Deere report gives outlook for FY25

In its latest 10-K financial report, Deere & Co. outlined its outlook for fiscal year 2025.

Equipment sales in the company’s agriculture, turf and construction segments are expected to be lower than fiscal year 2024, due to fiscal demand. The outlook follows John Deere’s third quarter earnings report on Aug. 14.

John Deere expects weaker sales across most segments due to high interest rates, trade uncertainty and softening demand. The company has lowered expenses to buoy these numbers.

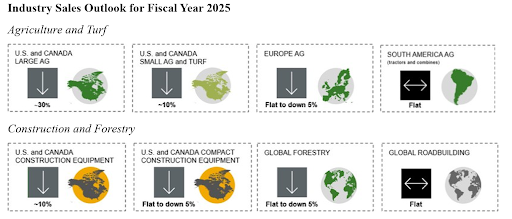

For agriculture and turf equipment:

- Demand for large agricultural equipment in the U.S. and Canada is expected to decline due to high interest rates, elevated used inventory levels in late model-year machines, trade uncertainty, and the persistence of lower commodity prices. Constrained global grain and oilseed stocks, stable customer balance sheets supported by strong farm land values, the impact of U.S. government subsidies on farm incomes, and projected strong crop yields are expected to partially mitigate this decline.

- John Deere expects small agricultural equipment sales to be down from 2024 levels in the U.S. and Canada. Solid profitability is anticipated to continue in the small agricultural sector as dairy and livestock prices remain elevated, however, this is projected to be more than offset by restrained demand in the turf and compact utility tractor markets.

- Industry demand in Europe is forecasted to be flat to down slightly. Farm fundamentals are improving, supported by strong dairy margins, coupled with an improving interest rate environment.

- Demand in South America is expected to be roughly flat.

For construction and forestry equipment:

- Construction industry sales for earthmoving equipment are forecasted to be down and compact construction equipment sales are expected to be flat to down in the U.S. and Canada from 2024 levels. Projections for single-family housing starts are slowing, while rental sales along with multifamily and commercial real estate markets continue to soften. These unfavorable factors are projected to be partially offset by high levels of U.S. government infrastructure spending.

- Global forestry markets are expected to be flat to down .

- Global roadbuilding markets are forecasted to be generally flat, supported by growth in Europe and a slight recovery in China, offset by slightly lower demand in North America compared to 2024.

John Deere’s net income for fiscal year 2025 is expected to be higher than fiscal year 2024 primarily due to lower administrative and operating expenses, partially offset by less favorable financing spreads.

Agricultural market business cycle: The agricultural market is affected by various factors including commodity prices, acreage planted, crop yields, government policies and uncertainty in macroeconomic trends. These factors affect farmers’ income and sentiment that may result in lower demand for John Deere’s equipment. In 2025, John Deere increased its allowance for credit losses and expected to continue experiencing elevated write-offs due to unfavorable market conditions.

Global trade policies: During 2025, new tariffs were imposed in the U.S. for imports from a broad range of countries and materials. Certain countries also implemented or proposed retaliatory tariffs on imports from the U.S. and barriers to trade. Trade policies are rapidly evolving causing uncertainty in the agriculture and construction industries.

Interest rates in the U.S. have remained elevated in 2025. Higher rates and volatility in rates impact the company in several ways, primarily affecting the demand for John Deere’s products and its financing spreads.

Tax legislation: In July, new tax legislation as part of the “One Big Beautiful Bill Act of 2025” was enacted. The legislation has multiple effective dates, beginning in 2025 and continuing through 2027. It did not have a material impact on John Deere’s financial statements and is not expected to affect the current fiscal year materially.