Iowa’s unemployment trust fund remains solvent even as state pays out record amount in jobless benefits

KATHY A. BOLTEN Dec 21, 2020 | 9:18 pm

3 min read time

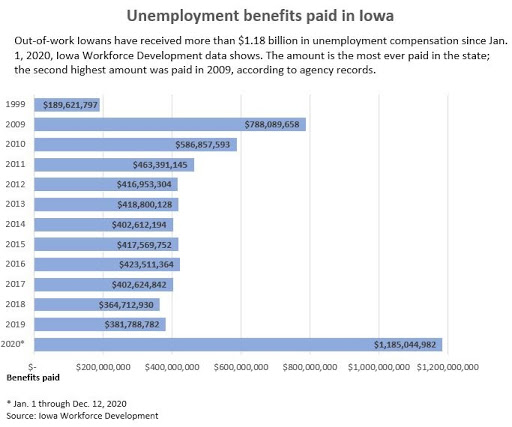

754 wordsAll Latest News, Economic Development, Statewide NewsOut-of-work Iowans in 2020 have received a record $1.185 billion in benefits from unemployment compensation, an amount that eclipses jobless benefits paid annually during the recession, a review of Iowa Workforce Development data shows.

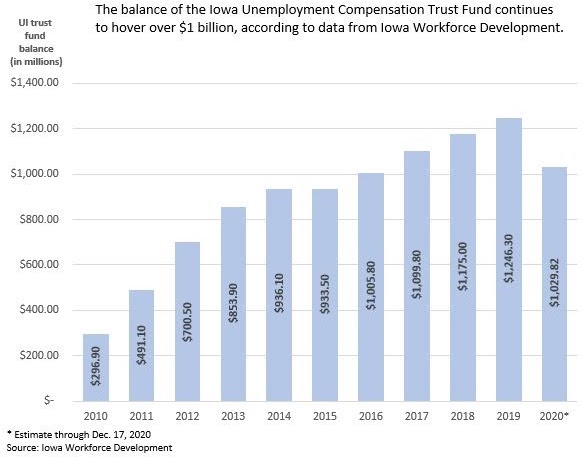

But while a record amount in jobless benefits has been paid in 2020, Iowa’s unemployment compensation trust fund balance has remained above $1 billion for much of the year. A $490 million infusion from money included in last spring’s federal COVID relief bill has helped keep the trust fund healthy.

In addition, some pressure was taken off the fund between July and the end of October when more than 44,500 Iowans exhausted their up to 26 weeks of regular unemployment benefits.

However, it was the infusion that most benefited the trust fund, said Ryan West, Iowa Workforce Development’s deputy director. “The infusion helped keep the trust fund solvent,” he said.

Iowa was among about 17 states that used a portion of the federal COVID relief money to bolster its unemployment trust fund, West said. As long as the fund remained at a certain level, the tax rate paid by employers for state unemployment insurance did not change, he said.

“When the trust fund balance goes down, [unemployment insurance] taxes will go up to help replenish the trust fund,” West said. The state’s goal was to keep the trust fund’s balance at a level that didn’t adversely affect the state’s employers, who would have been required to pay higher taxes for unemployment insurance, he said.

When thousands of Iowans were unemployed during the recession, the trust fund’s balance fell to a level that required employers to pay a higher unemployment insurance tax rate, West said.

The trust fund began 2009 with a balance of $368.4 million, a nearly 50% decline from the $714.9 million balance it began with in 2008, state data shows. By the start of 2010, the balance was $296.9 million. The decline was due to the then-record $788.08 million paid from the trust fund to jobless Iowans, state data shows.

Iowa will start 2021 in a “really good position,” West said. Iowa is also in a better financial position than the 20 states that borrowed money from the federal government to keep their unemployment trust funds solvent, he said.

According to a federal Congressional Research Service report issued Dec. 1, 20 states have outstanding loan balances ranging from Delaware’s $32.9 million to California’s $16.1 billion.

In all, those 20 states and the Virgin Islands owe nearly $42 billion to the federal government for money they borrowed to shore up unemployment compensation trust funds, according to the report. If the interest-free loans are not repaid within a specific time period, employers will pay a higher unemployment tax rate.

“When you’re in a position like that, it really can be stressful,” West said. Iowa “is in a fantastic position, and we obviously want to keep it that way as we move through January and February, which are always tough months because of the weather.”

A lot of seasonal workers, like those in construction, can’t work in the winter months, which traditionally causes a spike in the number of unemployed workers, he said. Iowa is already starting to see the spike occur. Last week, 20% of 1,379 of new claims were filed by people who worked in construction, according to the state agency.

Iowa began the year with a balance of $1.260 billion, according to a U.S. Department of Labor report issued in February. The fund’s balance has shrunk 18% since the start of the year, state data shows.

Additional pressure was put on the trust fund when Iowa’s unemployment rate reached double digits, requiring the state to provide extended unemployment benefits.

The last time Iowa provided extended jobless benefits was in 1983 during the farm crisis, West said. “We did not trigger extended benefits during the recession, but a lot of other states unfortunately had to.”

A portion of the extended unemployment benefits came out of the trust fund; the federal government paid the other portion. The extended benefits were paid through Oct. 31. Last week, the state agency announced that Iowa’s seasonally adjusted unemployment rate in November was 3.6%.

West said he doesn’t envision the extended benefits being provided in Iowa in 2021. He also said he expects the trust fund balance to remain healthy.

“People are returning to the workforce and the vaccine distribution has begun,” he said. “Hopefully, things will be getting back to normal.”

Iowa’s unemployment trust fund balances