Career economists weigh in on 2024

A global view of the economy from ISU, UI professors and Wells Fargo analyst

The U.S. economy has, so far, avoided the recession some predicted. But according to economists interviewed by the Business Record, slower growth, a prolonged worker shortage, wars in Ukraine and the Middle East, and the November elections could all play a role in the story of the 2024 U.S. economy.

To get a global view on this year’s economic forecast, the Business Record spoke with four economists to get their takes.

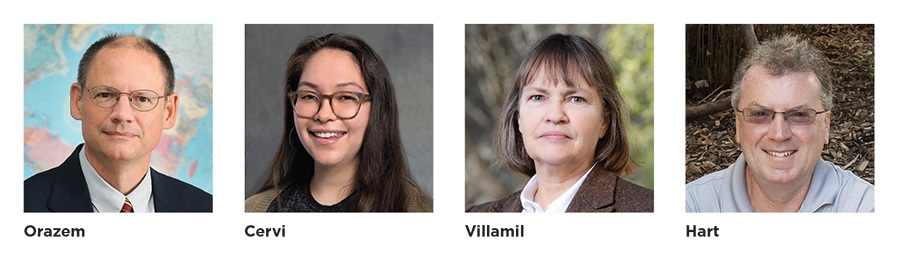

Peter Orazem, Iowa State University professor emeritus in economics

Nicole Cervi, Wells Fargo corporate and investment bank associate economist

Anne Villamil, University of Iowa Tippie College of Business professor of economics

Chad Hart, Iowa State University professor of economics

The following responses were lightly edited for clarity.

What are your broad predictions for the U.S. economy this year, and what should businesses be paying attention to in the next 12 months?

Orazem: The unemployment rate will remain low, but that reflects the lack of workers to fill the historically very strong demand for labor. Economic growth will be disappointing as the lack of labor holds back businesses seeking to expand.

Core inflation will stay between 3-4% and will not get back to the Fed’s 2% target unless we slip into recession. Short-term interest rates will remain above 4%.

Iowa will continue to lag the rest of the U.S. in economic growth as its labor market recovery – both employment and labor supply – continues to lag the rest of the U.S., holding back the Iowa recovery from the pandemic.

Cervi: We look for growth to slow this year, primarily due to softer consumer spending. The savings that households accumulated during the pandemic have been whittled down and the personal savings rate is running at about half of what it was in 2019. In short, consumers have a thinner financial cushion, and loan delinquencies have already risen in recent quarters. Muted consumption will dampen the labor market’s momentum and foster a continued deceleration in inflation, which will compel the [Federal Open Market Committee] to lower its baseline rate. Lower short-term rates should offer a lifeline to businesses with exposure to floating rate debt.

Villamil: Interest rates will fall as inflation returns to 2%. Interest rate sensitive sectors should plan for declines.

Hart: The ag economy is going through its own “soft landing” right now. Following [the COVID-19 pandemic], the ag economy was very strong, especially for the crop markets. Prices were high, yet demand was robust. But as 2023 played out, crop prices fell as demand pressures eased. Normally, a downturn in agriculture flips profits to losses. Thus far though, the retreat has put the ag economy back to “normal,” with prices being roughly in line with production costs (as ag is a competitive industry). In 2024, farms and ag businesses will devote more time and effort to managing costs to create profitable opportunities.

How will U.S. economic health affect interest rates in 2024, and what global factors could come into play as the Federal Reserve decides what to do with the baseline rate?

Orazem: This is an election year, and the Federal Reserve will not want to be a factor in the election. As a result, the Fed will not be raising interest rates and will likely make some small reductions to improve consumer confidence and investor sentiment while taking some of the heat off their own anti-inflationary policies.

While the media seems to believe the Fed has made great strides in fighting inflation, core inflation (which excludes the effects of volatile food and energy prices) remains near 4% and has fallen very slowly. We still have 3.3 million unfilled vacancies per month, meaning that 38% of job openings go unfilled compared to around 7% pre-pandemic. That level of unfilled vacancies points to continued upward pressure in wages and inflation that will be hard for the Fed to combat. The massive increase in federal government borrowing will continue to put upward pressure on interest rates and crowd out private investment.

Cervi: While the U.S. economy may avoid a recession this year, growth should moderate. We look for consumer spending to expand 1.3% in 2024—a downshift from 2.2% in 2023. Tepid consumption will dampen the labor market’s momentum and foster a continued deceleration in inflation. Barring a widening conflict in the Middle East, which could usher in higher oil prices and cargo costs, we expect the core [Personal consumption Expenditures] deflator to end 2024 at 2.3%. The sustained improvement in inflation will compel the FOMC to ease its benchmark rate by 125 [base points] this year.

Villamil: GDP; inflation; employment and productivity; consumer spending; monetary and fiscal policy; trade; geo-political factors; energy prices; and shocks – COVID-19, wars, financial instability, natural disasters and climate events – affect interest rates. The Federal Reserve wants to return inflation to 2% and its preferred inflation measure (personal consumption expenditures) was 2.6% in December. But the Fed also wants to see sustained improvement across multiple indicators. For example, adverse war events could disrupt supply chains again and raise prices. The Fed considers all of these factors when it decides the timing and level of rate adjustments.

Hart: The health of the economy will determine the pathway forward for interest rates in 2024. Thus far, the Federal Reserve has managed a “soft landing,” lowering inflation while maintaining economic growth and job creation. However, inflation is still not at the Fed’s target of 2%. While the markets have factored in lower interest rates early in 2024, I expect the Fed to maintain the federal funds rate at its current level through the second quarter of this year in an attempt to bring inflation down to the target. Beyond then, economic growth will likely shape the Fed’s decisions.

Mike Mendenhall

Mike Mendenhall is associate editor at Business Record. He covers economic development, government policy and law.