Iowa Leading Indicators Index up 0.3%

Business Record Staff Aug 11, 2025 | 3:47 pm

2 min read time

473 wordsAll Latest News, Economic Development

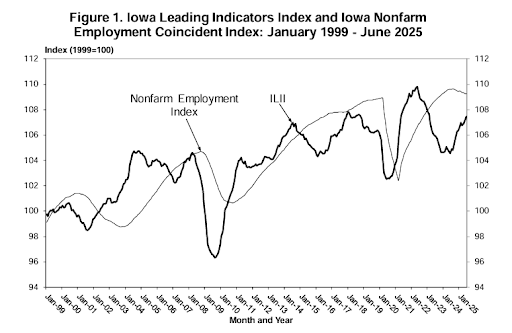

The Iowa Leading Indicators Index increased to 107.5 in June, up 0.3% from 107.1 in May.

The monthly diffusion index increased to 75.0 in June from a revised 62.5 in May. The Iowa nonfarm employment coincident index recorded a 0.00% change in June. The Iowa nonfarm employment coincident index has experienced decreases in eight of the past 10 months. Long-term trends in the index suggest that nonfarm employment will increase over the next three to six months.

The index was designed to track economic turning points with two key metrics that when seen

together are considered a signal of a coming contraction: a six-month annualized change in the

index below -2.0% and a six-month diffusion index below 50.0.

Six of the eight component indicators increased more than 0.05% during the past half-year: the agricultural futures profits index (AFPI), average manufacturing hours, diesel fuel consumption, the Iowa Stock Market index, the national yield spread, initial unemployment insurance claims and residential building permits.

The new orders index was the only component to decrease by more than 0.05% during the past six months, while the national yield spread increased by less than 0.05%.

- Residential building permits was the strongest positive contributor to the index in June, when permits were 1,688, up from 1,061 in June 2024. The 12-month moving average increased to 1,153 in June from 1,101 in May. June 2025 permits were 59.1% above June 2024, and 41.57% below the monthly historical average (1998-2024).

- The new orders index and the national yield spread went from contributors in May to detractors in June. Average weekly manufacturing hours, initial unemployment insurance claims and diesel fuel consumption went from detractors in May to contributors in June.

- The national yield spread was the strongest detractor to the index in June 2025. During June, the yield spread detracted from the index, and returned to inversion territory (below 0.00%), down from 0.06% in May to -0.04 in June. The long-term rate decreased by 4 basis points in June while the short-term rate increased by 6 basis points.

- Agricultural futures profits index: During June 2025, this component contributed 0.04 to the index; expected profits increased in hog commodities, however live cattle as well as both crop commodities experienced expected profit decreases. Compared to last year, new crop corn prices were 4.6% lower while soybean prices were 8.9% lower. The June crush margin for cattle decreased 6.9% from May while the crush margin for hogs increased 6.4% from May. Composite measure of corn and soybean expected profits, measured as the 12-month moving average of the futures price less estimated breakeven costs, and cattle and hog expected profits, measured as the average of the crush margin for the next 12 months, weighted by the respective share of Iowa annual cash receipts averaged over the prior 10 calendar years.