What you need to know from the Project 515 on office space

Michael Crumb Aug 27, 2025 | 6:00 am

5 min read time

1,107 wordsAll Latest News, Real Estate and DevelopmentThe flight to quality is continuing in the Central Iowa office market with more tenants willing to sign long-term leases, and while activity is strong, new construction continues to lag, panelists said during the Business Record’s recent Project 515 event about office space in the metro.

The Aug. 14 event was the second in the Business Record’s Project 515 series, and featured Abi Reiland, president of commercial real estate at the Sara Hopkins Real Estate Team with REMAX Precision Office; Danielle Hermann, principal at OPN Architects; Justin Lossner, senior managing director at JLL; and Ryan Wiederstein, owner and broker at WB Realty Co., as panelists.

Here are some of the key takeaways from the event. Panelists’ answers may be edited for clarity and brevity.

How is the office market in Central Iowa?

Lossner: It’s better than people think. If you watch the national headlines there’s a lot more doom and gloom being reported than the good news. If you look at markets like New York there was no activity three years ago and now they’re leading the nation, so for us it’s a bellwether of what we think is to come. It’s a lot healthier than you think.

Reiland: There’s a lot of those smaller businesses who previously explored shorter term opportunities, one- to five-year max, pivot to something longer, like seven to 10 years. I also see that flight to amenities. They want to be able to offer things like a gym in the office or a shared conference room or break room.

Wiederstein: We see a lot of companies moving from Class B space, particularly the insurance and financial sectors. My sense is these companies are trying to get better deals locked in for the longer term. They realize there is less Class A space available in the market and they’re trying to get a foothold on that space knowing three to four years down the road it may be harder to find that space.

Hermann: We’re seeing a lot less new build. There is some, but where we do see it, it is smaller scale or an expansion or renovation of an existing space. On the tenant improvement side, we’re seeing a lot more demising of space and adding amenities, trying to attract tenants by the addition of amenities.

What amenities are contributing to the return to the office?

Lossner: We see a lot of workplace design concepts, when we talk to our furniture providers the trend they are seeing is a lot more soft seat landing areas, so bringing the home to the office feel. Another concept we’ve seen is child care. So the proximity of child care options either in the space itself or support for that is something people are really focused on as well.

Reiland: A lot of CEOs, presidents and owners of companies are putting a lot of value into the collaboration and productivity they don’t see as much of when people are at home. I also think people got burnt out of video calls. So, I think a lot of small business owners want that face-to-face time, the ability to develop employees and have conversations to allow people to grow personally and professionally. It is a matter of creating space people want to come to.

Hermann: Introducing those soft seating areas, there’s a term for that. Resimercial. That is a huge trend. We don’t talk much anymore about work-life balance. We talk more about work-life integration. How do you bring those things together to bring people back to the office? And when they are, the environment we’re seeing is balancing, are you there two days a week? Are you there three days a week? The office environment has to adapt not only from a technology standpoint but also the kinds of spaces we provide.

Will there be more absorption of office space in the future?

Reiland: I think there will be a lot more absorption. I think it took a minute for a lot of businesses to determine what the future would look like. I think now they have a clearer idea and they begin the process of seeking space. Transactions can take anywhere from nine months to years, so we’re just now seeing the fruits of the labors we’ve been working on the past couple of years.

Lossner: We’re tracking a million square feet of active deals in the market today. Three years ago those companies were either cautious or slow-playing these long-term decisions. There was a litany of issues that caused volatility which caused people to pause. A lot of that has loosened up. If you look at today, there have been more 50,000-square-foot leases signed in the last few months than I’ve seen in the past five years. If you saw one 70,000-square-foot lease signed in our market in a year, we’d be doing great. Now I can count at least seven of those actively in the market right now. The levee had kind of broken and people have figured out what their long-term strategy looks like.

Wiederstein: I think the absorption in the office market will continue. I think we’re on a good trend. There’s good developers in this town who have the capability to build new office space, but it’s a math exercise. If you’re paying $400 a square foot for an office build out, you can’t make those rents work. If you have a nice building that was built prior to COVID before construction prices went up, I’m not even sure those numbers work. I think it will be a while before anyone builds spec. There’s a lot of owner-occupied users trying to pick up buildings and taking advantage of lower-priced assets and renovating them. I think there’s a good trend in that.

What redevelopment opportunities around the metro are you watching?

Wiederstein: The Midtown area is probably poised for some nice redevelopment. It will be exciting to see what happens with the Valley West site. That whole corridor on Westown between 50th and 22nd Street in West Des Moines, if the buildings are good and are going to be retained. The Regency West deal for instance. In my opinion that gets scraped and there’s 650,000 square feet of office space that’s not on the market. That’s an opportunity in that corridor that really improves that area. Also, the Grand Experience in West Des Moines.

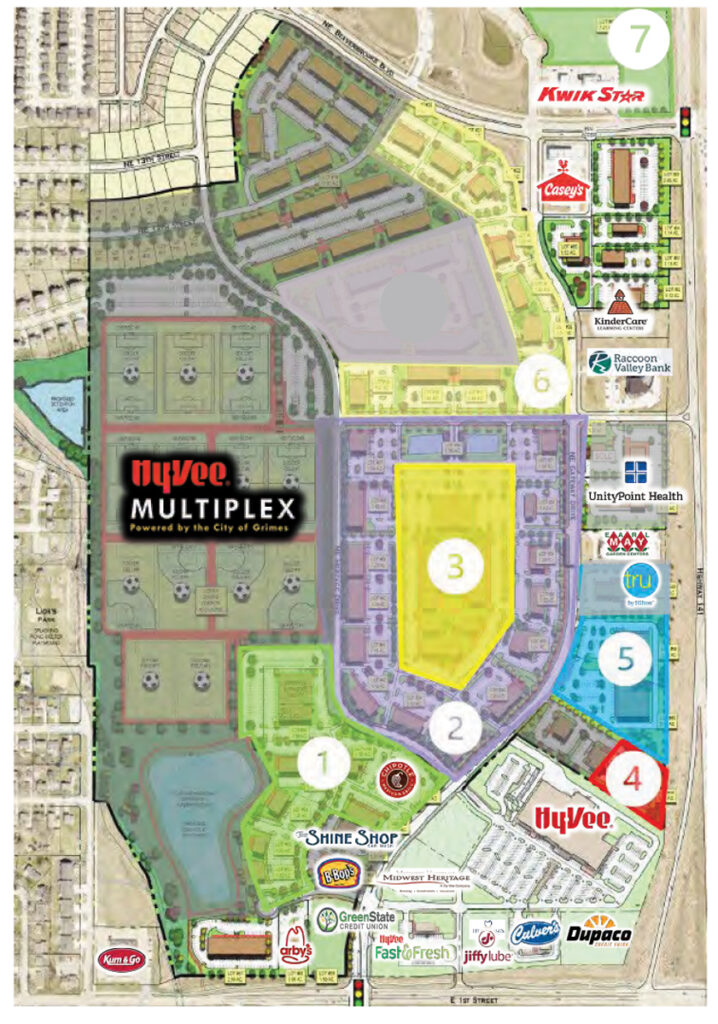

Hermann: Downtown. Certainly the Global Plaza and soccer stadium. The city of Des Moines, what could come of those historic buildings and what could spur for development around those. But also the suburbs. Grimes, Waukee, Norwalk, Bondurant. They’re all experiencing tremendous growth and development opportunities.

Michael Crumb

Michael Crumb is a senior staff writer at Business Record. He covers real estate and development and transportation.