Documents reveal possible conversion of downtown Wells Fargo buildings

Michael Crumb Apr 29, 2025 | 11:27 am

4 min read time

852 wordsAll Latest News, Real Estate and Development

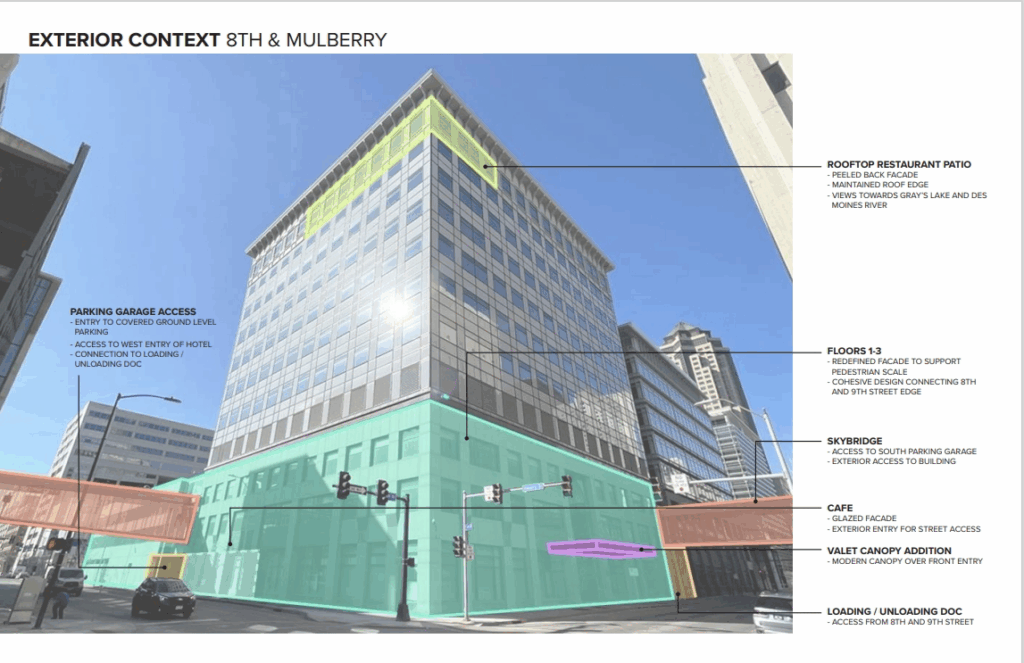

Wells Fargo’s downtown Des Moines office building at 206 Eighth St. would be converted into a hotel with a rooftop restaurant, according to a pre-application document filed with the city of Des Moines.

An adjacent Wells Fargo building at 207 Ninth St., would be converted into meeting and office space with a wellness center and spa, and ground-level parking, the documents, filed earlier this month, show.

While the documents do not indicate who the prospective buyer of the buildings is, the pre-application documents were filed by Invision Architecture on behalf of the prospective buyer.

According to the Polk County assessor’s website, both buildings are still owned by Wells Fargo.

The Business Record reported in December that buyers were under contract for the buildings, although who the buyer might be wasn’t disclosed in city documents.

Justin Lossner, senior managing director with JLL’s Des Moines office, the listing agent for the buildings, declined comment citing a non-disclosure agreement. Invision Architecture did not respond to an email seeking comment.

Wells Fargo announced in early 2023 that it was moving most of its downtown workers to the company’s Jordan Creek campus in West Des Moines. Several weeks later, Wells Fargo listed for sale four downtown office buildings and a parking garage. In early 2024, Wells Fargo sold properties at 7001 Westown Parkway and 1725 68th St. in West Des Moines and 13733 University Ave. in Clive.

For the past couple of years, the national financial institution has been downsizing its workforce and shedding its real estate properties.

A Wells Fargo spokesperson said in December that the company was working with a single buyer for the downtown properties and that progress was being made toward a closing date this year. The spokesperson did not identify the prospective buyer. When contacted Monday, a spokesman said there were no further updates.

The 11-story Eighth Street building, constructed in 1984, has an assessed value of $12.7 million, while the three-story Ninth Street building, constructed in 1910, has an assessed value of $2.5 million.

A pre-application is offered by the city to any developer considering the redevelopment of a property, said Cody Christensen, director of the city’s department of development services.

City staff reviews proposals outlined during the pre-application process to help a developer learn what the process would look like and what might be required by the city for a project to proceed, such as rezoning or receiving conditional use approval, he said.

Meetings often include several city departments and other entities, such as Des Moines Water Works, Christensen said.

Other details revealed in the pre-application documents show that the conversion of 206 Eighth St. would also include retail on the south side of the ground floor. It would also feature an 11th floor rooftop restaurant.

The estimated project value is $45 million, documents show.

Christensen said a pre-application being filed with the city is no guarantee a project will move forward, but he is optimistic about the interest in the buildings.

“What this tells us is it gives us confidence there is market interest in these buildings,” he said. “This project may go through. It may not. This is the first step in that process for a developer to get feedback from the city on what it would take for that proposal to move forward. It’s too early to say. But what I can say is I feel confident when proposals come through for properties like these that are available. That’s a good indication something is going to come through.”

The pre-application is the only one submitted for the buildings, although another party has expressed interest in the site, Christensen said.

If the proposal described in the pre-application moves forward, Christensen said he would envision some of the changes having to go before the city’s planning and zoning commission for approval. A conditional use approval would also likely be needed from the city’s board of adjustment for the restaurant and bar, he said.

“Usually, somebody who’s looking at purchasing a property has a due diligence period that’s usually a few months where they have to sit through all the details of what the requirements are for the property and what it’s going to take for a project to move forward,” Christensen said. “I would imagine that within a few months we’ll either see some additional progress with additional plans being submitted or maybe some other buyers who are interested in the property.”

Whoever ends up buying the buildings, Christensen said it will add to the vibrancy of the Central Business District.

“It’s really important that we get people into these buildings because that’s what really drives downtown’s engine,” he said. “Every building like this that we get occupied, whether it’s for office residential or a hotel, that’s key in activating that block and activating those corridors. And the more people we can get downtown the more momentum it builds for additional repurposing and adaptive reuses.”

Michael Crumb

Michael Crumb is a senior staff writer at Business Record. He covers real estate and development and transportation.