Forecast: Retailers won’t have a blue Christmas

Holiday sales will increase 2.8 percent and bring in about $465.6 billion this year

Economists predict that retailers’ profits won’t be as merry as they were at the end of last year’s holiday season, but the stores won’t be left out in the cold.

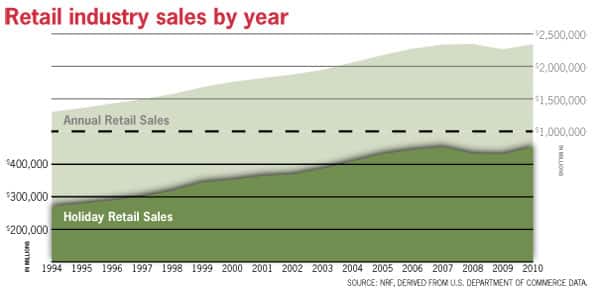

The National Retail Federation (NRF), the world’s largest retailers association, forecast that holiday sales will increase 2.8 percent and bring in about $465.6 billion. That’s a smaller rise than last year, when retailers saw a 5.2 percent increase.

But Iowa State University economics professor Dan Otto said he’s not surprised that predictions aren’t as robust as last year’s growth.

“It’s a modest rate of increase that reflects a modest rate of economic growth,” Otto said.

Mike Lipsman, who formerly managed the tax research section of the Iowa Department of Revenue, said the growth rate forecast for Iowa is slightly lower than the national average at 2.4 percent.

Lipsman said this is largely because analysis has shown that most of the growth in retail trade in the past year has been generated by households with higher income. He said specialty retail stores have been doing much better than general merchandise stores, which is a category dominated by discount stores in Iowa.

“Furthermore, the concentration of the retail trade recovery in the area of luxury and other higher-priced items explains why retail sales during the holiday season in Iowa this year is forecast to grow at a lower rate than the nation as a whole,” he said. “This is because Iowa has a much lower share of high-income households than the nation as a whole.”

But even though Iowa’s retail sales are expected to grow more slowly than the national average this holiday season, Lipsman said the result should exceed the average state increase of 1.9 percent for the past seven years.

Lipsman also said it’s possible that Greater Des Moines retailers could see a higher growth in sales than the rest of the state because of higher incomes and a greater concentration of higher-end retail stores.

Economists have chalked up this year’s lower growth rate to high unemployment, increasing food and gasoline prices, and lackluster job growth.

“There’s continued uncertainty with the stock market and a stubbornly high unemployment rate,” Otto said. “We are seeing growth in the economy, but the unemployment rate is still stuck there.”

Likewise, a surprisingly low consumer confidence rate in October, 39.8, which was down from 46.4 in September, is also a driving factor in this moderate outlook.

All are reasons shoppers will be on the lookout for sales, Internet deals and incentives – such as free shipping – when it comes to their gift purchases, and retailers plan to keep leaner inventories than in years past.

An NRF survey conducted by the research firm BIGresearch polled 8,585 consumers in early October and found that most of them plan to spend an average of $704.18 on gifts and holiday merchandise, which is slightly lower than the $718.98 spent on average last year.

And though holiday spending is not a make-it-or-break-it deal when it comes to the economy, it is important to the health of the retail sector, as it represents about one-fifth of annual retail sales.

But 14 consecutive months of retail sales growth and signs that Americans are getting their finances back in order are painting a solid picture for the holiday season.

“People are getting their balance sheets in better shape,” Otto said.