1 in 3 Central Iowa households financially unstable

‘These folks … have no safety net in a time of crisis,’ official said

Kathy A. Bolten May 13, 2025 | 12:11 pm

3 min read time

680 wordsAll Latest News, Housing, Nonprofits and Philanthropy

The income in one in three households in Polk, Dallas and Warren counties falls below what’s called the “survival threshold” meaning there isn’t enough money to pay for the basic expenses of housing, food, health and child care, transportation, and taxes, according to United for ALICE, a project that measures financial hardships of families.

“These folks are income-constrained – they have no safety net in a time of crisis,” said Erin Davison-Rippey, a senior community impact officer at United Way of Central Iowa. “They are employed but are not earning enough to make ends meet. … [They] are workers that are the engine that keeps our economy running. This includes child care providers, bank tellers, delivery drivers, retail clerks, health care workers and many more.”

Davison-Rippey was among the panelists at a community conversation held this week at Ankeny Kirkendall Public Library. The conversation focused on creating stability and opportunity in Iowa’s workforce.

The acronym ALICE stands for Asset Limited Income Constrained Employed. The project, led by United Way of New Jersey, began over a decade ago as part of an effort to change the national dialogue about financial hardship. It has spread to two-thirds of U.S. states, including Iowa, and is composed of corporations, foundations, nonprofits and United Way organizations.

Traditional metrics like the Federal Poverty Level don’t take into consideration regional differences in the cost-of-living, Davison-Rippey said. ALICE more accurately reflects the cost of living by geographical area, uses a variety of data and takes a more holistic view of economic hardships, she said.

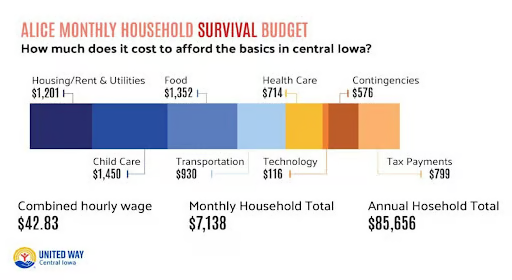

In Polk, Dallas and Warren counties, a household of four with two adults and two children in day care needs an annual household income of $85,656 to be able to pay for the basics, according to ALICE. “This is a survival budget. It does not include a cushion for emergencies.”

In Polk County, 35% of households have annual incomes below the ALICE Survival Threshold, according to the ALICE stability budget. In Warren County, 30% of households have income that is below the threshold; in Dallas County, 25% of households are below the income threshold.

Put another way, over 90,000 households in Polk, Warren and Dallas counties have annual incomes that are below the ALICE threshold, Davison-Rippey said. That’s about the same number of households that were in Ankeny, Bondurant, Urbandale, Waukee and West Des Moines in 2023, according to the U.S. Census Bureau.

For a household of four to be considered financially stable, it would have to generate an annual income of $149,988, or a combined hourly wage of $74.99, according to the ALICE stability budget.

Among the 20 most common jobs in Central Iowa, 40% pay less than $20 an hour, Davison-Rippey said.

“While the cost of household basic [needs] has been increasing, wages have just simply not risen enough to keep up,” Davison-Rippey said. In Central Iowa, wages increased an average of 9.8% between 2021 and 2023 while the cost of living in Central Iowa jumped 20%, she said.

“Many of the most common jobs in Iowa still have a substantial percentage of workers [whose annual income] is beneath the ALICE threshold,” Davison-Rippey said. Many of the families earn too much to qualify for rental or food assistance programs, she said.

A recently released Community Health Needs Assessment found that more than one-third of Central Iowa residents cannot afford a $400 unexpected expense such as a medical bill without going into debt, Davison-Rippey said.

“These are very real challenges that ALICE individuals and families encounter,” she said.

Kathy A. Bolten

Kathy A. Bolten is a senior staff writer at Business Record. She covers real estate and development, workforce development, education, banking and finance, and housing.