Iowa’s nuclear decision

Will Iowa be part of an American nuclear energy renaissance?

What could be better than launching a billion-dollar economic development project that would provide more reliable energy for Iowa? MidAmerican Energy Co. officials say a new nuclear power plant in Iowa would provide both benefits for the state.

Opponents of expanded nuclear energy in Iowa, meanwhile, are concerned about untested technology and a financing plan they say would lay all the development risks at the feet of the utility’s customers.

If approved by the Legislature, House File 561 would allow the Iowa Utilities Board (IUB) to consider a rate-making case by MidAmerican Energy to finance and construct a new nuclear plant in Iowa.

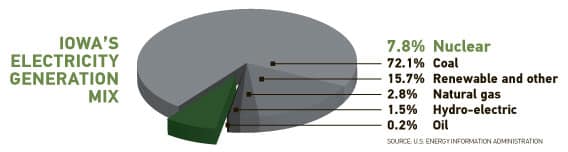

There are now 104 nuclear reactors operating in 31 states. Iowa’s only nuclear reactor, the Duane Arnold Energy Center in Palo, has been operating since February 1975 and produces approximately 9 percent of the electricity generated in the state.

The proposed legislation would allow MidAmerican to impose fees on its customers to recover the financing costs for a nuclear plant while it’s still under construction. Though MidAmerican officials say that imposing those fees would save its customers a significant amount on the final cost of the project, opponents liken the scheme to a buyer paying interest on a house for several years before moving in.

Some utility customers in other states have already paid millions of dollars in cost-recovery fees for proposed nuclear plants – which may or may not be built – through advance cost-recovery fees that regulators have approved in their electric bills. However, MidAmerican says it’s pursuing a much lower-cost option – small modular reactors – that will enable it to start small and add generating capacity as needed. Whether the state will choose to join other states in a renewed push for nuclear power may or may not be resolved by the final gavel of the legislative session.

MidAmerican began considering the feasibility of adding nuclear power to its production portfolio in Iowa about three years ago, said Dean Crist, the company’s vice president of regulation.

“This is a 10-year process, and as we look forward, we’re going to have to retire some coal plants, reduce some coal (power) output and switch some over to natural gas,” he said. “Our demand is increasing; we’ve set new demand (levels) every year since 2008. We need to plan how we’re going to meet our customers’ needs, and with this long-term type of project, you need to start now.”

Increasingly stringent environmental regulations on coal-fired plants are requiring utilities to consider other options for producing power, he said, noting that natural gas and nuclear power are the only two alternatives that can generate electricity on a 24/7 basis.

The Des Moines-based utility company, which now generates nearly 50 percent of its power using coal, is seeking a balanced approach that uses a diverse mix of fuel sources.

“If nuclear isn’t an option, then it’s all natural gas,” Crist said. “This is all about protecting customers and keeping electric prices low.”

Out of favor politically for decades following the near-meltdown in 1979 of the Three Mile Island nuclear plant in Pennsylvania, the nuclear power industry seems poised for a renaissance as new technologies promise to deliver safer and in some cases less costly options for construction.

On Feb. 9, the Nuclear Regulatory Commission (NRC) approved the first construction permits for new nuclear reactors in 30 years. The Plant Vogtle expansion in Georgia will add two reactor units to an existing two-reactor plant, which currently provides power for a three-state region. And on March 30, the NRC announced its approval for two new reactors to be built in South Carolina.

The future of other nuclear projects is less certain, which has provided ammunition for opponents of further nuclear development.

In Florida, the state’s two largest utilities, Progress Energy Inc. and Florida Power & Light Co., are seeking NRC approval to operate two new nuclear reactors each. However, neither utility has committed to building the nuclear plants. Progress has spent $1.1 billion of customers’ money developing and planning the $22.4 billion project, which has been delayed several times and won’t come on line until after 2021, if at all, according to the Tampa Bay Times.

On April 12, the Florida AARP joined a lawsuit before the Florida Supreme Court in which the Southern Alliance for Clean Energy is appealing Public Service Commission decisions in 2011 that allow the utilities to collect millions in construction fees in advance.

Other utilities are looking toward small modular reactor (SMR) technology as a more cost-effective model for bringing more nuclear power on line. In May 2011, the Tennessee Valley Authority (TVA) signed a letter of intent to build what could be the first small reactor project. The TVA plans to build up to six of the mini reactors at a site west Knoxville, Tenn.

Another modular reactor project was announced earlier this month. On April 11, NuScale Power LLC, one of four SMR manufacturers, announced an agreement to work with an economic development group to build a modular reactor at the Savannah River Site, an existing nuclear plant operation in the state. The company said it plans to apply for federal funding through the U.S. Department of Energy’s $452 million Small Modular Reactor Licensing Technical Support program.

‘Fundamentally flawed’

Under traditional rate-making rules, state regulators typically allow costs for power plants to be recovered only after the facility becomes operational. However, because of the increased costs and lead time needed to plan, license and build a nuclear plant, that approach might be inadequate, proponents say. In a January guest opinion in The Des Moines Register, IUB Chair Libby Jacobs wrote: “Utilities considering investment in nuclear energy maintain that it would be difficult, if not impossible, to finance one or more nuclear plants without a greater level of assurance of cost recovery than is provided by traditional public utility regulation.”

Because the three-member utilities board would be hearing the case if the bill is passed, IUB officials declined a request for an interview.

In a prepared statement, the board said it will be ready to carry out its responsibilities as outlined in any legislation that is approved.

“The IUB appreciates changes to the legislation which includes an appropriation for additional full-time staff and consultants,” the board said. “Making sure we have access to knowledgeable, qualified professionals with nuclear energy experience will be the first order of business for the IUB.”

The type of advance cost recovery that Iowa regulators may consider for MidAmerican has generated considerable controversy in other states, possibly even more so than environmental or safety concerns.

An expert on nuclear reactor financing said that allowing advance cost recovery in Iowa would lead to significantly higher electricity costs for consumers – up to $70 a month more. Mark Cooper, a senior fellow for economic analysis with the Institute for Energy and the Environment at Vermont Law School, authored a study released in March that analyzed the effects of advance cost recovery in Florida, Georgia, North Carolina and South Carolina.

“In addition to the dismal economics of nuclear power, the primary reason that the practice is limited to a very few states is that advance cost recovery is fundamentally flawed,” Cooper wrote, “placing ratepayers at extraordinary risk for an excessive and unnecessary cost burden that runs into the billions of dollars.”

In Georgia, legislators in 2009 authorized the state’s largest power provider, Georgia Power Co., to collect nearly $1.7 billion in advance from its customers in the form of a cost-recovery charge that went into effect on Jan. 1 of this year. Those fees, which added an average of $3.73 to customers’ monthly bills, will increase annually to nearly $9 in added monthly charges by 2015, a year before the first of the two scheduled reactors is due to begin operating. A consumer advocacy group, Georgia Watch, said nearly $1 billion of the cost recovery amount, which pays finance costs on the plant, will be used to ensure that the utility maintains a guaranteed profit margin of more than 11 percent.

Clare McGuire, director of Georgia Watch’s consumer energy program and a former Georgia Public Service Commission (PSC) staff attorney, said the advance cost recovery plan approved by her state’s legislature is “along the lines of paying finance charges on a house five or six years before you move in.”

More cards have been stacked in Georgia Power’s favor as well, McGuire said. The legislature approved a provision that exempts Georgia Power’s major commercial and industrial customers from the cost-recovery fees, placing the full burden of the payments on residential consumers. Once the two reactors go into service, an additional $4.4 billion will begin to be recovered from customers. Under a risk-sharing mechanism approved by the Georgia PSC, that amount could be increased if the regulatory agency determines that the cost overruns are “reasonable and prudent.”

The increases from cost-recovery fees are in addition to a $2.1 billion increase in electricity rates the Georgia PSC approved in December 2010 that is being phased in during the next three years, McGuire said.

“Georgia is a state that has been hit very hard by the recession,” she said. “Another $15 or $20 a month may not sound like a lot to someone in the top 1 percent, but it is a lot for someone in the 99 percent.”

Cutting-edge technology

Crist contends that MidAmerican Energy will be paying all of the financing and construction costs up front for any nuclear project, with cost recovery taking decades to complete.

“So our company is at risk for that long period of time,” he said. “What our customers are paying is financing costs through the construction period to reduce the final cost of the plant. Our company puts up all the money before our customer puts up a dime.”

By recovering the financing costs of the plant, MidAmerican will “avoid paying interest on interest” and will save an estimated 20 to 25 percent on the final cost of the plant, Crist said. Additionally, because MidAmerican’s favored approach is to build a modular reactor, the total project cost would be much smaller than the projects under way in the Southeast, he noted.

“The plants in Georgia, Florida and other states are almost apples to oranges because what they’re looking at is tens of billions of dollars in plant,” Crist said. “The small modulars we’re looking at are a $2 billion to $3 billion investment. So the impact with those plants is much larger. It’s the same technology, yet it’s the smaller modulars versus the very large multibillion-dollar plants.”

In 2010, the Iowa Legislature approved a bill authorizing MidAmerican to conduct a study to assess the potential for more nuclear generation in Iowa. Crist said that study, which was intended to be up to a three-year effort, is not yet completed.

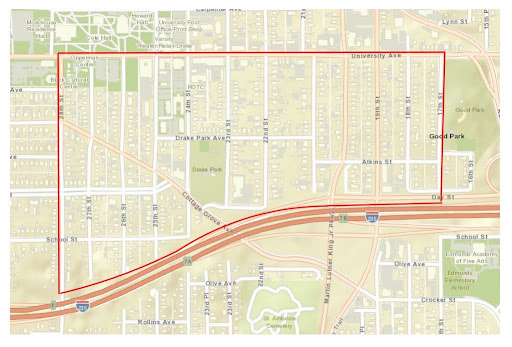

“We’ve answered some questions; we haven’t gotten them all answered yet,” he said, adding that the company has not released any interim report. “But we know there are some sites in Iowa that are accessible, at least from publicly available data.”

MidAmerican officials have also investigated options for modular reactors with all four existing vendors of the technology, and the company likes what it has found, Crist said.

Modular reactors “are on the cutting edge of where nuclear is today,” he said. “Even though today’s nuclear plants are considered very safe, these are even increments above that in terms of safety. Also, they’re small; we can add capacity when we need it. With some of the plants being built elsewhere, you build this large plant and you hope you grow into it. With small modulars, you can add as you grow, so it’s a cost-effective way to meet the needs.”

What’s next

Crist said he’s still hopeful the legislation will pass this year.

“We still think it’s the right thing for customers,” he said. “At some point, if the state decides that nuclear is not part of the energy mix, then we’ll shift our focus to natural gas; we have no other alternative.”