Principal Financial index inches up, outlook worsens

Business Record Staff Sep 5, 2025 | 11:10 am

2 min read time

439 wordsAll Latest News, Banking and Finance, Economic Development

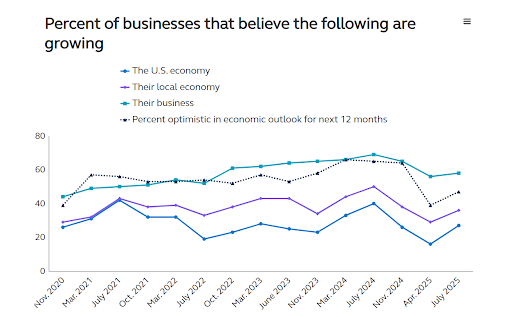

The results from Principal Financial Group’s latest Financial Well-Being Index released this week show U.S. business confidence remained near historic survey lows, increasing slightly to 6.80 out of 10 in August.

This is up from 6.02 in April but below last year’s 8.08.

The report is based on 1,000 surveys with business owners and leaders about financial health sentiment.

The increase in the index for August is attributed to improved optimism in the national and local economies. At the same time, uncertainty remains high: nearly half of businesses (46%) now feel cautious or pessimistic about the economic outlook for the year ahead, an increase from 29% in July 2024.

Expectations for individual business growth was 58% in August, up from 56% in April.

For many decision makers, general uncertainty due to policy unpredictability continues to be the leading factor influencing growth outlooks.

Effect of tariffs

Principal reports that among survey respondents, more than half of U.S. businesses (58%) report higher tariffs negatively impacting their operations, with retail (70%) and manufacturing (69%) industries reporting very substantial impacts. Sixty-eight percent of businesses say they have either already raised consumer prices (33%) or plan to do so within the next year in response to tariffs (35%).

Small and midsized businesses are increasingly absorbing more of these higher costs due to tariffs as compared to larger businesses, the study said. The gap between small and large businesses passing costs on to consumers has widened, from 9 percentage points in April to 12 points in August.

“We’ve seen businesses continue to adapt since the April tariff announcements,” Amy Friedrich, president, benefits and protection at Principal, said in a press release. “But today, business owners are striking a fragile balance — they’ve absorbed what they can and are now feeling the full weight of new tariffs. An unpredictable economic landscape continues to impede their planning, and the path to sustained growth still feels uncertain.”

Labor market

Despite ongoing uncertainty, most businesses remain committed to maintaining their workforce, the report showed. Nearly half (48%) say they would only consider staff reductions as a last resort, and 70% say they would never, or only as a last resort, reduce or eliminate the employee benefits they offer. During the past three months, 50% of businesses have increased staffing while 13% have reduced it, holding steady with the prior quarter.

“The labor market has shown resilience, despite rising cost pressures,” Friedrich said. “Business owners are adapting to tougher conditions and treating layoffs as a last resort. Their priority is keeping teams intact so they’re ready to capture growth opportunities when uncertainty lifts.”