Iowa Business Council members expect flat growth, for the moment

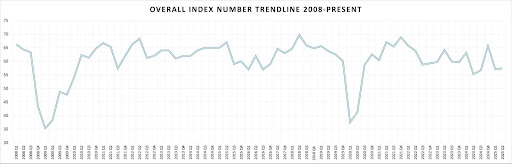

The Iowa Business Council today released its latest member poll, the second quarter Economic Outlook Survey, which sits at 57.41, an increase of 0.27 points from the previous survey, and down 2.95 points from its historical average. Although the number is down, optimism could quickly buoy with positive news about taxes and tariffs.

The report measures IBC member expectations and optimism for sales, capital spending and employment for the coming six months. If the number is above 50, sentiment is positive.

“That’s good news that we’re certainly well above that 50-point threshold,” said IBC President Joe Murphy. “Despite some of the obstacles that we’re seeing nationally and internationally, Iowa is continuing to position itself well from an economic opportunity standpoint for the future.”

The report concluded:

- Sales expectations declined 0.4 points to a value of 63.89

- Capital spending expectations declined 0.59 points to a value of 54.17

- Employment expectations increased 1.79 points to a value of 54.17

Business leaders are awaiting the outcome of tariff negotiations and how Congress votes on President Donald Trump’s “big bill.” The House could decide as early as today whether to pass it, and the tariff trade negotiations deadline is July 9. If outcomes benefit Iowa companies, the business sentiment will likely become more positive, Murphy said.

Many business leaders are hoping for renewal of the Tax Cuts and Job Act of 2017, which reduced corporate taxes from 35% to 21%. Provisions to the tax cuts, such as bonus depreciation and research and development deductions, are set to expire at the end of this year.

“The big thing on the tax policy at the federal level is that [Iowa business leaders] know what the rules are. They know what the policies are moving forward. From a workforce perspective, the individual rates are extended and will hopefully be made permanent,” Murphy said. “When you’re coming up with compensation packages, you can share with your employees, ‘Here’s what it is now, and here’s what you will have.’ Then from a business application standpoint, in particular, full expensing of research and development is huge, particularly for Iowa companies. At the federal level, bonus depreciation is huge for Iowa manufacturers and then making sure that the corporate tax rate remains at that 21%; there was some talk about possibly increasing that. The fact that it’s preserved at that lower rate is obviously a good thing. Having clarity particularly around the R&D credits and then bonus depreciation is really important for Iowa companies, and will hopefully alleviate some of that uncertainty, at least on their financial books.

Tariffs and the uncertainty surrounding trade negotiations has led to a slump in optimism from some business leaders in the state.

“At the end of 2024 if you look back to our fourth quarter survey of 2024 it was in the 60s [65.63], from an outlook standpoint. Then the second quarter of this year from the first quarter was down by about 8 or 9 points from that sort of high water mark as we were transitioning administrations into 2025. There was sort of a rush of optimism, and I think that’s been tempered with the tariffs and then some of the uncertainty around the tax bill,” he said. “Getting that clarity that the tax cuts from 2017 are in place moving forward and wrapping up some of these trade deals that seem to be punted into the future with some rapidity [will help improve business confidence]. I think that’s leading to some of the uncertainty and maybe some of the waning optimism that these things should be done sooner than the administration’s timeline. It will really be interesting to see, assuming that the House passes this bill, today or tomorrow, and then assuming we can get some resolution on these trade deals in particular by the fall, it would be interesting to see what our third quarter numbers will be if those things occur.”

Hiring outlook

Hiring expectations are way down, despite Iowa’s longtime workforce shortage, he said. When Murphy began in his IBC position six years ago, employment sentiment was in the 90s. This quarter, that number is 54.17.

“What that tells me is that companies are taking a cautious outlook on the potential for future hiring,” he said. “A lot of companies, if you look through our data, will show that they’re not expecting a lot of change in hiring practices over the next six months.”

Many companies are not filling positions through attrition, he said.

“I think that it is still true that we have a workforce shortage. There are more job opportunities than people on unemployment right now,” Murphy said. “When you talk to some of our higher education partners, their career services offices will tell you that their recent college graduates are having a difficult time finding jobs, and so, I think both can be true at the same time, where we’re still in a need for some critical workers in our economy. But I think companies are being a bit more selective in what they’re looking for, or at least as far as replacing workers, or going out and hiring a bunch of workers at one time.”

Overall, the latest survey results are positive for business in Iowa, he added.

“We’re not immune from some of the national effects [of federal policy changes], but we’re weathering some of those situations really well,” Murphy said. “I think it gives us a good sense of optimism that we can get through this sort of situation, no matter how long it takes, and come out better on the other side.”

Gigi Wood

Gigi Wood is a senior staff writer at Business Record. She covers economic development, government policy and law, agriculture, energy, and manufacturing.