A hardening market

After years of declining premiums, property/casualty is shifting to a seller's market

Pummeled by unprecedented catastrophe losses in the past several years and facing continued flat investment returns, property/casualty insurers are beginning to raise premiums and tighten their underwriting standards, both signs of a transition toward a “hard” insurance market.

Though the rate increases aren’t eye-popping, they’re still a significant shift from the soft market conditions that have prevailed for about the past eight years, characterized by declining insurance rates and robust competition among carriers. And it’s anybody’s guess whether the property/casualty market will harden to the point that it’s difficult to obtain coverage or that policyholders will see the kind of double-digit premium increases last experienced in 2001, when average quarterly increases topped 28 percent.

“It’s in a transition,” said Greg LaMair, president of LaMair-Mulock-Condon Co. (LMC), a West Des Moines-based insurance broker. “It’s firming, but it’s not anywhere near what I would consider an extremely hard market.”

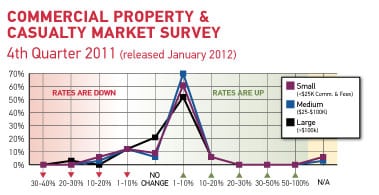

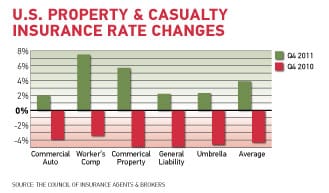

According to the latest report from The Council of Insurance Agents & Brokers, average property/casualty insurance rates increased by 2.8 percent in the fourth quarter of 2011, compared with a 5.4 percent decline a year earlier. At the height of the soft market, which began in about 2003, premiums decreased by an average of 13.3 percent in the third quarter of 2007.

Net income for the property/casualty segment took a hit last year, even though net premiums for the year were up an average of 3.9 percent, the first year-over-year increase since 2004. Property/casualty insurers’ net income dropped by an estimated 40 percent to $11.7 billion in 2011, according to the report.

Workers comp hardest-hit

One of the factors that can lead to a hardening market is sustained underwriting losses. Worldwide, insured catastrophe losses totaled $116 billion last year, second only to 2005, when hurricanes Katrina, Rita and Wilma caused insurance losses to reach a record $123 billion, according to a recent estimate by global reinsurer Swiss Re. U.S. property/casualty insurance companies experienced an estimated $15.2 billion in underwriting losses last year. At the same time, insurers’ investment income averaged only a 3.9 percent return.

Previous hard market cycles have resulted in doubling or even tripling of premiums for some lines of insurance and in carriers exiting some lines of business altogether. However, the market is “nowhere near” the point of clients being unable to find coverage, LaMair said.

“There are still a lot of carriers out there looking to write business,” he said. “So rarely do we end up in a situation where we do not have a market. We may have fewer options than we might have had two or three years ago, but we’re not anywhere to a point in the hard market where coverage does not exist.”

Businesses that have a higher portion of their overall premiums in workers’ compensation and property insurance, such as building contractors, will be the most severely affected by a hard market, said Mark Lyons, LMC’s chief financial officer. Renewals on workers’ compensation coverage are averaging premium increases of 7 to 10 percent, with businesses that have had some loss activity seeing higher rate increases than those that haven’t had losses.

On the positive side, a hard market pushes both agents and their clients to focus more on ways to mitigate risks, LaMair said. “It forces situations where there is more focus on safety, loss prevention and return to work programs and any other type of risk-management tools,” he said. “A hard market forces a push for more risk management programs to be put in place, which should be good for everybody.”

Asking more questions

Insurers are increasingly paying out more in claims than they’re taking in through premiums. A key measure of industry profitability, the combined ratio, deteriorated to an estimated 108.2 percent in 2011, compared with 102.7 percent a year earlier. Calculated by taking the sum of incurred losses and expenses and dividing it by earned premiums, a ratio above 100 percent indicates that more money is being paid out in claims than is being received from premiums, while a ratio below 100 indicates an underwriting profit.

“The underwriters are asking more questions; they’re requiring more documentation, more information about (risk-prevention) policies and programs in place,” he said. “So for accounts where we may not have all that, we’re helping them develop that so that when they are in the insurance marketplace they have a better submission.”

Properly assessing and pricing risk is a key to responding to the changing market, “which unfortunately will price some people out of the market,” said Aaron Brandenburg, an economist with the National Association of Insurance Commissioners. “But the insurers that maintain those risks, if properly assessed and priced, will be better off.”

From the agencies’ perspective, they tend to see their commission revenue trend upward in a hard market, but not in direct proportion to premium increases, because their workload, and therefore expenses, also increases in a hard market.

“What works a little bit to our benefit,” Lyons said, “is that in a harder market there tends to be a little bit of a flight to quality to agencies like us that have a broader market representation and have some loss-control services and some claims-management services that we can add to augment what clients are getting from the insurance carriers. So we benefit indirectly in firmer market conditions by having those ancillary services available and a broader representation.”

Still competitive

Property/casualty insurers such as Des Moines-based EMC Insurance Cos. are beginning to bring in higher premiums from rate increases they’ve already implemented. Premiums earned by EMC increased by 8.4 percent to $111.8 million in the fourth quarter of 2011, the company noted in an earnings release.

“We continue to see moderate rate improvement in the personal lines and are beginning to see small rate increases in most commercial lines as well, although that market remains very competitive,” EMC President and CEO Bruce Kelley said in the release. “Looking ahead, we do not expect commercial lines premium rate levels to increase significantly in 2012 as a result of the record catastrophe losses of 2011; however, we do expect steady rate improvement (increases) throughout the year and into 2013.”

It’s usually easier for insurance companies to turn a profit in a hard market, though there’s no guarantee of that, said Mick Lovell, EMC’s vice president of business development.

“Like any insurer, we’re going to try to underwrite to a level of profitability in any market cycle,” Lovell said. “As rates firm, that becomes easier, or at least you hope it will. Also, as rates firm, you get an opportunity to firm underwriting guidelines, which tend to soften when the market softens.”

EMC tries not to exit any lines of business during hard markets, according to Lovell. “We try to be very stable during hard markets,” he said. “I think it’s that prudent approach to the underwriting that allows a company to stay in a market, so they’re not jumping in and out and adversely affecting policyholders. But we’ll still be prudent in our pricing and risk selection.”

A smoother ride

Ideally, neither brokers nor insurers want to see broad market swings into either extremely hard or soft territory, said Ed Williamson, executive vice president of Reynolds & Reynolds Inc., a Des Moines-based insurance broker.

“One of the nice things in Iowa and the Midwest on the property and casualty side is that we kind of follow the rest of the economy,” he said. “We don’t have huge spikes or wild swings. So from our perspective and our clients’, you want something that’s stable. But you also have to understand that you get what you pay for; the insurance companies have to make a profit no matter what line they’re in. It’s always a negotiation process. The good clients and companies understand they have to work together.”

Partnering with a good broker and insurance company is one of the best strategies for dealing with a hardening market, Williamson said.

“People can’t look at it like, this is going to cost me so much money,” he said. “They need to understand a few dollars more don’t make that much difference when you’re talking about the survivability of the company. What we try to do is build long-term relationships between the parties. I’m a big proponent of buying quality when it comes to risk transfer.”

Factors that lead to a hard insurance market:

• A sustained period of large losses.

• A material decline in surplus and capacity.

• A tighter reinsurance market.

• Underwriting pricing discipline (insurers shedding unprofitable accounts if they can’t get adequate premiums).

Source: Aaron Brandenburg/National Association of Insurance Commissioners