Iowa economy holds while job trends, tax receipts lag in Leading Indicators Index

Business Record Staff Sep 11, 2025 | 11:26 am

3 min read time

611 wordsAll Latest News, Economic Development

Iowa’s economy continues to expand, but inconsistent job growth, weak diesel consumption and manufacturing orders have dampened the Iowa Department of Revenue’s Iowa Leading Indicators Index for July. For the month, the index declined slightly but remained at 107.5 in July due to rounding from June.

The monthly diffusion index decreased to 43.8 in July from 75.0 in June. The diffusion index measures how many of the eight components within the index moved in a positive direction in a month. In June, Iowa experienced an increase in six of its eight components. In July, only three improved. Gains were seen in the stock market, but not across sectors like agriculture, construction and fuel demand.

The Iowa nonfarm employment coincident index recorded a 0.01% increase in July, after experiencing decreases in eight of the past 10 months. Long-term trends in the index suggest that nonfarm employment will increase over the next three to six months.

The index was designed to watch for moments when these two events happen simultaneously:

- Six-month annualized change in the index below -2.0% and

- Six-month diffusion index below 50.0.

In July, the six-month annualized change was positive, despite the decline in the diffusion index. This indicates a growing economy in the state despite the weakening of certain categories.

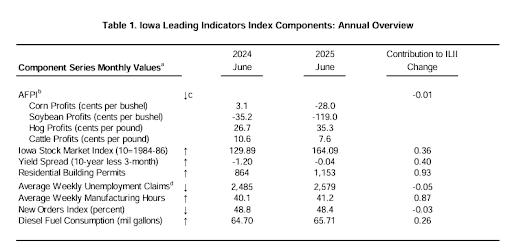

During the past six months, five of the eight component indicators increased more than 0.05% over the last half-year: the agricultural futures profits index (AFPI), average manufacturing hours, diesel fuel consumption, the Iowa Stock Market index and residential building permits. The new orders index, initial unemployment insurance claims (inverted), and the national yield spread decreased by more than 0.05% during the past six months.

- The Iowa Stock Market Index was the strongest positive contributor to the index in July. During July, 18 of the 27 companies on the stock market index gained value, and seven of the nine financial-sector companies increased in value. With more than half of the stocks experiencing gains, the index increased to 170.61 in July from 164.09 in June.

- Diesel fuel consumption, residential building permits and the AFPI went from contributors in June to detractors in July. The national yield spread went from a detractor in June to a contributor in July.

- Diesel fuel consumption was the strongest detractor to the index in July. Diesel fuel consumption decreased 5.4% between July 2024 and July 2025. The 12-month moving average decreased to 65.41 million gallons in July from 65.71 million in June.

Highlights of the department’s annual review of index performance include:

- The index rose in 10 of 12 months, finishing the year up 2.8%, signaling expansion.

- In contrast, the nonfarm employment index fell in 10 months, highlighting a divergence between the indicators and actual jobs.

- Historically, Iowa Leading Indicators Index contraction signals align with job losses (e.g., 2008, 2020), but in recent years the timing has varied, with employment lagging.

- Iowa GDP slipped 0.74% in the first quarter of 2025 vs. the first quarter of 2024, while real personal income rose 1.29%.

- State general fund receipts fell 5.1% in fiscal year 2025, with individual income tax revenues down 0.9%.

IDR created the Iowa Leading Indicators Index in 2006 as a tool to predict turning points in Iowa employment, and, in turn, changes in the Iowa business cycle. This matters since changes in employment are closely linked to individual income tax and sales tax receipts. The index also provides a signal of changes in these major revenue sources for the state.

Annually, IDR assesses how well the Iowa Leading Indicators Index has met the goals underlying its development, gauges the validity of the existing components, and considers any additional components that may have been suggested in the past year.