higher production in anticipation of the fallout from tariffs later in the year. April’s reading represented a return to manufacturing job losses in the region,” Goss said.

As reported by one supply manager in April, “Employees are concerned about the economy and their jobs.”

U.S. Bureau of Labor Statistics data show that the region shed 11,900 (-0.8%) manufacturing jobs over the past 12 months. The U.S. lost 74,000 (-0.6%) manufacturing jobs over the same time period.

Wholesale Prices: At 65.0, it’s up from 63.7 in March.

“The regional inflation yardstick has clearly moved into a range indicating that inflationary pressures are moving higher. Even so, I expect the Fed to leave interest rates unchanged at its next meetings on May 6-7,” Goss said.

Approximately 65% of supply managers reported that rising tariffs and supply chain interruptions have resulted in higher input prices.

Roughly 85% reported impacts from tariffs, either via higher prices or supply chain interruptions.

As reported by an April survey participant, “Some companies will push through price increases. Some won’t be able to due to the elasticity [responsiveness] of demand.”

Confidence: Looking ahead six months, economic optimism, as captured by the April Business Confidence Index, sank to 35.3, its lowest reading since September 2024, and down from 37.5 in March.

“Due to concerns regarding global economic tensions and rising tariffs, only one in four of supply managers expect improving business conditions over the next six months,” said Goss.

Inventories: The regional inventory index, reflecting levels of raw materials and supplies, expanded to 56.7 from March’s weak 32.5.

“In order to front-run tariffs, firms have expanded inventories for three of the first four months of 2025,” Goss said.

Approximately 21.1% of supply managers reported that higher tariffs have pushed their firms to switch suppliers for a share of their inputs.

Trade: Recent uncertainty regarding tariffs and trade restrictions pushed trade numbers lower for April. New export orders dropped to 46.2 from 52.6 in March. As result of record imports for the first two months of 2025, supply managers pulled back on purchasing from abroad in March and April. The April import index fell to a record low of 12.5 from March’s 32.6.

According to ITA data, the regional economy exported $14.7 billion in manufactured goods for the first two months of 2025, compared to $15.3 billion for the same period in 2024, for a 4.2% decline. In terms of export gains, Oklahoma registered the top gain with a 11.4% addition, and South Dakota recorded the largest loss with a 24.5% reduction in the export of manufactured goods.

Other survey components of the April Business Conditions Index were: new orders declined to 52.9 from 55.9 in March; the production or sales index was unchanged at 55.4; and the speed of deliveries of raw materials and supplies increased to 56.8 from March’s 56.0. Higher readings indicate rising supply chain disruptions or delays.

Other comments from supply managers in the April report include:

- “While the tariffs seem painful, it is my opinion that this approach is the correct reset. The social economical great reset is theft and power.”

- “If the U.S. doesn’t curb the Chinese ambitions, we will all be speaking Mandarin and Cantonese in the next decade! The unrest in the world today was created and is being perpetuated by China, Russia, Iran and other bad actors.”

- “The Chinese want to control Taiwan to keep U.S. influence out of the region with Japan and other smaller nations in their crosshairs. The U.S. is the only one capable of restoring global order with the support of its allies. The global economy will get worse before it gets better!”

- “The impact of the tariffs is just starting to be realized. Changes will be made now that the actual dollar impact is known.”

Iowa data

The state’s Business Conditions Index for April declined to 53.0 from 56.3 in March. Components of the overall April index were:

- New orders at 52.6, down from 55.9 in March

- Production or sales at 54.9, up from 54.8

- Delivery lead time at 57.1, up from 56.2

- Employment at 44.0, down from 66.9

- Inventories at 56.6, up from 47.9

According to ITA data, the Iowa manufacturing sector exported $2.3 billion in goods for the first two months of 2025, compared to $2.6 billion for same period in 2024, for a 12% reduction.

Gigi Wood

Gigi Wood is a senior staff writer at Business Record. She covers economic development, government policy and law, agriculture, energy, and manufacturing.