Principal index: Confidence at 4-year low

Business Record Staff Jun 6, 2025 | 11:43 am

2 min read time

564 wordsAll Latest News, Banking and Finance

The latest Principal Financial Well-Being Index has been published and sits at 6.02 a drop from 7.8 in November. That’s the lowest score since November 2020.

The index is scored on a 0 to 10 scale, with 0 reflecting no confidence in business health and 10 reflecting complete confidence. The index is based upon surveys of business owners, leaders and decision makers.

Highlights of the index include:

- While the drop in optimism is similar to economic conditions during COVID, one major difference is employers plan to retain staff instead of laying off workers.

- While just 16% of employers believe the U.S. economy is currently growing, a 24-point decline from June 2024, most remain cautiously optimistic about their own business performance. 56% report business growth, while 29% believe their local economy is growing. Both of those figures have declined steadily since late 2024, pointing to a broader pullback in optimism.

Small and midsized employers remain stable, while their concerns about growth and the future are at levels not seen since the COVID-19 pandemic in 2020, the study showed. The small-to-midsized business index — calculated on perceptions of financial health, year-over-year comparisons, and future business and economic outlook — dropped 14%, from 7.38 to 5.69, marking the steepest decline on record in the Index. Historically, businesses of this size have remained locally focused and somewhat insulated from broader economic volatility. But current data shows that macroeconomic uncertainty is increasingly shaping decisions on Main Street.

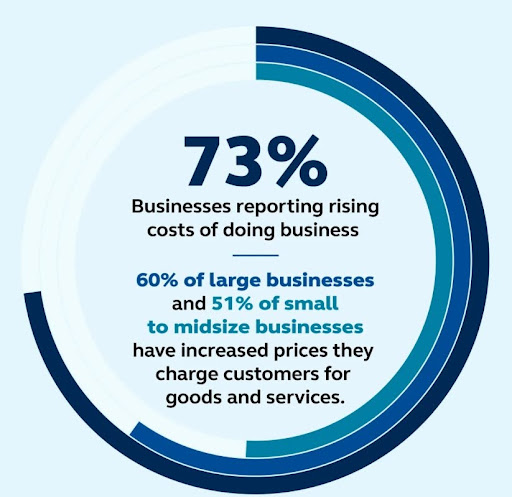

The Index shows growing concern among SMBs about the state of the U.S. economy, with more than half describing it as either declining (49%) or struggling (5%). Top concerns include:

- Health care costs (58%)

- Economic inflation (55%)

- U.S. economic stability (55%)

- Possibility of a recession (49%)

These issues are taking a toll on optimism, with just 36% of SMBs reporting they are optimistic about the year ahead, a sharp drop from 59% in November 2024.

“Uncertainty is pulling business owners out of a growth mindset and into stability mode,” Amy Friedrich, president of Benefits and Protection at Principal, stated in a press release. “After months of delays and mixed signals, what this market craves is certainty. Clear, sensible moves on tax and trade policy will give Main Street the confidence to move forward.”

Staffing trends

A full 90% of businesses in the report say they’re either maintaining or growing their workforce. Instead of resorting to layoffs, employers are focusing on operational efficiency. Nearly one in five (18%) are implementing cost-control measures, while 13% are making targeted staffing adjustments through selective hiring, reorganization, or enhanced retention efforts. Others have adjusted supply chain strategies to navigate ongoing logistical and materials challenges.

“Businesses haven’t forgotten the hard lessons of the pandemic era. They’re doing everything they can to preserve staffing, benefits and wages because they remember just how difficult it was to attract and retain talent as they began to ramp up their growth after the last economic downturn,” Friedrich stated.

While staffing remains steady, additional challenges and considerations remain. The rising cost of health care (58%) and providing employee benefits (51%) remain top concerns for business decision-makers. At the same time, 95% of employers report being affected by inventory or supply chain disruptions. In response, many are cutting non-essential spending like travel and events, reducing overhead, and streamlining processes to manage costs without compromising their workforce or customer experience.