Health savings accounts grow by more than 14 percent

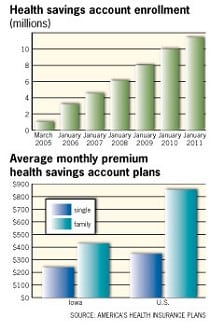

More than 11.4 million Americans are now covered by health savings account (HSA) insurance plans, an increase of more than 14 percent since last year, according to an annual census released June 14 by America’s Health Insurance Plans, a national trade association.

In Iowa, 132,175 people, or 6.7 percent of all those under 65 who were enrolled in private health insurance plans, were enrolled in HSA plans as of January.

First authorized to be sold in January 2004, health savings accounts are designed to give consumers incentives to manage their own health-care costs by coupling a tax-favored savings account used to pay medical expenses with a high-deductible health plan (HDHP) that meets certain requirements for deductibles and out-of-pocket expense limits. Most HDHPs cover preventive care services such as immunizations and routine exams without requiring enrollees to first meet the deductible. The funds in the HSA are owned by the individual and may be rolled over from year to year.

According to the study, which surveyed 83 health insurers nationwide, 10 percent of all new health insurance policies purchased in January 2011 were health savings account/high deductible health plan arrangements.

States with the highest percentage of HSA/HDHP enrollees among their under-65 populations with private health insurance were Minnesota (14.9 percent); Vermont (11.4 percent); Colorado (11.3 percent); and Montana (10.8 percent).