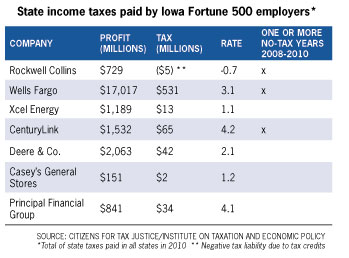

Fortune 500 companies paid half the average state tax rate

Many Fortune 500 companies are paying less than the average state tax rate, according to an analysis released last week by the Citizens for Tax Justice (CTJ) and the Institute on Taxation and Economic Policy (ITEP). The organizations examined 265 Fortune 500 corporations that fully disclosed state and local taxes and found that the average state tax rate paid by those companies in 2008-2010 was 3 percent, compared with an average state corporate tax rate of about 6.2 percent.

Among other findings from the report:

• 68 companies paid no state income tax at all in at least one year from 2008 through 2010, though they earned nearly $117 billion in pre-tax U.S. profits in those no-tax years.

• The 265 companies in the study avoided a total of $42.7 billion in state corporate income taxes in the three years.

The CTJ/ITEP report cites opportunities state by state where the corporate tax code could be tightened. One idea that has been proposed by Iowa’s last two governors, Tom Vilsack and Chet Culver, but has not reached a vote on the floor of the House or Senate is to close tax loopholes with a device called “combined reporting.”

To view the report, go to www.ctj.org/corporatetaxdodgers50states/