Hubbell emerging as potential buyer for Riverfront Y

KENT DARR May 13, 2015 | 4:04 pm

4 min read time

1,028 wordsBusiness Record Insider, Real Estate and Development| Click to see full downtown map |

Hubbell Realty Co. has emerged as the last potential buyer standing in efforts to devise a workable development plan for the Riverfront YMCA, which sits on what many city officials and business leaders believe is the most alluring piece of real estate in Des Moines.

“We have to come up with a concept to see if it even makes sense,” Hubbell President and CEO Rick Tollakson said today. “We are looking at it to see if we can figure it out.”

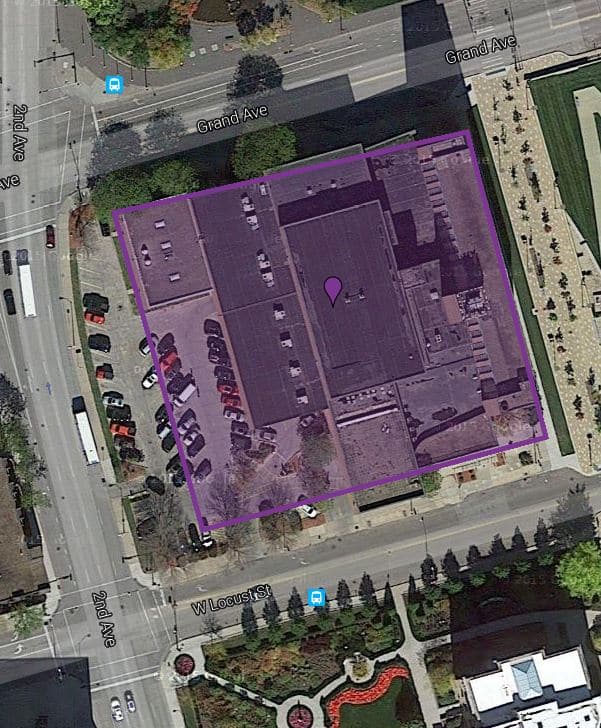

At least two other potential buyers have made preliminary offers on the nearly 2-acre site at 101 Locust St. that has been empty since late last year when YMCA of Greater Des Moines moved to tonier digs at the Wellmark YMCA, the renovated former Polk County Convention Complex at 501 Grand Ave.

Though a state document indicates that a Hubbell entity is the owner of the property, a deed has not been filed.

As Tollakson pointed out, other prospective buyers have backed out of the deal.

Matt Anderson, the assistant Des Moines city manager who guides economic development efforts, said previously that the city saw just one bare-bones plan from one the of the other potential buyers, and that plan basically mimicked a nearly decade-old effort to turn the Riverfront YMCA into a hotel and residential project.

“It’s in everyone’s best interest to have someone figure it out,” Tollakson said. “A number of people have tried and given up.”

A glimpse at Hubbell’s thinking was unveiled when the company submitted an application in March for state brownfield tax credits, a development incentive that is available to owners of old sites that could have some degree of environmental contamination.

In the application from an entity called Lofts on the River, the company proposed a $29.6 million project that included for-sale townhomes and rental units. The application says that the applicant is the owner of the property, with an acquisition cost of $3.5 million.

Tollakson said the application was not unusual from the standpoint that whenever his company considers a project, it casts about for available funds that make up the multiple layers of financing that go into complicated development projects.

The Riverfront Y is a “very complicated” project,” he said.

For weeks, Tollakson had refused to respond to rumors that Hubbell was the local developer that would take on the Riverfront Y.

During the Business Record CRE Trends & Issues Forum, he listed the development of a high-rise luxury residential redevelopment of the Riverfront Y site as his “dream” project. After the event, he told the Business Record that he could figure out how to sell the top two floors of such a structure, with views of the river and the city, but at the time he didn’t have a plan for the remaining floors. Still, he would not say that Hubbell was making a play for the site.

Hubbell lost out in brownfield/tax credit funding that was announced in April for the current fiscal year. Applications for that round of funding had to be submitted by March 16. In all, 27 projects in the city sought the tax credits, but just one was approved. Sherman Associate Inc.’s Nexus at Gray’s Landing residential development near Southwest Ninth Street and Martin Luther King Jr. Parkway was approved for $1 million.

Brownfield sites are abandoned, idled or underutilized industrial or commercial properties that may have some environmental contamination.

Crews are removing asbestos from the Riverfront Y in preparation for the demolition of the eight-story structure this summer. In addition, an underground storage tank must be removed from the property, according the application from Lofts on the River. The Polk County Board of Supervisors has agreed to pay $1 million toward the demolition, providing a buyer does not want to build a hotel on the site.

Brownfield projects can receive up to 24 percent of qualifying costs and 30 percent if the development meets green building standards, according to IEDA. The total award cannot exceed $1 million per project per fiscal year.

In April, the IEDA emptied the $10 million in funding available for this fiscal year in 18 awards, including the $1 million to Sherman Associates.

Tollakson said the application will stand for the tax credit funding for fiscal 2016. Those awards are expected to be announced in October, after a September filing deadline, said IEDA spokeswoman Tina Hoffman.

“It could take us that long to figure this thing out,” Tollakson said.

At present, development plans have not been presented to the city.

According to the tax credit application, “Hubbell’s interest in the success of this site is essential to their plan to create the Bridge District neighborhood across the river. Proposed development occurring within the five year future time frame would include redevelopment of sites east of the subject and increased action in the downtown area surrounding the subject. Des Moines continues to work to attract businesses to the downtown (Central Business District), and housing in this area supports these objectives.”

The YMCA needs to sell the building to help defray the nearly $26 million in financing for the Wellmark YMCA.

According to the Hubbell tax credit application, the developer also will seek other development incentives, including state of Iowa workforce housing tax credits, tax increment financing and tax abatements, according to the application.

Hubbell projects seem to dominate the downtown landscape.

The company recently announced its 5Fifty5 project on property south of its Riverpoint Office Park on Southwest Seventh Street, it is leasing apartments and commercial spaces at Cityville on 9th on Southwest Ninth Street, it has launched an ambitious development called the Bridge District, it could make a play to redevelop a city-owned parking lot across the street from Des Moines City Hall, and it has at least three other downtown projects on tap.

In all, Hubbell submitted six projects for brownfield/grayfield tax credits prior to the March 16 deadline.

Regarding the Riverfront Y property, Tollakson said he would welcome competing offers.