Construction firm owner on PPP aid: ‘I needed to make sure [workers] and their families were taken care of’

KATHY A. BOLTEN Jul 15, 2020 | 2:35 pm

4 min read time

838 wordsAll Latest News, Real Estate and Development

Gary Scrutchfield was on the fence about applying for a Paycheck Protection Loan when the aid became available in April.

But the owner of Lumbermans Drywall & Roofing Supply decided to apply for the forgivable loan after six employees in one day told him that their spouses or significant others had been laid off from jobs for reasons related to the pandemic. The workers inquired whether they were in danger of being laid off, too, Scrutchfield said.

“I needed to make sure they and their families were taken care of,” Scrutchfield said. “They’ve helped me build our business … and it’s important that I take care of them.”

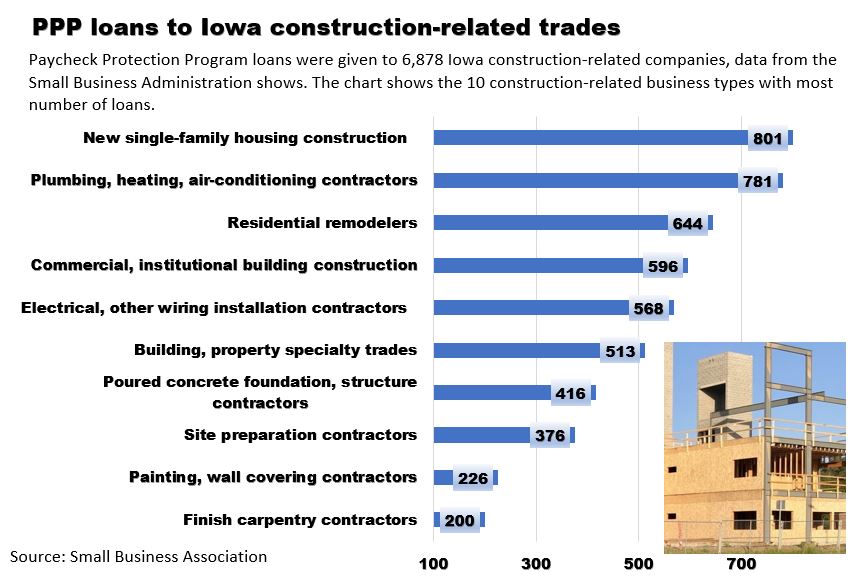

Lumbermans Drywall & Roof Supply was among the 6,878 Iowa construction-related companies that received forgivable loans through the Small Business Association’s Paycheck Protection Program, designed to help businesses and nonprofits with up to 500 workers stay afloat and keep workers on payrolls during the COVID-19 economic downturn.

In Iowa, 58,463 small businesses and nonprofits received the loans, according to SBA data. Nearly 12% of the entities had ties to industrial, commercial and residential construction and infrastructure-related construction.

A review of the data showed that Iowa construction-related companies received between $538.5 million and $1.03 billion in the federal aid, which doesn’t have to be repaid if certain criteria are met. (The SBA did not release specific loan amounts for companies that received a loan that was $150,000 or more.) The money preserved 55,459 Iowa construction-related jobs, the review showed.

Lumbermans Drywall & Roof Supply, located in Des Moines, has been able to keep its 24 workers employed during the pandemic because of the $150,000 to $350,000 in federal aid it received, Scrutchfield said. All of the money has been spent on payroll, he said.

“I know we could have used it for other things like utilities or our mortgage, but we decided to put it all towards payroll,” he said. “The money is helping [companies] keep moving forward and to help keep the economy rolling.”

Soon after the pandemic-related shutdown began in the spring, numerous real estate development companies as well as homebuilders had projects

Money from the Paycheck Protection Program allowed firms to keep workers employed, several people said.

“Everything shifted so quickly,” said Dan Knoup, executive director of the Home Builders Association of Greater Des Moines. “Several of our builders had customers lined up to buy new homes and the [customers] lost their financing because they were laid off from their jobs.

“This really helped people stay going during a difficult time.”

Property developers and managers were also hurt by the economic slowdown.

“Within the first two weeks of the pandemic we had several transactions that were either delayed or simply terminated,” said Chris Costa, president and CEO of Knapp Properties Inc. “From our perspective, brokerage commissions were certainly looking like they weren’t going to be supported like they had in prior years by transactions.”

Knapp Properties, which employs 114 people, also is a property management firm. “There were a lot of businesses that asked for rent deferments,” he said. Without the federal aid, the company likely would have had to furlough workers, Costa said.

“Every job we had going into the pandemic, we’ve kept that person employed,” he said. Knapp Properties received a federal loan of between $1 million and $2 million, SBA data shows.

Nearly 1,800 Iowa real estate-related companies received aid from the Paycheck Protection Program, the SBA data shows. The companies, which include appraisers, property managers and offices of real estate brokers and agents, received between $56.1 million and $89.1 million from the program. Nearly 7,300 jobs were protected, the data shows.

Also receiving the aid were 321 Iowa architecture, landscape architecture, interior design and engineering firms, the SBA data shows. The firms received between $77.1 million and $125.7 million in federal aid, money that protected 6,600 jobs.

RELATED ARTICLES: Thousands of Iowa jobs protected by Paycheck Protection Program

Majority of SBA loan recipients failed to provide demographic information

MORE INFORMATION: To view the Iowa businesses that received loans through the Paycheck Protection Program, click here.

Money still available in SBA loan program

More than $134 billion is still available in the Small Business Administration’s Paycheck Protection Program. Small business owners and nonprofit entities have until Aug. 8 to apply for a loan.

Also, recent changes to the program now allow loan recipients up to 24 weeks to spend money from the program. Previously, loan recipients had just eight weeks to spend the money. Also, the portion of the loan that must be spent on payroll has been reduced to 60% from 75%. In addition, loan recipients won’t be penalized if workers who were offered their jobs back with the same pay and hours don’t return.

For more information, click here.