Micro-loans change lives of women in Ghana, Nicaragua

Iowa nonprofit Self-Help International runs program that helps women around the globe

By Jerry Perkins, guest contributor

Sarah Barnie is a seamstress in Nerebehi, Ghana, who is using micro-credit loans from Self-Help International, an Iowa-based nonprofit organization, to start and expand her sewing business. Today, Barnie owns her own shop and reports that business is good. The products she makes are very high-quality, so it is common for aspiring seamstresses and tailors to apprentice at her shop to learn from her.

Barnie is one of 500 successful female entrepreneurs who have worked with Self-Help to pull themselves out of poverty by becoming successful entrepreneurs who can provide better nutrition, housing and education for their children.

On International Women’s Day, March 8, Self-Help saluted the hundreds of women who have been empowered to take control of their financial futures and provide for their families by working with Self-Help’s micro-credit staff in Ghana and Nicaragua.

How it works

Women in Self-Help’s micro-credit program start with $50 loans, which can gradually increase to $300 if needed to expand their businesses. Repayment rates by Self-Help’s micro-credit entrepreneurs average 98 percent, and the repaid loans are reinvested to offer training and financing to extend the opportunities to more women in need.

Before women are granted micro-credit loans from Self-Help, they must successfully complete a six-month training program teaching basic business guidelines, such as how to determine business income, how to make personal savings for future expenses, and the benefits of reinvesting profits into businesses. They also are exposed to healthy day-to-day living strategies for themselves and their families. Even illiterate women who lack formal education or collateral are able to start successful small businesses with Self-Help’s assistance, enabling the women to generate a steady source of income for their families.

Barnie has consistently used her loans to purchase machinery and other sewing essentials needed in her sewing business. Her first loan from Self-Help’s micro-credit program was for 100 Ghanaian cedis (approximately $50 then). Based on her strong repayment history, she has been able to increase her loan amounts, most recently borrowing 1,000 cedis, or approximately $225.

Barnie’s story is particularly gratifying, not only because of her business achievements but also because of the feminine hygiene product she learned to make at a sewing training session sponsored by Self-Help. At the training session on Feb. 20, 2017, Sarah learned how to make Days for Girls (DFG) sanitary kits with instruction from Self-Help volunteers Barb Dahlby of Waverly and Gail Stelmacher of West Des Moines.

The Days for Girls kits cost about the same as what a woman would spend on a three-month supply of pads, but they last three years because they can be washed and reused.

With her next loan, Barnie plans to start an additional business selling groceries in her community. This, she believes, will help her maximize her returns to support her family’s growing needs.

Self-Help is connecting Barnie with other micro-credit-financed women who can sell the kits on her behalf so she can focus more on producing the kits and less on market development.

In addition, Self-Help’s micro-credit staff in Ghana is staying in communication with Barnie to monitor her sales and to see what supplies she needs, for tracking and ordering purposes.

Here are more examples of women who have helped support themselves and improve their family’s lives by participating in Self-Help’s micro-credit program.

Women in Ghana

Veronica Asantewa is one of the stars of the micro-credit program. She saw a need in her village of Kukobuso for a store and has used her small loan to buy a refrigerator for the store.

In Ama Badu, micro-credit loan recipient Lucy Ataa held a cooking demonstration on how to make pastries for several dozen women in the village. Ataa was trained by Self-Help to make and sell the pastries using a micro-credit loan and has become proficient enough to teach other women how to succeed.

In the nearby village of Nkwamie, Agnes Asante received instruction at Self-Help’s Agricultural Entrepreneur Training Center on raising day-old chickens to market weight in a project that has been financed with a micro-credit loan.

Gifty Anapo of Adankwame is a trader and food vendor whose business has been financed by Self-Help’s micro-credit program. She has used her earnings to build a house where she lives with her husband and has been able to financially assist her sister so she can attend secondary school.

Mary Azibo, also of Adankwame, sells cleaning products and head scarves, purses and body cream. She also buys rice from local farmers and resells it. She has used her micro-credit loan to increase the products she sells.

Women in Nicaragua

In the Central American country of Nicaragua, Self-Help’s micro-credit program has empowered women to start and finance their enterprises, mostly preparing and selling baked goods and food.

Heliodora Cardoza uses Self-Help’s small-business loans to help run her bakery. “I wanted to make my own money and not rely on what my husband gave me,” she said. “When I learned there was money to be lent for an oven, I met with Self-Help and borrowed money for a small oven. I learned about making pastries and fillings for my pastries, cake decorating, and better ways to make bread to improve the quality.

“I sold enough bakery goods that, after a while, I was able to get a bigger oven and grow my business. I also do cakes twice a week.” She is selling almost all the bread she bakes to gold miners who work in the nearby mines, and she bakes food for Christmas and other special occasions.

“The micro-credit training is helping me grow my business with marketing and other things so I never miss a training session. Also, they’ve helped me improve the quality of my baked goods, do a business plan, and marketing.”

Cardoza has used her bakery’s earnings to add a room to her house where the other micro-credit women could meet in La Azucena, a rural village in southeastern Nicaragua near the border with Costa Rica.

Primitiva Pichardo, 43, lives with one son, Jose David Pichardo, 22, in La Azucena. Another son, Cruz Leonel Martinez, 20, is studying tourism at a university in Managua.

Primitiva Pichardo has been making bread since she was 15, when she worked in a bakery. She worked there until she married, three months before she turned 20. When her husband left the family, “I went back to baking bread because that was the only way I could get by.”

After she met Self-Help’s micro-credit staff, she joined the program and received a micro-credit loan. “It’s been a very excellent program,” she said. “I feel very gratified.”

Luz del Carmen Condega has worked with Self-Help’s micro-credit program to buy sewing machines and finance the inventory for a small store attached to her house that she opened because there aren’t many stores nearby. She also makes soap.

She wants to help other family members including her sisters start their own businesses by joining Self-Help’s micro-credit program.

Adriana Cardoza started her business making nacatamales and added enchiladas and natural juices, which she sells outside her home. She also bakes bread and makes salad.

At first, she didn’t have an oven and had to pay another woman rent to use hers. Using her micro-credit loan, she was able to build her own oven, which she lets other women use. She doesn’t charge them rent, but asks that they give her some bread as payment for use of the oven.

“I feel contented with the training Self-Help has given me,” she remarked. “Now, I need a freezer to store more meat so I don’t have to buy meat by the pound, which is more expensive than buying in bulk.”

Teen Girls Clubs

In addition to its micro-credit loans for women program in Ghana, Self-Help supports several Teen Girls Clubs in rural villages to help teen girls stay in school longer as a way to break the poverty cycle in rural communities. Girls from primary schools to junior highs are educated on girls’ and reproductive health issues; provided livelihood skills training; and given extra instruction to improve their English reading and writing skills.

Since its inception in 2016, 31 girls from Self-Help’s Teen Girls Clubs have gained admission to various secondary and vocational schools. Many of these girls couldn’t have qualified for advanced schooling without the program.

Marianna Mustafa, 12, is from Timeabu. She wants to be a nurse. “Teen Girls Club helps me in school,” she said. Her favorite activity is reading the book “The Little Blue Bell” in English. She also likes writing and playing soccer against the other girls’ clubs. “Teen Girls Club teaches us to respect our parents, teachers and others,” she said. The Teen Girls Club also helps her stay in school so she can attend senior high school, she added.

Marianna wants to become a nurse so she can help people. She said she wants to learn how to give people medicine because she doesn’t want people to get sick.

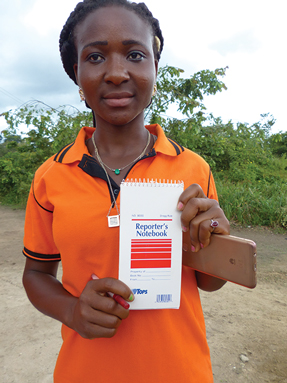

Jacinta Ayamali, 18, of Beposo, wants to be a journalist. She recently returned to her rural village in Ghana after several months working as a domestic worker in Saudi Arabia, where she endured poor working conditions. She said she has re-enrolled in school and wants to become a journalist so she can do investigations and help her country.

About the writer

Jerry Perkins is a retired journalist who is a member of Self-Help International’s board of directors. He traveled to Ghana and Nicaragua last year to review and report on Self-Help’s activities in those two countries. The photos in this story were taken by Perkins and Megan Sehr.