Manufacturing Forecast panelists address impact of tariffs on Iowa manufacturers

The Business Record recently hosted its annual Manufacturing Forecast event, which focused this year on economic uncertainty and tariffs. Four manufacturing and economy experts served as panelists to answer questions about the current state and outlook for the manufacturing industry in Iowa.

Manufacturing makes up 17% of Iowa’s GDP at $35 billion annually. Uncertainty due to changes in federal rules and trade deals have left many concerned about the financial health of manufacturing businesses and related companies in the state.

The panelists were:

- Nicole Crain, president, Iowa Association of Business and Industry

- Ernie Goss, director of the Institute for Economic Inquiry and Jack A. MacAllister chair in regional economics at Creighton University

- Matt Koch, chief marketing officer, Sukup Manufacturing Co.

- Peter Orazem, interim chair, Iowa State University Department of Economics

The panelists discussed how Iowa’s manufacturing sector is taking on several challenges, including higher interest rates, a lagging ag economy, supply chain disruptions and ongoing labor issues, including immigration and deportation.

Here are some key takeaways from the discussion:

Tariffs

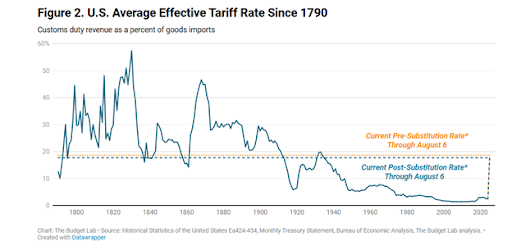

Tariffs and trade partnerships have been volatile in 2025, with tariff rates changing multiple times. Different countries have experienced different rates, with the latest changes taking place on Aug. 1 and Aug. 7.

Tariffs should be used to negotiate trade deals, not to punish countries for their politics, Orazem said.

“When you look at tariffs, they’re being used for, what is the old saying? ‘If you have a hammer, everything looks like a nail.’ Tariffs are being used in Canada because we don’t like their policies toward Palestinian statehood. We’re imposing tariffs in Brazil because we don’t want them prosecuting [former Brazilian President Jair] Bolsonaro. And in India, we don’t like them behind Russian oil,” Orazem said.

“If there’s a purpose to tariffs, you want to have them narrowly tailored to the purpose of business, and not for political ends. Using them for political ends actually just adds more uncertainty. Who knows what will be the rationale for a change in tariff policy tomorrow, and whether or not we’re actually going to impose those things? If you look at the impacts on agriculture, part of it is that you get retaliatory tariffs on U.S. agricultural producers, and Iowa depends critically on other people buying our products. If we were just selling to Iowans, we would have a much smaller economy here in the state.

Orazem said tariffs also have an impact on futures prices. “If there’s uncertainty as to whether or not there’s going to be an international market for our products at harvest, that then depresses futures prices. So currently agricultural prices for both corn and soybeans are about 30% below where they were in 2021. That has a huge effect on the Iowa economy.”

Half of Iowa exports go to Canada and Mexico, so it is important to maintain relationships with those two countries, he added.

“If you look at who we’re trying to tick off through our trade policies, it’s our biggest customers,” Orazem said. “That’s just bad business.”

Goss produces two monthly reports about the Midwest economy, one of which is based on surveys of rural bank leaders.

“About four out of 10 say tariffs are hurting, but the other 60% support the tariffs and support the negotiations,” he said. “I think there is broad support for the president’s trade negotiations and tariffs at this point in time, in this part of the country, the Mid-America region.”

Goss said he worries tariffs will worsen inflation and he expects to see staggered price increases for goods over the coming several months. To improve the situation, he said other countries, especially China, need to lower their tariffs.

“We need to see some movement there [on China’s tariffs]. We need to see India move, not retaliate. That retaliation is going to be not good for us in terms of India. In Canada, there’s so much back and forth [over the U.S.-Canadian border] that needs to be open,” he said. “We produce too many agricultural and manufacturing goods to only have a domestic market.”

He doesn’t see onshoring as a solution, because certain goods will always be produced in other countries.

“We ask about onshoring to our supply managers and manufacturers,” Goss said. “They’re not seeing it thus far. Now, that takes time, of course, but that onshoring, bringing them back, we haven’t seen it yet, and I’m not sure we’ll ever see, for example, baseball manufacturing in the U.S. It’s in Haiti, it’s in Central America.”

Crain said ABI members’ support for tariffs varies based on which country they affect.

“We hear that 40% don’t support the trade policy on Canada and Mexico, while 43% support the tariff and trade policy on China,” she said. “I also think it probably speaks to the different industries that we have within our membership, and how they are directly affected, and what they’re seeing and hearing in the work that they do.”

Canada is the largest trading partner for businesses that belong to ABI. It’s important to those members to have the United States-Mexico-Canada Agreement negotiated, Crain said.

“A lot of our smaller manufacturers supply the motor vehicle space. We heard from one manufacturer that a car cushion, for example, crosses the border seven times before it’s complete. That’s a lot of moving parts,” she said. “I think that also speaks to why we need to have the USMCA renegotiated to make sure that we’re getting fair trade. We have asked our members in our quarterly survey. We also conducted a CEO survey of all of our members in all industries … but when we’ve asked them about tariffs and if they support them, one thing that I think many of our members have experienced, not all, but several have experienced unfair trade practices.”

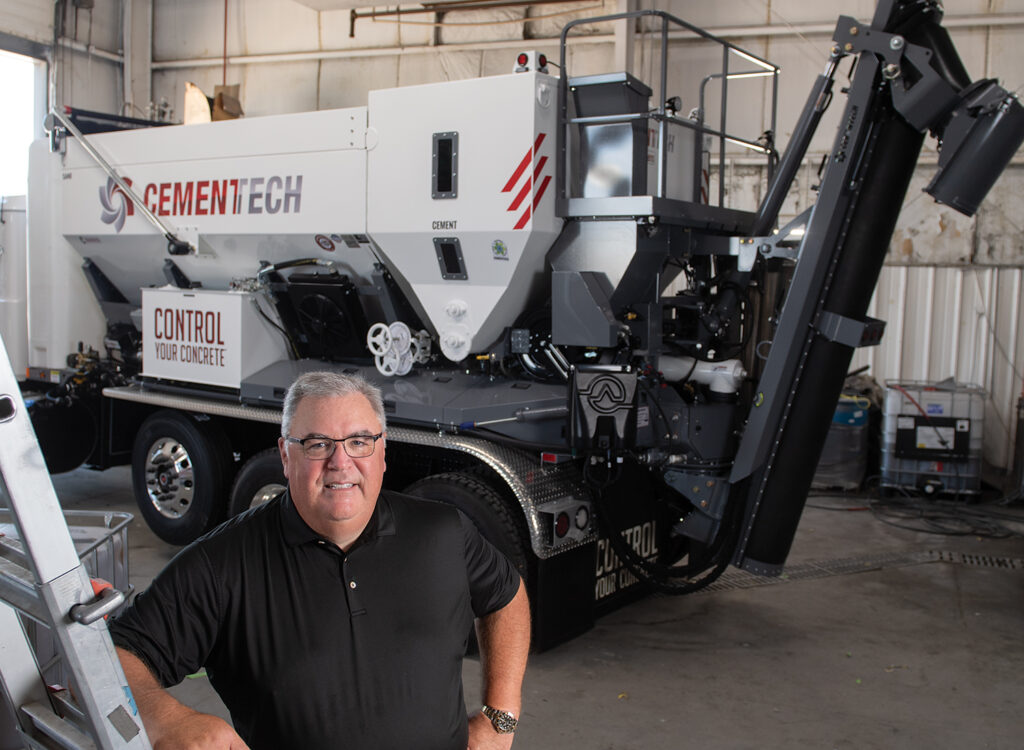

Sukup exports to 100 countries and sells to all 50 states in the U.S.

“We’re blessed to be able to have a wide net that we cast,” Koch said. “But broad strokes, our largest input cost here at Sukup is steel, which is indirectly affected by the tariffs. Despite the fact that we buy 100% U.S. steel, those costs continue to go up. As my team looks at that, as we’re in control of global pricing, we see a more or less 12% to 15% rise in raw material input costs. That’s a significant impact on what next year looks like.”

Koch said USMCA is important to Sukup’s business.

“USMCA has to mean something, we can’t just change the game. I think that we were all depending on each other,” he said. “We have such an interdependent economy. The moment we start changing the game, then all of a sudden the supply chain is massively disrupted. We have a fantastic Canadian partner that sells us a lot of hardware. There’s games being played on how that works with different bin manufacturers. The unfair trade practices, that’s what we’re seeing. We can’t just change HS export codes on a whim. Somebody’s going to get knocked at some point.”

Koch said Sukup needs more continuity with trade policies.

“I would like to see some permanency, regardless of what it is to it, so that we can make some intelligent long-term business decisions on not only supply chain, but also on customer base, where, in Canada, we’re down 40% in our year-over-year bookings with them and down 30% in Mexico, and they’re incredibly important trade partners for us,” he said.

Sukup sales are faring well domestically, he added.

“The benefit that we are seeing, though, is we are very competitive in the United States, and our domestic market still is the large gorilla for us,” he said. “There is a lot of renewed interest.”

Labor market

Goss and Orazem pointed to labor unavailability as a hindrance to the manufacturing economy in Iowa. They mentioned that deportations have worsened the labor market in the region.

“We had ICE raids in a manual food processing here in Omaha and that’s really pushed down the job picture,” Goss said.

Orazem said Iowa has been performing poorly in terms of employment for several years.

“If you look at employment overall, it has been relatively flat since 2019 in manufacturing,” he said. “We’ve given away about 4.6% of our jobs, particularly in durable goods manufacturing, but more recently, our nondurable goods, our food processing, has also given away jobs, and I think a lot of that is related to weakness in international markets for what we’re producing. That then has an impact on our manufacturing firms that are trying to sell, particularly agricultural machinery to farmers, not just in the U.S., but internationally.”

Immigrants are an important part of Iowa’s workforce, he added.

“Iowa is being held back by the fact that we’ve lost a lot of our labor supply over that period of time. The pandemic cut off immigration, which was 38% of our population growth since 2000,” he said. “The firms that want to hire are having trouble finding people, even as other firms are trying to cut back on their current use of labor.”

Koch said Sukup has had to look outside of Iowa for labor. Company-wide, Sukup employs about 850; 650 of those are in Iowa. Sukup operates six distribution centers in the Midwest and has a manufacturing presence in Ukraine, as well as a foothold in Western Europe, he said.

“We’ve onboarded four new production facilities in the last five years, and we cannot just rely on this area for labor,” he said. “We have to go to where the labor is.”

About 15% to 20% of Sukup’s workforce is Hispanic, according to Koch, who said he conducted 80 employee reviews in Spanish last year.

“It’s an important thing to be able to continue to do that,” he said.

With corn prices low, farmers are holding off on buying new grain bins.

“With the large crop that we have coming, it’s great in the fact that we’re getting more volume, but it is still keeping farm income definitely on the lower side that we’ve seen for the last decade,” Koch said. “You couple that with inflation and input costs rising and high interest rates, all of that is a formula for no major capital expansions and improvements within the farm side. They’d rather just get to next year where there’s a better financial situation.”

ABI members are keeping employment levels steady, Crain said.

“What I’m still seeing and hearing as I’m talking with members is workforce and how do we upskill our current workforce? How do we recruit new talent to the workforce and to the manufacturing industry, and how do we talk to them about the great jobs and careers there are in manufacturing?” she said. “Even through the uncertainty that we are seeing, employers still need employees, whether that’s in rural or urban, large or small manufacturers. What our members are talking to me about is they need people that are qualified, that can get through their initial application process and that are ready to go to work.”

2026 outlook for manufacturing

Goss said he expects manufacturing to worsen over the next six months, but long-term, he sees improvement.

“I expect manufacturing to move sideways to a bit down, but that’s in the next six months. Beyond that, I’m very positive about the U.S. economy, the regional economy, and why is that? Well, I think [artificial intelligence] is very, very useful in terms of what we economists would call segmenting the market. The airlines are doing it now, being able to offer different prices to different groups, what we would call price discrimination, and that will be very helpful to the manufacturers,” he said.

In Iowa, community and four-year colleges have strong connections to universities, there is a burgeoning data center market and a strong energy inventory, all of which are positive for the state. Iowa is also very welcoming to foreign manufacturers who want to set up shop in the state, and that is different from what he sees in other parts of the country.

Crain said ABI members are optimistic about the effect of the “One Big Beautiful Bill Act,” which was signed into law in July.

“Most, 63%, believe it will have a somewhat or very positive impact on their business or industry. As we’re talking about certainty, now we know some of those tax implications, what that will be,” she said.

For manufacturers, the outlook will be based on how long the tariffs last, Koch said.

“If we roll this out in three months and everything changes, I think that’s probably about the length of time that people can tolerate this before some significant dominoes start moving,” he said. “We talk about it on a daily, definitely weekly, basis here on what we’re going to do with a supply chain issue here, a vendor issue here, a growing international problem here in this market. There’s a fair amount of angst that we’re trying to navigate right now, but that long-term uncertainty is something that businesses are not going to tolerate and definitely their boards are not going to tolerate.”

Sukup continues to invest in advanced manufacturing equipment and business acquisitions, Koch said.

“We’ve purchased several businesses over the last five years in order to add to that overall manufacturing prowess,” Koch said. “We’ve increased employment by more than 100 people since that point, and since 2020, we’ve put another 50% on our top line revenue. … We need to keep responsibly vertically integrating. We very much believe in being in more control of what our overall process looks like. While we can’t completely insulate ourselves from things like the tariffs and supply chain issues, we try to handle and have a plan or a pipeline or other levers that we could pull to be able to offset those disruptions.”

The full recording of the event is available for viewing at businessrecord.com/video.

Gigi Wood

Gigi Wood is a senior staff writer at Business Record. She covers economic development, government policy and law, agriculture, energy, and manufacturing.