Winning in a tenants’ market

Rich Eychaner approached several banks before he found one willing to finance the retail center he planned for one of Des Moines’ busiest intersections.

A few turned him down, and he walked away from other banks’ offers.

“Some banks wanted 300 percent collateral,” he said. “It was ridiculous collateral requirements.”

For Eychaner, who is redeveloping the northeast corner of Merle Hay Road and Douglas Avenue, apprehensive lenders were the rock and cautious retailers were the hard place – and he was caught somewhere in the middle.

“I thought this was a 2009 project, and now 2011 is almost gone,” he said, glancing over at the construction site. “National tenants were cautious; they wanted to have their finger in the pot, but didn’t want to commit. They’ll locate maybe 100 potential sites around the country and then do 20.”

A banker at U.S. Bank, which finally financed the project in April, told Eychaner it was the first construction loan the branch had approved in nearly three years. Now, with signed leases in hand for four of the five bays, he’s looking forward to turning the keys over to tenants by the middle of next month.

Marked slowdown

Though retail activity is beginning to pick up, new retail construction projects such as Eychaner’s are still few and far between in Greater Des Moines. And as 2011 winds down, smaller retail centers in Greater Des Moines still face a tenants’ market, said Tyler Dingel, a senior associate with CBRE/Hubbell Commercial.

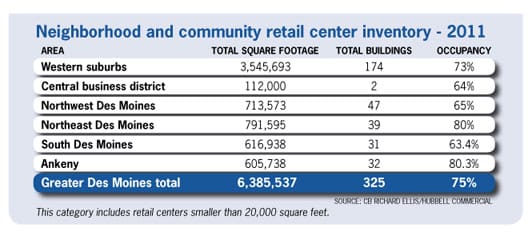

Neighborhood and community retail centers, defined as those with less than 20,000 total square feet, saw a “marked slowdown of new inventory over the past year,” according to the Spring 2011 CBRE/Hubbell Commercial Real Estate Market Survey. In the past year, less than 30,000 square feet of new space was added in this sector, all of which occurred in the western suburbs, wrote Dingel, who follows that sector for the annual report.

During the same period, overall retail vacancy rates in these smaller centers remained fairly steady at about 25 percent. In terms of average occupancy, centers in northeast Des Moines and Ankeny ranked highest at 85 and 80 percent respectively, according to the survey.

Though retail tenants still have the upper hand, “what we have seen recently is an uptick for quick-serve retail food services, particularly in end-cap locations (at the ends or corners of the buildings),” Dingel said. “They’re all battling for the same type of space, so that’s driven up demand and added some support for rents.”

Dingel pointed to some recent examples of new quick-serve chains expanding in the Greater Des Moines market: Noodles & Co., which will open in mid-October at 1551 Valley West Drive,, and Chipotle Mexican Grill, which will open in a new center just south of Eychaner’s building at the corner of Merle Hay and Douglas. Qdoba Mexican Grill, which already has a location on University Avenue in Clive, will open a second location, Dingel said.

The activity mirrors national trends. According to the Spring 2011 U.S. National Retail Report published by Atlanta-based ChainLinks Retail Advisors, growth plans among major retailers and restaurant chains were up 30 percent at the end of 2010 compared with 2009, and earlier this year, the annual growth plans of retailers tracked by ChainLinks had increased 40 percent from the previous year’s levels.

“Nearly every region in the United States should feel a boost; however, the strongest increase in growth plans has generally been in those markets where unemployment is lowest,” the report said.

Better deals

Jeff Stanbrough, president and CEO of Stanbrough Realty Co. LLC, said recent retail growth locally has come primarily from national chains, as the economy keeps many mom-and-pop businesses from expanding. Stanbrough said he thinks the existing tenants’ market will ease within the next couple of years, however.

In response to the market, landlords have reduced lease rates on retail properties between 10 and 50 percent since rates peaked in early 2008, he said. “You couple that with free rent and tenant improvements, (and) they’re getting a whole better package offered to them from their landlords,” he said.

The lack of new development in the past two or three years has probably helped some of the existing centers to hold on, Stanbrough said. “If a tenant is going to lease more space, there’s just nowhere else to go,” he said. “Whereas a few years ago there would be two new strip centers opening.”

A recent win for Stanbrough was filling a 3,600-square-foot retail bay at 5902 Ashworth Road. The Little Gym of West Des Moines, part of a national franchise specializing in experiential learning and physical development centers for children ages 4 months through 12 years, will open there on Oct. 24.

“That was an example of a big space that became vacant, but we had that leased in six months, and it was a new franchise coming to town,” he said.

Dingel of Hubbell Commercial said absorption of existing space, though not strong, seems to be moving in the right direction. According to the spring market survey, a net positive of less than 500 square feet was filled up across the metro area in the past year.

He’s currently leasing spaces in the Shoppes at Urbandale Marketplace, a 10,240-square-foot center planned on Northwest Urbandale Drive adjacent to SuperTarget. “We have some good demand, but first we have to land that strong anchor for the center,” Dingel said. “I think once we have that, the other pieces will fall into place.”

Fortunate so far

Marcus Pitts, a vice president with NAI Ruhl & Ruhl Commercial Co., is also working to put the pieces in place in the 60,000 square feet of planned neighborhood retail space at Prairie Trail, a mixed-use development in Ankeny.

“With the market being what it is in Central Iowa and nationally, I’m comfortable with the pace,” he said. “We’ve been pretty fortunate so far, and we’re working pretty hard to get it sold out.” So far, two-thirds of the initial 16,000-square-foot building has been leased and a second 6,000-square-foot building has been completed for Moulton & Associates Realtors, which opted to own rather than lease. Pitts said he’s seeing interest from retailers and restaurants for a third building.

“If we’re down to one or two bays left, we would look strongly at starting the next building,” he said.

Pitts said the spaces are leasing for $15 per square foot and $17 for end-cap spaces. The developer is offering a $20-per-square-foot build-out allowance and “depending on the credit of a tenant, we even consider amortizing improvements over the term of the lease,” he said.

Eychaner, meanwhile, said that four of the five bays in his new building, which will be called The Shops at Merle Hay, are leased and that the new construction is commanding strong lease rates. He’s asking $28 per square foot for the remaining 3,000-square-foot bay. He wouldn’t disclose the names of the businesses that will move in next month, but they will includes a wireless dealer, a fast-food franchise and a furniture-related retailer, he said.

Nearby, Eychaner is pre-leasing another redevelopment project, a 9,000- to 12,000-square-foot building to replace a former Firestone tire center that was at the southeast corner of Douglas Avenue and 59th Street. “We’re ready to build come spring if we find the right tenants,” he said.