Iowa’s Rural Mainstreet Index drops 14.2 points

Business Record Staff Aug 22, 2025 | 4:43 pm

4 min read time

895 wordsAll Latest News, Economic Development

The Rural Mainstreet Index for August fell for the 10-state Midwest region and lowered significantly in Iowa. Iowa’s exports, however, were up.

For the overall region, the index fell to 48.1, which is below growth neutral. It’s the sixth time this calendar year that the index has sunk below growth neutral, or 50.0. The number is down from June’s and July’s promising 51.9 and 50.6, respectively.

Highlights include:

- For the 15th time in the past 16 months, farmland prices sank below growth neutral.

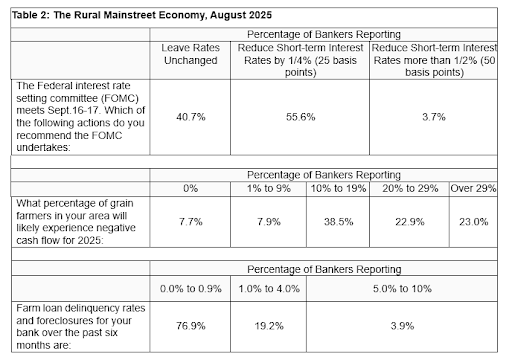

- Six of 10 bank CEOs support a Federal Reserve rate cut at its September meeting. Only 3.7% support a rate cut of more than 25 basis points (1/4%).

- On average, bank CEOs expect one in five grain farmers to experience negative cash flow for 2025.

- Farm equipment sales dropped below growth neutral for the 24th straight month.

- Ag and livestock exports were down 12.7%. According to trade data from the International Trade Association, regional exports of agriculture goods and livestock for the first half of 2025, compared to the same 2024 period, fell from $6.2 billion in 2024 to $5.4 billion in 2025.

- For the first half of 2025, Mexico was the top destination for regional agriculture exports, accounting for 57.1% of total regional agriculture and livestock exports.

The Rural Mainstreet Index is a monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy.

“Weak agriculture commodity prices for grain producers continue to dampen economic activity in the 10-state region. Bank CEOs and chief loan officers expect almost one-fifth, or 19.5%, of grain farmers to experience negative cash flow for 2025. This is unchanged from January of this year, when approximately one-fifth of grain farmers were expected to experience net losses,” Ernie Goss, Jack A. MacAllister chair in regional economics at Creighton University, said in a press release.

What bank leaders are saying:

- According to Jeff Bonnett, president of Havana National Bank in Havana, Ill., “As current prices for corn and soybeans are still below break even, the majority of producers in our area will struggle to show operational profitability.”

- Jim Eckert, executive vice president and trust officer of Anchor State Bank in Anchor, Ill., said, “Corn crop in Central Illinois is the tallest I’ve seen in 50+ years in a farm bank. However, rain came after prime pollenating time, so yields will not be as good as last year. The soybean crop should be better than last year.”

Despite weakness in the farm-based economy, bankers continue to report little change in farm loan payments, delinquencies and bankruptcies. On average, bankers reported a 1.2% increase in farm loan delinquencies and bankruptcies over the past six months. This rate has changed little since 2023 when farm income began its descent.

Farming and ranch land prices: For the 15th time in the past 16 months, farmland prices slumped below growth neutral. The region’s farmland price dropped to 46.2 from 47.9 in July.

“Elevated interest rates, higher input costs and volatility from tariffs have put downward pressure on farmland prices,” Goss said.

Farm equipment sales: The farm equipment sales index slumped to a very weak 14.6 from 16.7 in July. “This is the 24th straight month that the index has fallen below growth neutral. High input costs, tighter credit conditions, low farm commodity prices and market volatility from tariffs are having negative impacts on the purchases of farm equipment,” Goss said.

Banking: The August loan volume index declined to 82.7 from July’s record high 87.5. The checking deposit index soared to 63.5 from July’s 45.8. The index for certificates of deposits (CDs) and other savings instruments rose to 59.6 from 56.3 in July. Federal Reserve interest rate policies have boosted CD purchases above growth neutral for 33 straight months.

Hiring: The new hiring index for August advanced to 56.0 from 50.0 in July. Job gains for non-farm employers have been positive, but soft for the last several months.

Confidence: Rural bankers remain pessimistic about economic growth for their area over the next six months. The August confidence index weakened to 27.8 from 36.0 in July.

“Weak grain prices and negative farm cash flows, combined with tariff retaliation concerns, pushed banker confidence lower,” Goss said.

Home and retail sales: Home sales increased to 48.1 from July’s 48.0. Regional retail sales, much like national retail sales for August were fragile with a reading of 46.2 from 47.8 in July.

Iowa: August’s index for the state declined to 35.5 from 49.7 in July. Iowa’s farmland price index for August dropped to 35.4 from 46.3 in July. Iowa’s new hiring index for August rose to 46.6 from 43.0 in July. According to trade data from ITA, Iowa exports of agriculture goods and livestock for the first half of 2025, compared to the same period in 2024, climbed by $149.8 million, for an expansion of 18.1%. Mexico was the top destination for state exports, accounting for 72.6% of 2025 Iowa agriculture and livestock exports.

The Rural Mainstreet Index is a unique index that covers 10 regional states, focusing on 200 rural communities with an average population of 1,300. The index provides the most current real-time analysis of the rural economy. Goss and the late Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey and launched it in January 2006.