Iowa manufacturing outlook: rural opportunities, trade tensions and workforce gaps

The Business Record hosted its annual Manufacturing Forecast event on Aug. 6 to address the economic vitality of one of the state’s largest industries: manufacturing. Four panelists joined the event to share their perspectives on how the industry is faring and its future outlook: Nicole Crain, president of the Iowa Association of Business and Industry; Ernie Goss, director of the Institute for Economic Inquiry at Creighton University; Matt Koch, chief marketing officer at Sukup Manufacturing; and Peter Orazem, interim chair of the Iowa State University Department of Economics.

The event was highly attended and covered many topics, from tariffs to workforce shortages. As time for the panel discussion ran out, there were several questions from the audience left unanswered. Some of the questions were directed specifically at Orazem, who has spent his 40-year career focused on labor markets and regional development.

To watch the recording of the full event, click here.

In an email, he answered those remaining questions. His responses are below.

Audience question: The hollowing out of our smaller towns bothers me as a lot of talent/leaders have come out of these small towns in the past and I think we may be losing that. With automation on the horizon and the focus on incentivizing manufacturing in the U.S., is there an opportunity to bring some micro-manufacturing to some smaller towns – where land, labor, energy, etc., is fairly inexpensive and we have good rails to move the goods?

Orazem: This is an important issue for rural areas. The rising importance of cities as centers of economic growth has been ongoing since the 1940s. The U.S. rural population has grown 0.2% per year since 1940 while the urban population has grown 3.2% per year. The advantage to production in cities is related to what are called agglomeration economies – concentrations of suppliers, innovators, venture capitalists, educated labor and customers makes production in cities more efficient.

When I searched for places with expanding rural manufacturing, a story popped up on the automotive industry in Texarkana, Texas, a town of 35,000. At that size, Texarkana is large enough to generate agglomeration benefits. Really, rural areas cannot.

When we analyzed the factors that caused firm entry in rural areas, we found that it was the rural areas with greater agglomeration that were the most successful. That suggests that truly rural areas will find it hard to attract new manufacturing firms.

References:

- “Does agglomeration matter everywhere?: new firm location decisions in rural and urban markets.” Journal of Regional Science.

- “Which small towns attract startups and why? Twenty years of evidence from Iowa.” American Journal of Agricultural Economics.

I think Carroll, Iowa, is an example of a small town that has been able to retain manufacturing. It has just over 10,000 [people], which is at the low end of towns that can foster agglomeration economies. It hires people from all the surrounding counties, and so its economic footprint is bigger than the town.

I am not an expert on micro-manufacturing factories, but food processing is one of the areas that has moved to rural areas to be closer to inputs and take advantage of lower input costs. More information on manufacturing in rural communities from the USDA Economic Research Service is available here.

Audience question: Peter made the comment that Iowa has given away roughly 4.6% of our manufacturing jobs since the pandemic. Where does he believe these jobs have gone and does he see a path for them to come back?

Orazem: These jobs are largely cuts in durable goods manufacturing related to production of agricultural equipment and parts. I think they will return when the agricultural economy turns around. The worry is that these manufacturers are also exporters and those markets are threatened by trade wars. I expect that will also reverse if/when the trade wars become more costly.

Audience question: How do we make sure these links to the tariffs for price increases are true and factual as we get no news on how much is or can be sourced nationally, nor does anyone speak to the benefits of fair, reciprocal trade policies, i.e., how do we ensure people don’t take advantage of this news just to make a buck? And why do more not speak to the time to see the benefit?

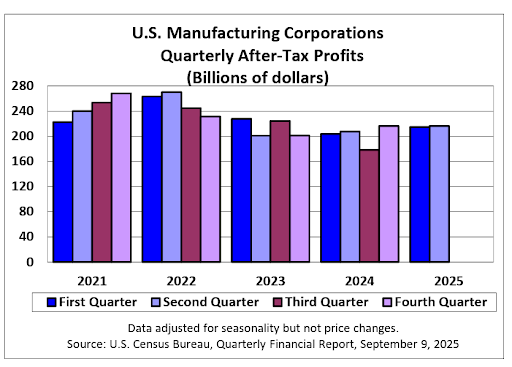

Orazem: I may be wrong. To the questioner’s point, we do not have much experience with such rapid and across-the-board increases in tariffs, and so we will have to wait and see. The last such increases occurred in the 1920-1935 period (see graph below), and that did not turn out well. Perhaps the tariffs will result in future trade agreements that will prove beneficial. Reference: The Budget Lab

Audience question: We have heard a lot of rising costs of labor and overhead, supply chain and the cost of money. Are Iowa manufacturers concerned about the rising costs of energy? With the increase of data centers we expect the demand to be more than the utilities will be able to support without expensive modernizations.

Orazem: I think Iowa will have a comparative advantage in energy production. If there is rising demand for data centers nationally, and the key inputs are land and energy, Iowa should benefit. Iowa has relatively low electricity costs compared to other states, ranking third lowest with rates at 77% of the national average. Reference: U.S. Energy Information Administration

Audience question: How long will it take to determine if the tariffs have been effective? And what is the impact if the next administration drastically alters them in three years?

Orazem: Biden largely left the Trump 2018 tariffs intact. Economic analysis found modest negative effects – on the order of 0.3% lower GDP per capita. The costs are not borne equally – and I think agriculture was a sector that had larger adverse effects.

Audience question: I don’t hear many economists talk about the reciprocal nature of U.S. tariff strategy. It seems to be yes/no. Why?

Orazem: The stated reciprocal tariffs were much larger than the tariffs imposed on the U.S. The reciprocal tariffs were quickly delayed and it is not clear if/when they will be imposed. However, the across-the-board 10% tariff was imposed on almost all goods, but this is not reciprocal, as it is the same for all countries, regardless of their tariff policies. Individual countries have faced higher tariffs, but these are sometimes imposed for non-economic reasons such as retaliation for Middle East policies or prosecuting past leaders.

Economists have been analyzing the effects of the 10% across-the-board tariff – and the average tariff has increased substantially from 1.5% to 18% as you can see in the graph above.

Audience question: With Iowa manufacturers facing labor shortages and the added strain from immigration enforcement, what are some actionable steps — either at the state or federal level — that could help support legal immigration and workforce development to sustain manufacturing growth in rural areas like Sheffield?

Orazem: I think Iowa should investigate making it easier for small firms to access the H1B visa program. Perhaps applications for H1B visas could be at the state level rather than individual firms. The current policies favor very large firms and Iowa does not have many of those.

We could also restart the state efforts to sponsor refugees such as were implemented during the Gov. Robert Ray administration.

Related coverage: 5 takeaways from the 2025 Manufacturing Forecast

Gigi Wood

Gigi Wood is a senior staff writer at Business Record. She covers economic development, government policy and law, agriculture, energy, and manufacturing.