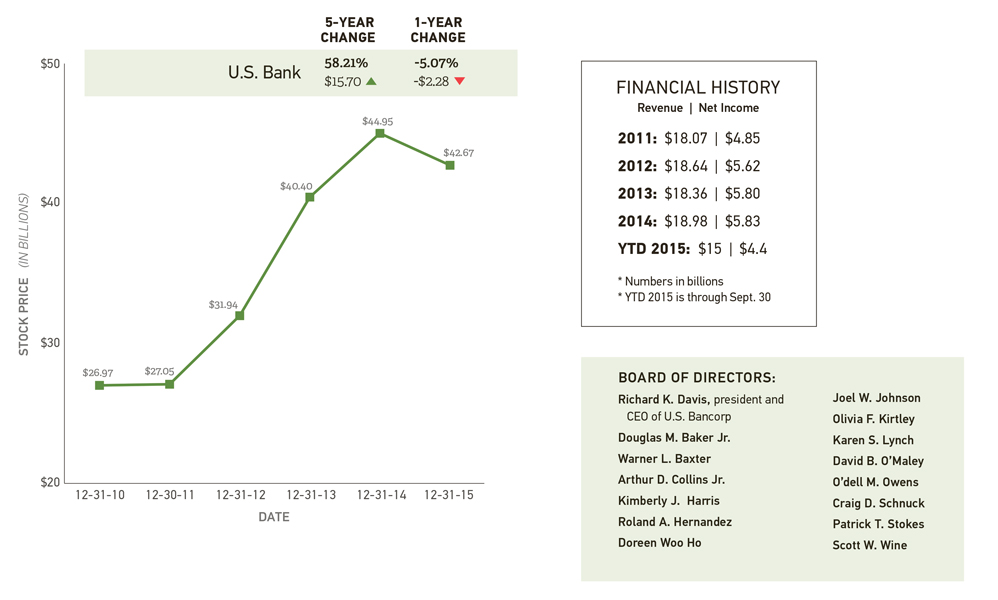

Public Companies: U.S. Bank

KENT DARR Jan 15, 2016 | 12:00 pm

6 min read time

1,322 wordsBanking and Finance, Business Record InsiderHeadquarters: Minneapolis

Website: www.usbank.com

Ticker symbol: USB

Employees: 67,000

As the regional president of the nation’s fifth-largest bank, Mike Helak has spent the past 18 years bringing a hometown touch to the operations of U.S. Bank.

U.S. Bank’s Iowa operations are sizable, with 100 branches staffed by 1,300 people. In Greater Des Moines, the bank has 15 branches and 225 employees.

In Greater Des Moines, U.S. Bank had written 1,287 mortgages through Dec. 18, up from 991 for the same period a year earlier. As of June 30, the most recent date for which data is available, U.S. Bank was the fifth-largest bank in terms of deposits in the region, holding more than $980,000 million, or 6 percent of all banks.

U.S. Bank came out of the financial crisis virtually unscathed. Helak points out that parent company U.S. Bancorp, based in Minneapolis, did not lose money during a single quarter of the recession. Seeking Alpha, a website that offers investment analysis and recommendations, notes that since the 1990s, U.S. Bancorp has boasted a 600 percent return on investment and has actually grown faster since 2008 than during the boom years that led to the housing crisis and the collapse of financial markets.

U.S. Bank also is considered the largest of the superregional banks that operate in multiple states and offer services that can include investment banking and fund management. In all, U.S. Bancorp operates in 25 states in the Midwest and West. It is an operation that grew during the 1990s through acquisitions of smaller regional banks. Through the third quarter of 2015, it had assets of $416 billion.

The operation also is a purchaser of tax credits that are used to stimulate economic development activity. As a buyer, the bank can be involved in projects in which it is not also a lender.

Q & A with Mike Helak, regional president

Age: 58

Education: University of Arizona

Hometown: Philadelphia, PA

Family: Spouse, Cathy; Children Nicole, 26, Megan, 24, and Jon, 21

In a state dominated by community banks, how does a superregional fit in?

I think size gives you capability, and how you deliver is important in Des Moines and in Central Iowa. … We make it personal and meaningful, rather than large and impersonal. We do that by not assuming that size gets you anything.

There’s really no type of lending that I can’t do. We have specialized with a lot of projects in housing; we have a community development component that invests in tax credits. I can bring that to the piece without bringing the lending.

We are a government banking specialist in Des Moines. To me, that comes down to size and resources. We try to position with what we have; we just match with what’s in our customers’ best interests.

With 225 employees, we’re not as large as some of our largest competitors, but we are large enough to have the kind of resources to come to the table. We are a purchaser, underwriter, equity player; we’re an owner on a number of projects over the last couple of years. There were six or seven tax credit projects where we were the lender, others where we were the providers and we have to underwrite differently. You can help the community as well with products that help in that area.

U.S. Bancorp profits were up again in the third quarter. How do you make money in a low-interest-rate environment?

It’s been a challenge. Rates can’t go lower than 0 percent. With the prime rate, when that increase occurs, our rates will go up; we’re going to pass that through. It will work its way through on a variety of products. (The Federal Reserve did raise the its basic benchmark rate to 0.25 percent in December, and U.S. Bancorp followed suit by raising its prime lending rate to 3.25 percent from 3 percent.)

Will the bank or has the bank ratcheted down its underwriting in the wake of recession?

We didn’t ratchet down our underwriting. We have always been conservative, thorough, and we pick clients appropriately. Banks are a mirror of their underlying credit policies and underlying businesses. U.S. Bank didn’t lose money during any quarter, so we weren’t forced to put the brakes on any one class of lending. We were conservative through that process. If you know your clients and how to respond, if you know them well enough, you can support them whether good times or bad times.

I’ve been around 18 years, called on a lot of businesses that everybody wanted to bank. We would have one or two terms a business couldn’t get comfortable with, but if they had listened, they might be around today because our ideas made a lot of sense. We want to say yes, we want to find a way to do business, but we have to be disciplined and go slow. We do that with prospects who view that as part of a successful bank relationship. If success was based on whether they got a loan, then they were disappointed. Companies that listen have been very pleased with our style of banking relationship.

US Bancorp President and CEO Richard Davis recently said the company might slow hiring in order to control expenses. Does that mean there is a hiring freeze?

We don’t use the word freeze. Internally, we might slow evaluations as positions become available through normal attrition to see if (some work) can be done efficiently elsewhere.

I have open positions that I’ve been authorized to fill, so clearly this is a market that we want to focus on. We’re looking very actively to add to certain areas. Some banks hire and lay off; we all have to react to circumstances as we see them. I would rather restructure hiring than go through layoffs.

You have to be attendant to your costs. We don’t manufacture a physical product. Our greatest expenses are people and labor. In our case, our efficiency ratio … we’re about as efficient as you can get. (A bank’s efficiency ratio is determined by measuring costs as a percentage of revenue. U.S. Bank’s efficiency ratio rose to 54 percent in the third quarter, while most large banks try to maintain a ratio of 60 percent. The lower the ratio, the more efficient the operation.)

We aren’t a one-trick pony. There are other services and resources that we can bring to a corporate entity where we can make money, (such as) cash collection and disbursement, card products, where we can generate revenues and resources.

What are the services that you bring to the table?

We have small business lending, commercial and midmarket lending; we have wealth management service, a government banking specialty group. We have openings today in our commercial and midmarket teams. We see Central Iowa and Des Moines as a growing community. We want to make sure we have the resources to be in that space.

We also offer private banking for people with wealth considerations, with all of the challenges and volatility, who have a need of and interest in specialized services, to make investing and planning easier for that constituency. The agribusiness community has created a great deal of activity; it’s down a little, but that is a really important constituency. Des Moines is a finance and insurance town with the second-largest concentration of those services outside of Hartford, Conn. There are executives who generate income. We provide expertise and resources to help them leave a legacy.

What are the opportunities going forward?

Business is very robust for us. We’re intending to add to staff so we have more resources available to take care of segments of the business community that are growing, who have cash to put to use. Our commercial customers typically work through cash before borrowing. In 2016 and beyond, we are seeing an increase in projects and loan requests across all sectors. I’m very encouraged by that.