Parking on potential

Des Moines leaders expect surface lots to hold buildings - someday

If you want people to come to downtown Des Moines, it helps to have lots of parking. If you devote lots of space to parking, there are fewer business and retail reasons for people to come downtown.

So there’s something for the city’s leaders to worry about, whenever they tire of worrying about how to fill the 1.5 million square feet of vacant space in downtown office buildings. Because if there’s another thing Iowa’s capital city has in abundance, it’s downtown parking.

“A lot of consultants come here and have the reaction that we have quite a few parking structures,” said Erin Olson-Douglas, the city’s urban designer. “We do get that reaction quite often.”

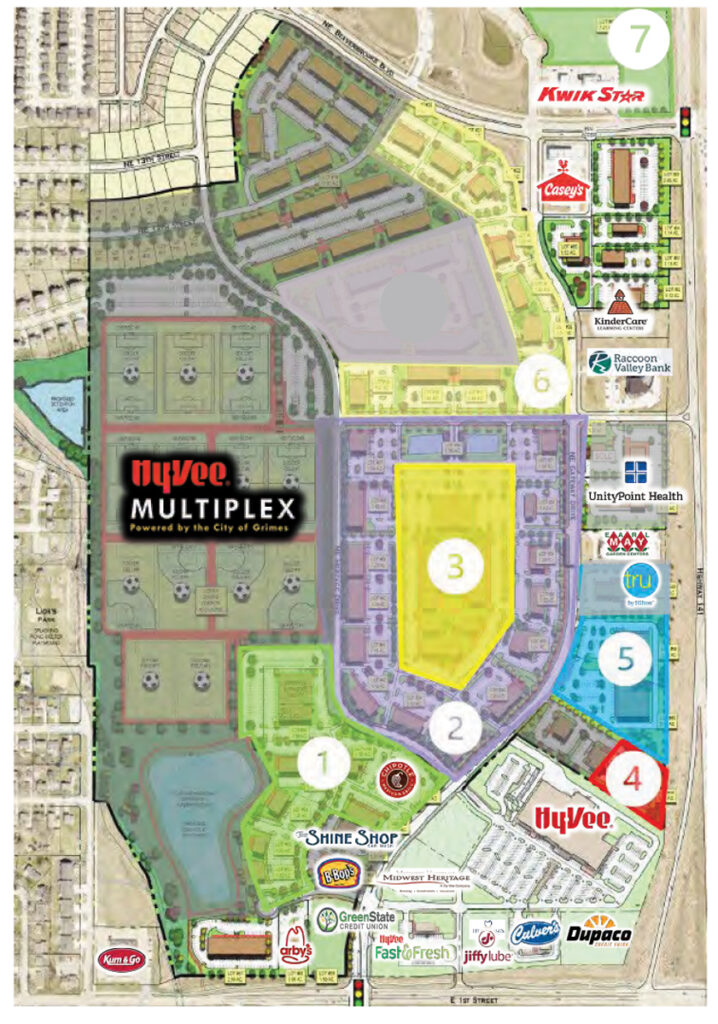

With those parking garages, we’re at least stacking up a lot of vehicles on a half block or full block of space. However, there also are vast surface parking lots surrounding the core like a besieging army, and a fair number of lots interspersed among the buildings on what we like to think of as some of Iowa’s most valuable land.

There’s surface parking on Locust Street, in the heart of the city. City officials face a big slice of surface parking every time they walk out the east doors of City Hall. None of the plans have panned out for development on a blank space on Court Avenue between Fourth Street and Fifth Avenue.

A key question in the city’s development is: What will such spots hold 20 years from now?

“We have some great, well-located surface lots on the riverfront, along Locust Street, on Court Avenue and in the East Village,” Olson-Douglas said. “That’s all opportunity at this point.” But remember, two teams have the opportunity to win every ballgame, and only one does.

“You have to build for the long term in key locations,” she said. “It’s an investment for the next 50, 60, 75 years.

“I would rather see housing, office buildings and retail on those sites — but be careful what you wish for.”

The city recently decided the future of a parking lot on the west bank of the Des Moines River. Developers received a package of incentives to construct a Hampton Inn & Suites there, but only after agreeing to do things the city’s way – a way that suggests what’s in store for other downtown parking lots.

The original plan called for a hotel on one-quarter of the block and surface parking on the rest. Not enough density, said the City Council and City Manager Rick Clark. The final plan has a hotel, a parking structure and, eventually, a second hotel.

“The city has the perspective that downtown Des Moines should as much as possible resemble downtown Chicago,” was the opinion of Frank Levy, the seller of that land. During the negotiations, he said, “Des Moines sometimes makes decisions that put aesthetic choices above the basic needs of a retailer.”

But there’s much more than aesthetics in play here. The dominant idea is that if you turn a surface parking lot into a building, it pays off in property taxes – eventually. See the nearby sidebar for an example.

The owners of downtown lots also hope to make more money off them – eventually. “In downtown Des Moines, going from north to south, you see some examples of: headquarters, ramp, surface parking,” Olson-Douglas noted. “That’s likely a long-term real estate strategy, planning for the future.”

City Council member Chris Coleman sees it that way, too. “I don’t think anybody who’s downtown and owns surface parking has a business plan where they’re going to operate that surface parking lot for the next 15 years,” he said. For the prime locations, parking is “a temporary status.”

That sounds good to city leaders. “When you look at downtown as an urban environment, with a relatively high density of development, parking lots tend to be something that are essentially a holding pattern until some other development occurs,” Clark said. “They’re really not the kind of thing you want to see in a downtown environment. Land is expensive, the cost of service is high, so you hope over time they’re developed.”

When a company owns a surface lot, however, it’s a matter of great financial importance to do the right thing, not just do something.

“You control your own destiny when you own your own land,” said Matt Anderson, who left the city’s office of economic development to become the vice president of asset management at Knapp Properties Inc.

In his city job, Anderson worked with EMC Insurance Cos. on its proposal for the parking garage that now stands south of the company’s headquarters. “They were adamant that they wanted to keep their surface parking lot,” he said. “They don’t know what they’ll need in 20 years, and they don’t want to box themselves into a corner. They’re going to save (the lot), because they’re a long-term-thinking company.”

Companies with downtown headquarters aren’t the only ones with such plans. For example, Knapp Properties has assembled a big chunk of land near the Iowa Events Center that’s heavy on surface parking.

“It’s low-hanging fruit to redevelop parking lots,” Anderson said. However, we’re not exactly back to boom times, and “the future uses of parking lots will be market-driven.”

Anderson said the Knapp holdings near the Events Center make sense for development driven by that entertainment venue, such as hotels and restaurants. Polk County is studying the feasibility of a hotel in the neighborhood, which could determine the use of some of the Knapp parcels.

“There’s no demand right now for office space,” Anderson noted.

A couple of proposals for new downtown office buildings withered in the blast furnace of the global economic meltdown, making it hard for anyone to predict how soon that sort of construction might land on Des Moines’ blank spaces.

However, developers haven’t forgotten about them. “We see and hear, even now, from people with ideas and interests in doing things downtown,” Olson-Douglas said.

“Not a week goes by that I don’t get a call from a developer or a group of individuals looking at projects involving some of the surface lots,” said City Council member Chris Hensley. “New developers are coming into town that we’ve not seen before, looking at building sites.”

Eventually, some choices might come down to (A) demolish an existing building and replace it with something more suitable, or (B) let the old stock stand and build fresh on the surface lots.

“It all depends on what the market will bear,” said Glenn Lyons, president and CEO of the Downtown Community Alliance. “When rents are high, it justifies the construction of new buildings. When people can’t pay that rent, owners think about renovating old buildings. Overall, the rents in Des Moines are not strong enough to support new high-rise development.”

But someday, if Central Iowa continues to attract residents and companies, the balance could shift. “We truly have a lot of land that can be developed,” Lyons said. “I’d say every other block could be redeveloped.

“I think we’re going to get infill, but the way the market is now, we’re not seeing a lot of development anywhere,” he said. “When the market changes, and the vacant (office) spaces have gone away, then builders can get serious about filling in parking lots.”

Pay now, collect later

As part of the proposed construction of a Hampton Inn & Suites, a parking garage and an extended-stay hotel, the city of Des Moines provided $6.8 million worth of incentives. Is it a good deal for the city? Backers of such a strategy might point just a block north, where Sherman Associates Inc. of Minneapolis built apartments and condominium housing a few years ago.

According to the Polk County assessor’s office, the western portion of that parcel was a parking lot a decade ago, and, although the parcels involved have been altered over the years, it appears that the city was collecting less than $6,000 in annual property taxes in 2000.

In 2002, the land was assessed at $184,300. In 2003, the assessment rose to $452,000. Now, with the Vine Street Lofts in place, the land and buildings are valued at $8.4 million.

The incentives doled out by the city mean that the only property taxes being collected now are on the value of the land, and amount to about $32,000 per year. But abatement expires at the end of 2014, and, assuming current commercial property tax rates, the property owners will start paying $395,000 per year.