Amazon owns just 3.4% of fulfillment centers it occupies

The online retail giant recently announced it was opening a fulfillment center in Bondurant on property now owned by a Texas-based entity.

KATHY A. BOLTEN Feb 13, 2020 | 10:23 pm

4 min read time

1,015 wordsBusiness Record Insider, Manufacturing, Real Estate and Development

Amazon.com, the online retail giant behind the massive fulfillment center under construction in Bondurant, occupies more than 193 million square feet of warehouse space in North America, according to its recent annual report.

But the Seattle-based company owns just 3.4% of the space, leasing the remaining 187 million square feet, the report, filed with the U.S. Securities and Exchange Commission for the fiscal year that ended Dec. 31, 2019, shows.

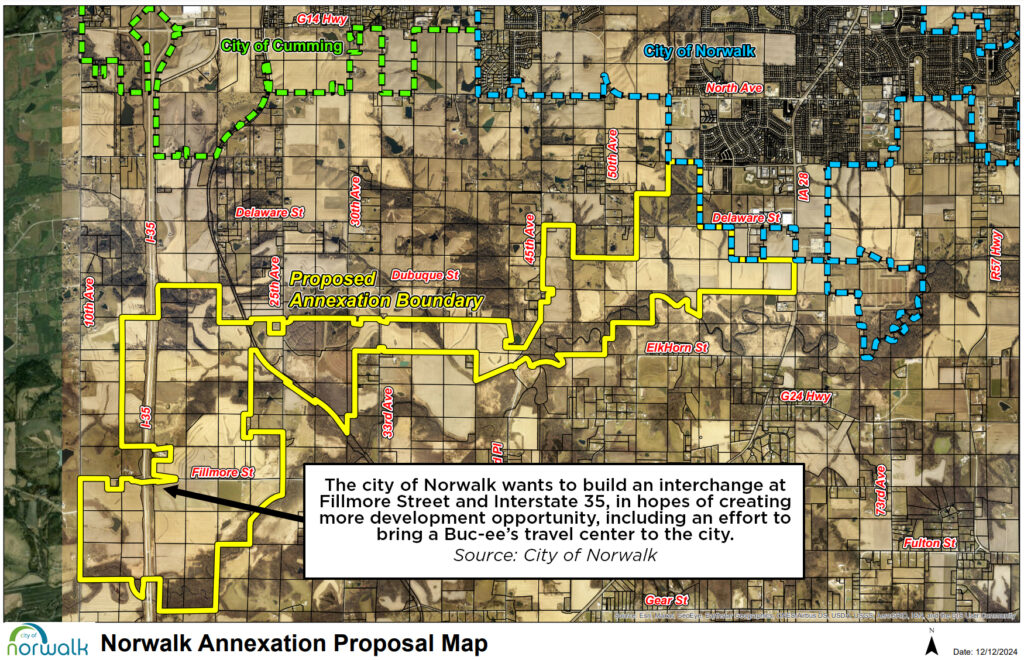

So it’s not surprising that Amazon.com apparently won’t own the fulfillment center under construction at 500 32nd St. S.W., east of U.S. Highway 65 in Bondurant. Minneapolis-based Ryan Cos., which in 2019 bought 169 acres where the distribution center is under construction, sold the property in late January to a Texas-based entity for $60.8 million, Polk County real estate transaction records show.

“The main reason a company like Amazon leases space is because it helps them get into more spaces and locations quickly,” said Matt Lundberg, a vice president with Cushman & Wakefield Iowa Commercial Advisors. “Leasing the spaces helps them keep their costs down and invest in other areas of their company.”

Amazon.com on Feb. 6 announced it was opening a fulfillment center in Bondurant. Construction of the facility, which will employ 1,000 workers, is expected to be completed by late this year, Amazon.com said in its release.

Grant Street Project LLC, based in Dallas, bought the property on Jan. 22, records show. The limited liability company is owned by Hillwood, a Perot-family company that bills itself as being among the top industrial, commercial and residential real estate developers in the United States.

Hillwood officials did not respond to requests for comment. An Amazon spokesperson said the company would not comment on the “ownership structure or its terms.” A spokeswoman for Ryan Cos. did not respond to a question about the sale of the property.

Amazon triples amount of leased space

According to data compiled by MWPVL International, Amazon operates 339 fulfillment centers and delivery stations in the United States. The company’s plans include adding 94 other fulfillment centers and delivery stations that would fill 39 million square feet of space, according to MWPVL, which tracks Amazon’s distribution network.

(Orders are filled in fulfillment centers; delivery stations are the final stop for an order before being delivered to customers.)

In 2015, Amazon leased about 58 million square feet of warehouse space in North America, according to SEC filings. In just five years, the amount of leased space Amazon occupies has more than tripled.

Jeff Randolf, a former director of Amazon’s worldwide real estate team, told the Real Deal’s New York Real Estate News in December that Amazon’s strategy to lease rather than own property is not unique.

“Leasing property has been a trend that’s been going on for 20 years, and most large companies do this,” Randolf told the real estate publication. “Amazon is probably the only company that leases everything, but they started at a different time. They weren’t encumbered by old ways of thinking.”

Lundberg said it wouldn’t be surprising to see companies like Target, Walmart or Home Depot adopt Amazon’s strategy of leasing space for their distribution networks. Those and other companies are trying to keep pace with Amazon’s strategy of getting items into the hands of customers two or fewer days after an order has been placed.

“Amazon is the trailblazer,” Lundberg said. “They are almost forcing these other companies to adopt some of their strategies.”

If they do, that could open the door to those companies opening Amazon-like distribution centers in Iowa, he said.

Suppliers often locate near fulfillment centers

But even if other large retailers don’t locate in Iowa, the fact that Amazon is in the central part of the state will likely attract Amazon suppliers to open facilities close to the Bondurant fulfillment center, many believe.

Curt Sullivan, the mayor of Bondurant, which has about 6,200 residents, said the city is starting to prepare for the additional development that could follow Amazon.

“We’re looking at where other similar fulfillment centers have been built and talking with those communities about what has occurred,” he said. “We fully expect additional development to occur.”

Austin Hedstrom, a vice president with JLL in Des Moines, said suppliers for Amazon want to be located near the company’s fulfillment centers.

“Amazon is going to have a great effect on the industrial market in Central Iowa and specifically the northeast quadrant,” Hedstrom said during a recent Business Record roundtable discussion about the industrial sector.

Industry experts have researched that when Amazon opens a distribution center in a new location, it has a multiplier effect, Hedstrom said. The question is, what is the multiplier effect and how much space will be needed to support the fulfillment center in Bondurant? he said.

In Bondurant, Amazon is occupying a fulfillment center whose total area is more than 2.6 million square feet, information on the building permit shows. If the multiplier effect of Amazon is just 1, that means the Des Moines area could see an additional 2.6 million more square feet of space developed to support the Bondurant facility, Hedstrom said.

Amazon “has suppliers, they have customers, they have clients that want to be in close proximity to these fulfillment centers, so we foresee that Amazon is going to have a great effect on the industrial market here in Central Iowa and specifically in the northeast quadrant,” Hedstrom said.

Derek Lord, Ankeny’s economic development director, said Ankeny, located directly west of Bondurant, is well positioned to support the expected demand for development ground for industrial projects.

Ankeny has “a lot of land available, zoned appropriately, along the interstate,” Lord said during the roundtable discussion. City staff members have talked with other communities with large distribution centers, and depending on where they are located, the multiplier effect could be significant, he said.

“I think that some of the difference is where some of those suppliers might already be, but there is going to be some benefit to the greater [Des Moines] region based on what we found,” Lord said. “How much is yet to be determined.”