Funny socks mix with serious concerns at Global Insurance Symposium

JOE GARDYASZ May 29, 2015 | 8:18 pm

3 min read time

611 wordsAll Latest News, Business Record Insider, Insurance

|

| Photo credit: Greater Des Moines Partnership |

Anyone who thinks that insurance executives aren’t fun obviously didn’t sit in on the right sessions at this week’s Global Insurance Symposium.

|

| Photo credit: Courtesy of Mandi Bishop’s Instagram account |

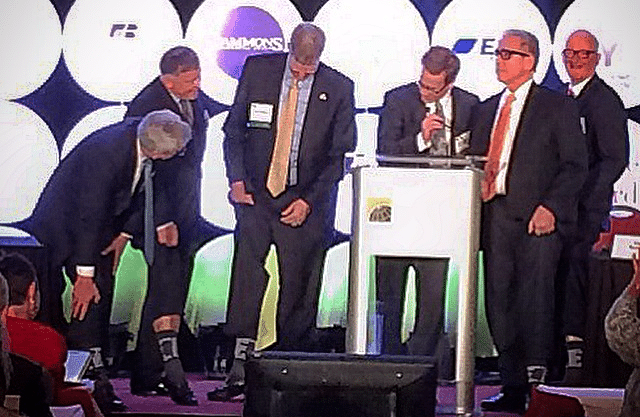

At the end of a CEO panel discussion Thursday morning, moderator Charlie Richardson asked Iowa Insurance Commissioner Nick Gerhart to step onto the stage, where the four CEOs on the panel — among them GuideOne’s Jim Wallace and Symetra Life’s Tom Marra — bared their ankles to show off their matching socks from Raygun that said, “Des Moines: Kicking ass, taking names and selling insurance.”

The panel discussion was the kind of let-your-hair-down, no-holds-barred discussion that Richardson, a partner in the Washington, D.C., office of Faegre Baker Daniels LLC, encouraged as the moderator — asking the CEOs to talk about their biggest opportunities, concerns, and what keeps them up at night. Also on the panel were Ed Noonan, chairman and CEO of Validus Holdings Ltd., and Peter Schaefer, president and CEO of Hannover Life Reassurance Company of America.

Marra said the thing that keeps him up at night, besides continued low interest rates, is “the damned complexity of our industry.”

“I kind of feel like we’re hanging on a regulatory string, and if it’s changed it may need to be all retooled or thrown out,” Marra said during the panel discussion. “We need a more stable environment in which to operate,” he said. “We need to define the rules and just stick with them for a while.”

Marra was hired by Symetra in 2010 in part to rebuild the company’s life insurance sales after its sale of its SafeCo division (check). “We’re in a take-share mode,” he said. “There are a lot of players backing away from the universal life market, and we’re going after it.”

The biggest risk facing Symetra is the Federal Reserve’s continued low interest rate policy, which Marra said “has just gone on too long.” Marra said he believes keeping interest rates so low for so long has actually created a wider wealth gap in the U.S.

Noonan observed that the Solvency II regulations that go into effect in Europe next year are not only costly for companies but are also draining innovation out of the insurance marketplace. “We’re seeing that play out across the world,” he said. “The thing that keeps me awake at night is the U.S. having the Fed involved in regulating the insurance industry. … My real fear is that the U.S. (insurance) market is headed down a very bad path.”

Schaefer said one of his company’s biggest challenges, from a life insurance perspective, is that Americans aren’t buying life insurance like they used to. The estimated amount of unmet life insurance needs in the U.S. are about $15 trillion, he said.

From Wallace’s view as a property/casualty insurer, “we don’t want to see bank-centric regulations forced down on us.”

Technology was also at the top of Wallace’s watch list, both for opportunities and risks. He said the thought that some kid could invent some app that would make his company obsolete overnight crosses his mind occasionally as he’s perusing the state of the industry.

“More practically, we’re concerned about winning the technology wars,” he said. GuideOne, which specializes in covering churches and church members, is in the midst of rolling out new information technology systems, a process that’s expensive and risky, Wallace said. Big data in particular is a big deal for GuideOne, he said. “It’s a giant opportunity. In our case, almost no one has the church (insurance) data we do.”