Annuities hit their stride

Boomers seeking safety and earnings drive a shift of assets to guaranteed products

When the Standard & Poor’s 500 index suffered one of its worst periods of decline in 2008-2009, people who owned certain indexed annuities had to feel a little smug.

During the same two-year stretch when the S&P lost 31 percent of its value from peak to trough, policyholders of an annuity called “Indexed 5” offered by American Equity Investment Life Insurance Co. held steady with no loss in value. And when the market began heading back up by mid-2009, so did the returns on the indexed annuity.

It’s that kind of performance that has enabled American Equity to post record sales and earnings of its indexed annuity products for the past three years, enough to earn it a place on Fortune magazine’s list of 100 Fastest Growing Companies in September.

With a generation of Baby Boomers now entering retirement, demand for investment products that offer principal protection and guaranteed income streams is only going to increase, said John Matovina, president and CEO of West Des Moines-based American Equity Investment Life Holding Co., the insurer’s parent company.

“There aren’t very many defined benefit pension plans anymore, so there are lots of 401(k) distributions or that type of money becoming available that people have to manage,” Matovina said. “The product that we sell we think is a good spot for that money, because it protects that accumulated retirement saving from loss but gives it an opportunity for some incremental growth that could be linked to the equity market.”

However, pre-election uncertainty and a wavering economy have slowed indexed annuity sales for American Equity so far this year.

“The products we sell are longer-term products in terms of the period of time policyholders would be exposed to a penalty if they want to withdraw all their funds, and people perhaps are just not as willing these days to commit funds for that extended period of time,” Matovina said.

“That being said, people taking distributions from retirement plans have to do something with their money. …. Certainly we would think that interest rates moving back up – which we’re convinced will have to happen at some point – will be a favorable change in environment that will be helpful to sales.”

Unique market

Annuities are insurance products in which the carrier accepts a premium in return for providing a policyholder with a guaranteed future stream of payments. In contrast with fixed annuities, which during their accumulation phase earn interest at a rate set by the insurer, variable annuities are invested by the insurer in a separate account through which a policyholder may select stocks, bonds or other types of investments that could be subject to unlimited upside and downside potential.

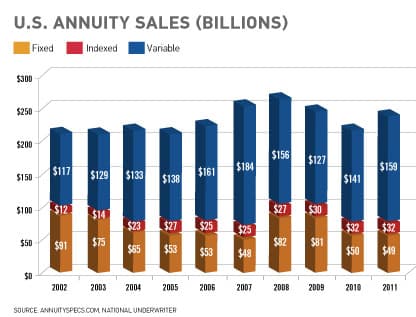

Industrywide, indexed annuities are the fastest-growing category of annuity, though it’s still the smallest category of the three. Sales of indexed annuities in the United States reached $32.39 billion last year, compared with more than $159 billion in variable annuity sales. However, sales of indexed annuities increased 29 percent during the past five years, compared with a 15 percent decline in variable annuities.

The extreme market volatility is making indexed annuities attractive to people who are fearful of suffering more losses in the stock market, said Sheryl Moore, an industry expert based in Pleasant Hill. Her firm, Moore Market Intelligence, tracks the performance of 49 insurers that offer indexed annuity products. However, the record-low interest rates are making it a difficult environment in which to sell products that offer downside protection but can currently offer only a 3 percent return on the upside.

To boost sales of both indexed and variable annuities in the past several years, insurers have increasingly added guaranteed lifetime benefit or death benefit riders as options. Those types of riders have proved to be particularly popular with – and problematic for – variable annuity carriers, Moore said.

Those guarantees “really drive sales of variable annuities, definitely,” she said, noting that people might otherwise be hesitant to accept those products’ added risk of losses.

However, variable annuity issuers didn’t fully anticipate the impact that severe market swings could have and should have priced them higher, Moore said. So far, three insurers have sent letters to their policyholders offering them cash buyouts to surrender those benefits so the company doesn’t have to meet its obligations for these benefits, which if exercised would be greater than the cash surrender value of the annuity.

“It’s gotten to the point where total fees for these annuities have gotten so high that they feel that they can’t market them,” she said. It’s also a reason that some insurers, among them John Hancock Life Insurance Co., have exited the variable annuity market, while others, including Hartford Life Insurance Co., have sold their variable annuity businesses.

Ron Grensteiner, president of American Equity Investment Life Insurance Co., said guaranteed lifetime income benefits don’t present the same dilemma for indexed annuity carriers. Whereas the liability a variable annuity carrier owes on a guaranteed benefit significantly widens in a falling market, the gap that must be insured remains relatively small in an indexed annuity contract because the value can’t fall below the minimum guaranteed level, he said.

Worth the price?

Jon Davis, a principal with Davis Life Brokerage in West Des Moines, said that because indexed annuities are invested in more long-term, capital preservation instruments, “the hedging of these (lifetime benefit) riders is much more straightforward. It’s definitely a much safer base.”

As a broker handling annuities, Davis said he examines carriers’ lifetime income benefits carefully, as a number of insurers are now charging for this benefit.

“We look carefully to see whether it is worth the additional price to pay,” he said. “Close analysis is required to make sure you’re buying the right product.”

Some of the fees are being charged in an effort to offset the effects of today’s extremely low interest rates, Davis said. Though it’s unlikely that indexed annuity carriers will have to abandon such guarantees altogether like many of their variable counterparts did, it could happen if ultra-low interest rates persist for several more years, he said.

American Equity now offers a lifetime income benefit rider on every annuity it sells, Matovina said. “I think it’s probably been important to help escalate sales industrywide to the levels they’re at, and I think they will continue to be important,” he said.

According to a survey conducted by LIMRA, a worldwide consortium of financial services companies that provides research and other services for its members, the top concern among Americans is that they will have insufficient lifetime income from their investments.

“So this goes right at the sweet spot for people who are worried about what’s going to expire first, them or their income,” Grensteiner said. “It’s been a wonderful benefit that we’ve been able to add on.”