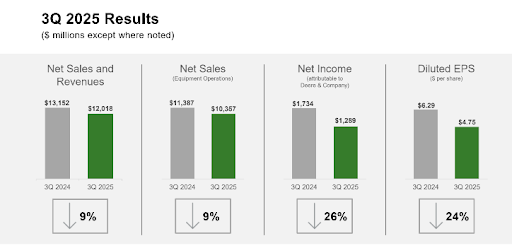

Deere reports 9% sales decline for Q3, $600M FY2025 tariff costs

In its third quarter earnings call, Deere & Co. reported a 9% decline in net sales to $12.018 billion for the quarter. Interest rates were a challenge, according to company officials, and tariff costs increased to nearly $600 million for fiscal 2025.

“The best way for us to function as a business during times like these is to focus on what we can control, namely execution, items like [reducing] production, inventory levels and cost,” said Josh Beal, director of investor relations at John Deere. “Starting with production, our factories are running well across the business. We’re delivering to our production plans, hitting our retail sales targets, and that’s allowing us to sustain and even improve upon the significant inventory reductions that we’ve driven over the past couple years, and that’s true across all three of our business segments.”

Tariffs

The biggest drivers for the $600 million tariff costs are reciprocal tariffs with Europe, steel, India and Japan, in that order. The company is augmenting its sourcing decisions and working on United States-Mexico-Canada Agreement certifications of origin to reduce exposure from tariffs.

Midwest crop farmers are expecting big yields this year, which could lead to an increase in equipment sales, Beal said. Bipartisan support for biofuels like ethanol could also boost agriculture and equipment demand.

“One thing that’s true over time is more bushels will drive better outcomes for customers, which can, in turn, drive demand incrementally, whether that’s pulling used equipment into the harvest or post-harvest, new and used [equipment],” he said.

When it comes to pricing, Deere has added incentives on its machines to improve sales.

“Obviously, it’s been a price competitive segment, and what we did in the quarter was reflective of that,” Beal said. “We expect to see some price moderation in the fourth quarter as we’ve accrued this current level of incentives in Q3. We’ll see where the market goes in 2026. Obviously there are some headwinds from tariffs that are in play, and we’ll see how that plays out.”

Impact on farmers

When asked what Deere is hearing from farmers and other end users about tariffs, crop prices and yields, Cory Reed, Deere’s president of worldwide agriculture and turf division: production and precision ag for the Americas and Australia, said farmers are waiting to hear the details of trade deals and tariffs.

“I think we’re seeing probably about what we’d expect if you have customers that are concerned about what their end markets are going to look like in a tariff environment. They’re waiting to see the outcomes of what these trade deals look like. The good news is the frameworks that have been announced are favorable. They include crop commodities. They also include energy, which is beneficial to us, but the details are not known yet. So if you’re a producer sitting there trying to decide whether you move into your next used machine or your next new machine, you might do it because it’s a crop-based necessity, something like the large yields that are sitting in the field, but otherwise you’re going to wait and see how these things play out.”

It’s a wait-and-see environment, but Deere officials remain positive, Reed said.

“We think there’s positive tail winds from both what we see in the trade deals,” he said. “We think there are positive tail winds from what we see in tax policy. We think there are positive tail winds from what we see in the RVOs [Renewable Volume Obligations] that are going out there in renewable fuels. So there’s good things coming. It’s a question of, when does that relate to the demand that we see? If you look at overall demand for crops, it’s continuing to go up, even with the large expected crop, the demand is going up and it’s going to be tight in terms of stocks going forward. So the future is bright. The question is, when do we see that turn? What we can do is prepare ourselves for it and get ourselves positioned to respond when it happens.”

Tax changes

Justin Rose, Deere’s president of lifecycle solutions, supply management and customer service, said that when it comes to the “One Big Beautiful Bill,” the research and development deductions are very important to Deere. It remains to be seen how tax changes and bonus depreciation will shake out. It may lead to end-of-year buying.

“I think broadly, from a tax perspective, it will be beneficial for the company as well as for customers,” he said.

Despite global uncertainties, positive trends in Europe and South America were noted. Early order programs for 2026 showed cautious ordering, with a 2% to 4% list price increase.

Company officials said they remain focused on managing costs and inventory, and leveraging new technologies to support future growth.

Gigi Wood

Gigi Wood is a senior staff writer at Business Record. She covers economic development, government policy and law, agriculture, energy, and manufacturing.