Industrial Roundtable Q&A – 2020 Annual Real Estate Magazine

KATHY A. BOLTEN Apr 20, 2020 | 4:31 am

18 min read time

4,251 wordsBusiness Record Insider, Real Estate and Development

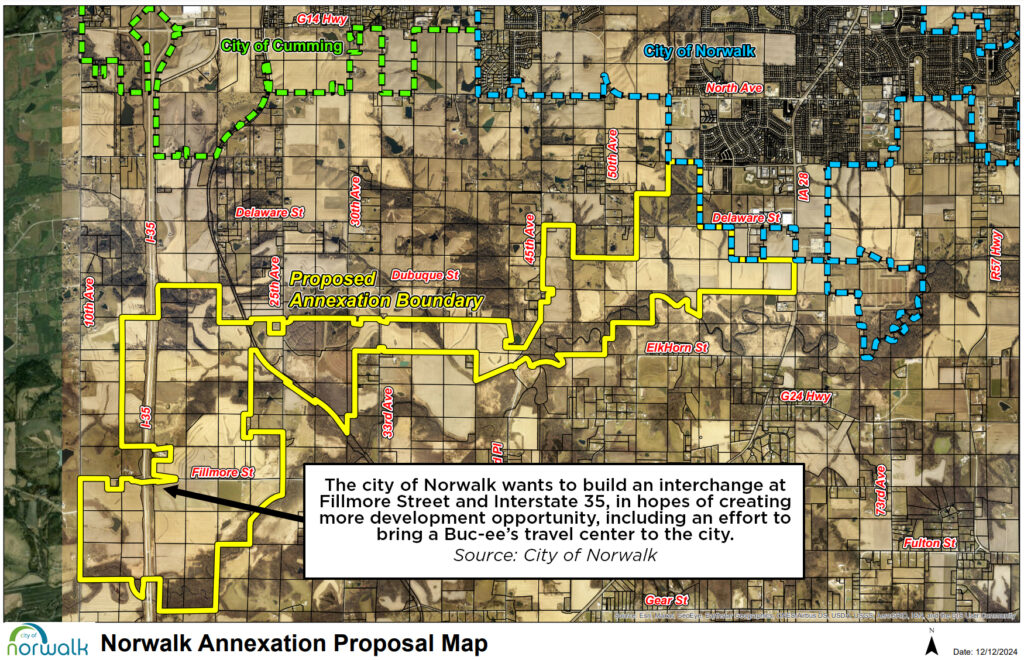

Amazon.com in February announced that it was opening a massive fulfillment center in Bondurant, a revelation that surprised no one after months of behind-the-scenes work.

But the long-awaited announcement likely will spark a flurry of other development in Polk County’s northeast quadrant, an industrial sector panel said.

“Amazon is going to have a great effect on the industrial market in Central Iowa and specifically the northeast quadrant,” said Austin Hedstrom, a vice president with JLL in Des Moines. Amazon’s suppliers want to be near the retail giant’s fulfillment centers.

Industry experts have found when Amazon opens a fulfillment center in a new location, it has a multiplier effect, Hedstrom said. The question, he said, is what is the multiplier effect and how much space will be needed to support the fulfillment center in Bondurant?

In Bondurant, Amazon is occupying a fulfillment center whose total area is more than 2.6 million square feet, information on the building permit shows. If the multiplier effect of Amazon is just 1, that means the Des Moines area could see an additional 2.6 million more square feet of space developed to support the Bondurant facility, Hedstrom said.

Amazon “has suppliers, they have customers, they have clients that want to be in close proximity to these fulfillment centers, so we foresee that Amazon is going to have a great effect on the industrial market here in Central Iowa and specifically in the northeast quadrant,” Hedstrom said.

In addition, other big-box retailers are trying to duplicate what Amazon has accomplished by offering customers next-day delivery or even same day pickup. That means retailers like Target and Walmart could be looking to put fulfillment and distribution centers closer to their brick-and-mortar stores, a move that would be beneficial to places like Central Iowa that are located on interstate highway systems, panelists said.

Read the discussion:

Q. Where do you see the industrial/warehousing sector heading in 2020 in Central Iowa?

Chris Curran: I see a lot of continued activity, a lot of optimism for the industrial sector in 2020. There’s a big wave of new construction, new development that’s going to be hitting the market in 2020. You’ve got the big fish Amazon that’s been announced. … I think a lot of continued development and activity just following right behind their footsteps.

Austin Hedstrom: Momentum with industrial is very strong. [JLL’s] research department is tracking about a 3% vacancy rate and we see continued growth. There’s a number of spec projects that are currently under construction or proposed. I believe in 2020 there’ll be some new ones announced as well. So for the industrial market, it’s kind of, in my mind, the golden child.

Derek Lord: I think 2020 is going to continue to be strong, as my colleagues here have shared. I do think that if there is any type of slower growth, it’s going to be related to the fact that there’ve been so many expansions [of] companies in the metro that have needed to expand, relocate. They’ve done a lot of that activity. … That being said, [with] Central Iowa’s strategic location in the United States and [having] a growing population, it is still very attractive, whether it be new companies looking at Iowa, or even specifically Central Iowa, coming from out of state, or companies that are in other parts of Iowa looking to tap into Central Iowa’s growing population. I think the growth is going to continue to be strong and definitely one of those strongest sectors out there. We could see some changes, given the fact that there’ve been so many expansions, but overall it’s going to be robust.

Jackie Johansen: What I would say about the market in 2020 is that there is a lot of investment dollars that are ready to flow. There’s a very large pent-up amount of capital. Market researchers and economists say the highest ever amount of investment dollars are still being held by funds that are ready to invest. And of course, in the industrial market with e-commerce and the last mile, there’s a lot of activity. Investors are watching very closely and are interested and have an appetite to invest. And that includes the tertiary markets. As you look toward the coasts, cap rates are getting to a point where [investors are] starting to look interior in the country and to tertiary markets. That’s good news for Des Moines.

Darin Ferguson: I see the 2020 industrial market [having] continued growth, albeit … a little lighter on the amount of second-generation space that’ll hit the market in 2020 as well as the amount of time it takes to lease up the new spec space. I think as a whole, from our perspective, we’ve seen more nonindustrial users taking industrial space as a backfill-type tenant instead of having the third-party logistics company come in and gobble them up in a hurry, taking them over. I’m hoping that the Amazon effect will hopefully push that over and we will get more actual logistics companies and third-party distributors, last-mile distributors, whatever you want to call them, leasing up third-party space in the market.

Q. We have talked about the last-mile space. Is there going to be increased demand for last-mile warehouse space because of consumers increasingly wanting those products they order today on their doorsteps no later than tomorrow? How will that play out in Central Iowa?

Lord: I think we’re going to first see creative approaches that we’re already starting to see in the marketplace, whether it be Amazon kiosk pickup boxes, partnerships like Amazon [has] with national retailers … like Kohl’s. There are a lot of models out there that will help address that kind of last-mile need prior to it starting to have a significant impact on space. As far as … consumers’ expectations across all industries, [it] very much seems to be the sooner the better, right? You need it, and you need it now.

It is going to have an impact, but first we’re going to see more of those creative approaches to see if that can solve the need prior to stores leasing and retrofitting existing retail spaces into something else. I think there’s the potential for larger retailers to convert some of their existing space for distribution purposes. That’s been discussed and kind of predicted for a long time. Take Walmart, for example. They have stores everywhere. Easily they could cover that last mile out of their existing stores, but because retail sales within those stores hasn’t dropped … they’re not willing to give up that space. I do think when those bricks-and-mortar stores see a decrease in sales and foot traffic in their existing stores, you might see a 200,000-square-foot big-box retailer devote some space within that store to the last mile because sales in the store have dropped, but we haven’t seen that yet.

Johansen: There’s an incoming growing trend about having different locations for the warehouses that are not time sensitive. They might be business-to-business, but they’re not coming from e-commerce when people want things within two days or 24 hours. … There’s still plenty of [people in] the population of logistics that don’t need things the very next day. Having those warehouses a little bit further removed and on the outskirts of metros makes a lot of sense, and then you don’t need the cost of those downtown urban infills.

Q. An Amazon fulfillment center is under construction in Bondurant. Will that facility have a sort of domino effect of drawing other distributors to Central Iowa that supply Amazon with their products?

Hedstrom: We’ve heard and we’re continuing to do research on this, but [Amazon could have] anywhere from a 1 to 2.3 multiplier effect. … They have customers, they have clients that they want to be right next door. So I foresee that yes, Amazon is going to have a great effect on the industrial market here in Central Iowa and specifically in the northeast quadrant. … Suppliers, clients, customers, whoever’s doing work with Amazon, or whoever Amazon hires to do work for them, they’re going to want to be as close as possible, and depending on the transportation and what they’re shipping and what type of work they’re doing with Amazon will dictate how close they want to be, whether it’s next door or within a 30-mile radius.

Curran: It also depends on where those other big distribution centers are. Are they close enough where some of these other suppliers can still serve our market from those other locations, whether it’s Kansas City, Chicago or Minneapolis? But clearly I think there will definitely be some residual effects and some additional development and then some space built, leased, etc., but … to what extent, if it’s the multiplier, we’ll find out, we’ll see, but I think … it’ll be a positive growth for their presence.

Lord: The city of Ankeny is well positioned near [Amazon] with a lot of land available and zoned appropriately along the interstate. We’ve done our research and talked to communities that have these large centers to see if there is indeed that multiplier [effect], and it varies. I think the difference is where that market is and where some of those suppliers might already be, like [Curran] alluded to. But there is going to be some benefit to the greater region based on what we found. How much is yet to be determined, but we’re trying to position ourselves as a city to capture that, given our proximity [to Bondurant].

Johansen: I represent some buildings in Grimes that are just a stone’s throw from [Amazon’s delivery station]. We’re finding that as we talk with city leaders and [others], that there’s not necessarily enough restaurants and enough amenities that are walkable or even drivable within Grimes. So that is something that’s a real opportunity for Grimes. Several of the business owners [in Grimes] were working together to talk about what these employees will need and how can we bring it to Grimes.

Lord: I would just say on that topic there is a need for some supporting businesses, but I think you have to look closely at break schedules and lunch schedules because there are a lot of those large distribution centers, fulfillment centers, no matter who it is, it’s a quick 30-minute lunch. There might be some benefit [to nearby businesses as employees are] coming into work because they’re going to have to draw from a very wide area to get employees, but in terms of the lunchtime services there’s usually not a lot of time. You have got to catch them either coming in or coming out.

Q. Will Iowa’s low unemployment rate deter other distribution companies from locating in Central Iowa, and will Amazon be able to attract enough people to fill 1,000-plus jobs?

Johansen: So part of that is the trend of having amenities in some of the warehouse space. We’re starting to see that in other larger cities where they’re putting in gyms. Free vending machines seems to be one of the more popular ones, that it keeps people in the building.

Ferguson: To me, these new businesses like Amazon are going to hurt the fast food [restaurants], the convenience stores, the lower-echelon type of employment. [Amazon is offering] a $15-an-hour base plus full benefits. That’s a big number. … If somebody has got the opportunity to take it, you’d think they would go running and chasing that opportunity.

Q. When you’re bringing people into this area to locate a business, do they ask about labor? And how do you answer them?

Hedstrom: I think whether it’s industrial, office, retail, that’s the number one question in today’s world: Where am I going to find my workers? … If you build a good culture, you pay them well, give them the benefits, you’re going to attract your labor force.

Curran: It’s a good problem to have. We’ve talked a little bit about it in our organization too in terms of why people are locating where they’re locating. Going back to the [Amazon project], I don’t know this, but suspect that maybe part of the reason [they located in Bondurant] was access to labor, and being in that part of town … they’re clearly going to have to draw from well outside the metro — Marshalltown, Newton, Grinnell, Knoxville, you name it. Maybe even the south and east sides of Des Moines, where that demographic tends to be a little more blue-collar.

Q. Let’s talk about renewal rates for industrial occupants. There are some studies that are predicting that we’ll see higher than usual renewal rates because of low vacancies. What are we going to be seeing here in Central Iowa?

Curran: I think rates will certainly trend up a little bit, but as we mentioned, there’s over a million square feet of supply coming, so that will slow that down a little bit, there’s going to be options out there for tenants that have leases coming up for renewal. … Across the market, there are a lot of landlords that are building in 2% increases, maybe not with renewal rates, but 2% increases within leases. So I think nominal increases such as 1%, 2%, 3% are not unusual, but that supply that’s coming will keep everything in check.

Hedstrom: I think it goes back to what Darin said. Do they want a 32-foot clearance in a brand-new building, or are they willing to go into a class B or class C industrial building? I think it is a little bit of a landlord’s market and it depends on what’s built out in the shell in terms of how aggressive they’re going to get on a renewal rate. That means if somebody has 30% of office that is built out specifically for them and 70% of warehouse, if they leave, the landlord is going to be out a good chunk of change to repurpose that because there’s not a lot of groups that can come and say “Great, I need this exact product.” So I think it’s a case-by-case basis, and we’ll see what happens.

Johansen: I would just echo that for the flex space, that’s also pushing just a little bit higher on the renewal rate. You’re still kind of mid-$8 to high-$9, but we’re seeing some renewal rates start to push up on the flex side.

Q. How are the costs of construction affecting spec and other projects?

Ferguson: [Tenants] are asking for lease rates of $4.95, and you’re like, that’s a tight return. And then if you carry it for a year, two years, or if somebody comes in and all of a sudden they’ve got a great balance sheet … then all of a sudden they can kind of put the screws to tighten everything down even further.

Curran: Just with construction costs I think anything new that’s coming out of the ground, it’s four and a half dollars a square foot on up and it’s clearly a factor in the market to be able to do something new or spec. I think that’s where if you’ve got some second-generation space that’s move-in ready, even with some office build-out. That’s where you’ve got a clear advantage too, because the spec stuff is new, it’s shell; if you need to build out some office, that even adds more cost to it, so you’ve got the second-generation space, at least in our portfolio has leased up really, really well once we have availability. … There’s some existing improvements available, probably even able to do that at maybe a little bit lower rate, but the new construction is expensive with the cost of construction, and then, if you have to build out anything additional, whether it’s add dock doors or office, build-out just makes them much more expensive.

Q. How are these new buildings being designed compared to maybe 10 or 15 years ago? What are some of the new features that are being added, or being asked to be added that maybe weren’t included 10 years ago?

Curran: [Some buildings are adding] a little more glass, just even three to four [windows up high] just to add some natural light into the warehouse. Parking is a big thing … at least having the ability to expand parking in case it’s needed. I would say in terms of other design, just even more glass along the front of the building and probably more flexibility with dock doors and drive-ins as well. Those are probably some of the bigger things that we’re seeing design-wise.

Ferguson: Probably height. I mean everything seems to go back to height. [Tenants] want to be able to rack as tall as they can.

Lord: I think it’s been great to see the development community plan these buildings for alternative uses. And I think that kind of ensures the long-term viability of the product. I think in the past it was a warehouse, you put it up, you assumed it was going to be full of racks, full of forklifts and pallets. Now you don’t know if it’s going to be a youth gymnastics place or a basketball court or a yoga studio. I think some of the design changes have obviously helped from the leasing side because they can appeal to more tenants. From the city’s perspective, it’s nice to know that products, as they’re being planned on the front end, [have] alternative uses that will make sure that building is viable 20, 30 years from now. Even if a warehouse industrial tenant moves out, [if the building is] in a nice area, has nice landscaping, there’s glass, it could be something else, and that speaks to the development community in the quality of the developers we have in the area.

Q. Are cities asking for these buildings to include any sustainability features?

Lord: I can speak for Ankeny. It’s one of those that we do not ask for anything specific; things are encouraged, but because a lot of times these buildings, they’re built and held long term. [Some developers] do it on their own because they know the operating costs are something that’s going to help them secure tenants. So we’ve worked on projects where there wasn’t anything specific in terms of environmental design but the property owner wanted the developer to put the list together and it was a very long list of environmental features and energy efficiency features that appealed to the tenant even though it wasn’t explicit on the front end. It’s just part of doing business today.

Q. Are there some other things that you’ve seen across the country that people are using industrial-warehouse space for?

Hedstrom: Hy-Vee’s IT department that’s in R&R’s building. I’ve heard that it’s pretty unique space [with] the go-carts, the trampolines, entertainment. It’s a cheaper rate than going straight retail for the most part, usually, and you get that higher clear heights, so if you need it you can use it.

Curran: I would agree nontraditional use is still out there. Everything from fitness to food prep to even office. You look at what Hy-Vee did — completely took over 100,000 square feet — and now it’s the home to their marketing and IT staff and just they have got a lot of amenities for their employees to enjoy. People have heard about that, they’re familiar with it, so they’re at least still exploring that idea of doing similar things.

Johansen: We’re still seeing interest from church groups. That can be a really good fit — parking is good — and also coworking spaces that are looking at some of the second-generation spaces if they’re priced right, they’re interested in putting in coworking-type spaces.

Q. Are out-of-state investors looking at Central Iowa for investments in the industrial sector?

Hedstrom: They’re definitely flooding into Central Iowa and in the central region of the United States, in general. I mean, Corporate Woods II, to an East Coast investor, and they’re not the only East Coast investor that reached out. There’s a number of West Coast investors that also reached out. So I think the problem for brokers … is finding any product to sell, not the capital that [investors are] willing to spend.

Johansen: If you look at the [industrial] transactions for the past three years, about 36% of those transactions came from out-of-state investors. If you look at the flex product, it’s only 5%. So that tells a little bit of a story right there. I recently joined a group of 300 female investors in commercial real estate, and among our top three priorities of the type of product categories we wish to put our dollars towards, industrial is in the top three. And that’s what I’m finding as I speak with other investors that I’m building relationships with. It’s definitely a hot category.

Ferguson: Do you think the flex number is so low because of the more intense management and turnover, or what do you think was the reason for that?

Johansen: I do think that’s part of it. And I also feel that, as I was looking at the data, some of the flex properties transacted more than once in three years.

Q. What’s behind the inability to find sellers?

Hedstrom: There’s a lot of people out there that if they have a good product, why sell? And if they do, where do they put their money if their properties do sell?

Curran: R&R typically rarely is ever a seller. With the recent warehouse developments that R&R has completed, there’s been a lot of interest, a lot of brokers calling up our subsidiary asking about [whether we’d be] interested in selling. And that’s just not R&R’s philosophy. There are other long-term owners/holders [of industrial property].

Q. We have a lot of long-time holders in this market, right?

Johansen: Yes.

Ferguson: I call us the “farmers’ mentality commercial real estate market.” You buy and hold, and then you want to buy your neighbor’s property as soon as you can.

Q. Are there any concerns that out-of-state investors won’t maintain the property?

Ferguson: Typically, if that’s going to be the case, it’s going to be … held up by the city enforcement. If it gets that bad, the city would come in and force it [to be maintained]. With anything, there’s the opportunity to bleed the money out of it and not put it back in, but I think that would change hands quicker than not because then it’s empty; they don’t want to own empty property. Like everything else, it usually corrects itself.

Curran: You would hope if it’s an out-of-state investor, that they’d look to a third-party property manager to help them keep the property maintained.

Q. Talk about any one concern you might have for the next 12 to 18 months.

Hedstrom: The two big ones are labor and tariffs from our industrial standpoint. [Regarding tariffs], just the cost of goods, obviously coming into and from the U.S. It’s affecting industrial manufacturing businesses and it’s affecting their decisions of expansion or relocation.

Johansen: And it’s easy for people to take a pause as we go into presidential elections — wait to see exactly what happens. It doesn’t necessarily bring things to a stop, but it can cause the pause.

Curran: I think economic uncertainty would be up there, but [also] continued increasing costs of construction. … Operating expenses, property taxes. … When do we get to that point of enough is enough or too much is too much?

Q. What are your closing thoughts?

Ferguson: The one thing I would challenge everybody to do is to go back and figure out something you bought two to three years ago and see what you paid for it, and then go research what it would cost you today. And a hard good, not a clothing item, something that maybe you bought for your house, or was made for you and go look at the cost. Nobody’s talking about inflation, but it’s definitely there.

Johansen: I’m excited to watch the flow of dollars that come from out of state and eventually out of country that will come into Des Moines and other tertiary markets. I think it will really have an impact on some of the projects that we do here. A lot of times those kinds of investors come to invest in your city, but they end up being a part of your community.

Lord: I think the development community doesn’t always get enough of the credit that they deserve. We are fortunate as people who work for cities and as residents of the metro to have developers and commercial property owners that really care about the long-term health and longevity of our community.

Hedstrom: I echo exactly what everyone else says in terms of the growth in Des Moines. Being in commercial real estate at this time is … fun. I look forward to continuing to see whether out-of-state investors or owner-users look at Des Moines and getting us on the radar of those businesses. I look forward to seeing exactly where it takes us.

Curran: We’ve got a great region; we’ve got a great community and it just continues to grow. … We’re all well positioned; there’s plenty of land for future development. I think e-commerce is just going to continue to drive that. I don’t think things are slowing down; the region is growing, it’s booming, so I’m very optimistic going forward.