Is Your Portfolio Aligned with Your Purpose and Plans?

Business Record Staff Sep 6, 2018 | 11:00 am

3 min read time

793 wordsBusiness Insights Blog, FinanceBY KENT KRAMER, CFP®, AIF®, Chief Investment Officer, Foster Group

How might smart investors target the risk and return of their investment portfolio to meet the unique aspects of their total financial plans and goals?

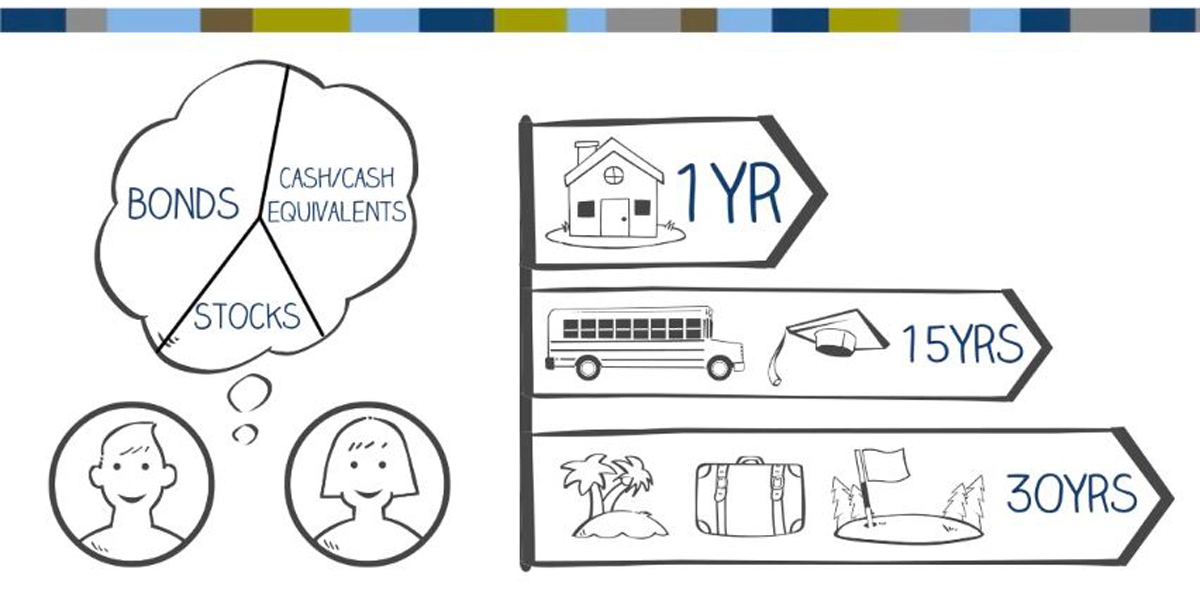

Financial plans consist, in part, of goals that need dollars at planned intervals. Cash to buy a house may be needed next year, funds for helping children with college could be needed 15 years from now, and funds for retirement expenses may be needed 30 years from now, and then every year for another 25 years!

As an investor considers how to fund these different goals, targeting the appropriate risk and expected return with dollars being saved today for tomorrow’s expenses is vitally important. Targeting can be effectively done by allocating dollars to asset classes that have risk and return expectations matched to the goals.

An investor might think of their portfolio in three segments. One segment consists of cash and equivalents, including money markets and CDs. These preservation assets are very liquid, meaning that no matter what day they are needed, they are available to the investor without any significant risk of loss. They fund near-term goals, like a house down payment needed in six months, very well. In exchange for this liquidity, these assets provide very little in the way of expected return.

Another segment of the portfolio may be dedicated to long-term growth to fund a goal like retirement, if retirement is still 10-20 years away. This segment may consist of a variety of stocks, real estate and other growth assets. Because the dollars in this segment of the portfolio are not needed for many years, they can be invested in assets whose prices are far more volatile than preservation assets, but which have an expected return significantly greater than inflation and preservation assets. This kind of growth is usually required to fund larger, long-term goals like retirement.

A third segment of the portfolio may be dedicated to managing and reducing the risk of the growth portfolio, while not being quite as conservative as the cash assets. Usually investment-grade bonds with maturities between five and 15 years or more are found here. This third segment may also be thought of as a portion of the preservation portfolio since it is generally far less volatile and more liquid than stock and real estate asset classes.

Depending on each investor’s unique circumstances, the sizes of these three segments will vary. For investors who have a primary need to target higher returns for accumulating retirement funds, the growth portion of the portfolio may be larger. For investors with immediate cash needs, their portfolio will need an allocation to cash assets, with their emphasis on minimizing risk and providing immediate liquidity. All investors must consider how comfortable they are with the stability of their overall portfolio and may use the third segment of intermediate-term bonds to manage the risk, albeit reducing the overall expected return of the portfolio at the same time.

Because investors need reliable and consistent assets to fund each of the three segments, it is important to know what management style is being used for any mutual funds or exchange traded funds being selected. Index funds and quantitatively engineered asset class funds have very specific types of securities that they must hold every day. As we have seen in our previous “Index vs. Active” videos, actively managed funds may have broader guidelines in which to operate, meaning that a “growth and income” fund may hold 50 percent stocks one month and 75 percent stocks in the next.

This changing approach by the fund manager may not be in line with an individual’s carefully targeted risk and return allocation. Alternatively, an index fund constructed to replicate the S&P 500 will consistently hold to its virtual 100 percent stock allocation every day. The same is true of many quantitatively managed U.S. large company asset class stock funds.

For those segments of the portfolio with specific, goal-oriented risk and return targets, investors would be well-served to consider using the consistency of true cash assets combined with index and quantitatively managed asset class funds.

| Kent Kramer View Bio |

PLEASE NOTE LIMITATIONS: Please see Important Disclosure Information and the limitations of any ranking/recognitions, at www.fostergrp.com/info-disclosure. The above discussion should be viewed in its entirety. The use of any portion thereof without reference to the remainder could result in a loss of context. Foster Group cannot be responsible for any resulting discrepancy. A copy of our current written disclosure statement as set forth on Part 2A of Form ADV is available at www.adviserinfo.sec.gov. All investment strategies have the potential for profit or loss. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses.