Tax credit claims projected to keep rising

The dollar amount of tax credits claimed by businesses through the state’s economic development programs is expected to increase by 27 percent in the next five years, according to an updated contingent liabilities report recently released by the Iowa Department of Revenue.

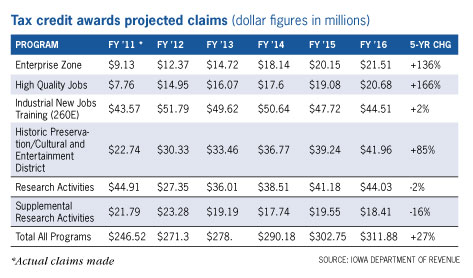

According to the estimates, which are based on the average of historical claims, taxpayers will claim nearly $312 million in tax credits in fiscal year 2016 from more than 30 economic development incentive programs designed to spur additional job creation and research activities by Iowa companies. The actual tax credit liabilities in any fiscal year are usually less than the amount awarded because not all awards are claimed.

Though tax credit claims continue to rise, the pace of new awards being made annually is slowing. The $160 million in new tax credits awarded in fiscal 2011 represented a decrease of nearly 12 percent from the awards made in fiscal 2010, and were 54 percent below the $345.8 million awarded in fiscal 2007.

Here’s a look at projected claims for some of the largest tax credit programs, along with total projected claims for all 36 tax credit programs.