Public Companies: Winnebago Industries

PERRY BEEMAN Jan 10, 2018 | 3:50 pm

5 min read time

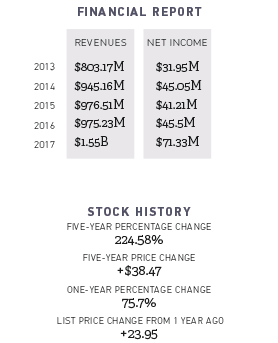

1,109 wordsBusiness Record Insider, Economic Development2017 was the year that Winnebago Industries shifted from its familiar role as a manufacturer of RVs into a bigger player in camping trailers. And the company, enjoying one of its best financial years in recent history, plans to look for ways to expand into broader outdoor recreation plays. The longtime fixture of Forest City was incorporated in 1958.

An eye-grabbing stock run-up in 2017 came after Winnebago bought Grand Design RV. Winnebago’s stock jumped immediately on the news, and the price has more than tripled since January 2016, when the new CEO came in.

The next few years will see Winnebago come out with new camping models, look for outdoor recreation plays, including acquisitions, and launch an employee stock program. Already, the firm’s market share in its central RV and towables divisions has risen.

We interviewed President and CEO Michael Happe about what’s in store.

Can you share highlights from 2017?

I probably look at the fiscal year, which begins Sept. 1. Our fiscal ’17 was a tremendous year of transformation in many regards. We bought Grand Design RV. Winnebago Industries was acquiring the fastest-growing company in the industry. It was $522 million in cash and equity in November 2016. It changed our top line and our bottom line.

What were the immediate effects?

We added a lot of talent. We have a more balanced runway for the future between motorized business, which was our legacy, and the towable industry, which will be a more significant share of our future. That led to more financial success. We went from a $950 million company to a $1.5 billion company. (Winnebago stock rose 20 percent on the news of the purchase.)

You became CEO in January 2016. What has changed since then?

The $16 stock that January is now $57 a share. We now participate in the towable North America market. We had had a very light profile, with less than 1 percent of the market, in a sector that was 87 percent of the market. We need to have a higher profile there to be more competitive and more profitable. We started to begin more momentum in our own Indiana towable segment. Now we have a 5.5 percent share of the towable market. We are an incredibly small player compared to some, but we have a ton of runway to compete with.

How do you balance your efforts in the motorized units with the models that will be towed?

Towables are more profitable than the motorized units. We want to increase the motorized, but the towable is more profitable. The motorized has more pressure for profit. There are more parts. There are higher transportation costs. There are higher price points. The Grand Design model is incredibly profitable in the RV industry.

What other changes did you see in ’17?

Our leadership profile has changed significantly. Eight of nine direct reports beginning Jan. 2, when a new general counsel comes in, will be new to the company or the position. We have Winnebago veterans, RV people and folks like myself who came in from durable goods. You look at the geographic footprint. A decade ago, it was mostly Iowa. Now we have eight campuses in seven cities in four states. We are expanding.

What does the near future hold?

We really have a new product image. Each of the three businesses has been very active. The motorized section has three new companies. Towable has one. Grand Design has two new products. We’ve gotten some nice press on a few. It’s a reflection of the energy and the activity at the company.

We bought a campus in Junction City, Ore., to build diesel RVs. We did that because it is a better facility to deal with 45-foot coaches with huge slide-out rooms. We have backfilled in Iowa with gas products in Forest City. We have a new line too in Forest City, making the Intent (model). The other two lines are in Indiana.

Winnebago towables is expanding in fiscal ’19. Grand Design is adding 40 percent more square feet for lamination and assembly capacity in Middlebury, Ind.

Are you still in acquisition mode?

I told investors in New York City in November that by the end of 2020, we want to have 10 percent more of the market unit share. It’s 6.5 percent today.

We want operating income of 10 percent of net sales by 2020. We need 25 percent more profitability. And we want 10 percent of our revenue to come from new business or business segments that we aren’t in now.

We created a new vision statement for the company. We stopped defining ourselves as an RV company and started seeing ourselves as an outdoor lifestyle company. That could make Winnebago more profitable and less cyclical. We have our eyes wide open.

We are paying down debt for Grand Design. We hope that we will be active again in (mergers and acquisitions).

Our growth will come from inside or outside RVs. We want to find the right target. We don’t want to buy just to buy. We have looked at whole segments.

We are really going to focus on the outdoors. The average age of an RV owner is coming down. (The Recreational Vehicle Industry Association’s occasional national surveys found that the typical RV user was 48 years old in 2011, down from 49 in 2005 and 2001. RV owners ages 35 to 54 posted the largest gains in ownership rates, rising to 11.2 percent in 2011 from 9.0 percent in 2005.)

They are used in different ways. People view being outside as a priority now. We believe Winnebago Industries can be a fit.

Are you looking globally?

We have no presence in international now. There is lots of potential growth. We want to give ourselves permission to look broadly.

How will you change internally?

For me personally, we want to create the strongest culture we can. We are focusing on a safe environment. We want an environment in which they have the right tools. We make quality products. We want to encourage an environment of giving. Winnebago Industries has an opportunity to be involved with that. We want to give back more to the communities in North America.

The shareholders just approved an employee buyback program. I want employees to own stock whether it is in an employee stock purchase program or from the company. Early 2018, there will be an employee stock purchase program. With the rise in our market value and stock price, we want more of an ownership culture. We don’t want people to look at Winnebago as a job, but rather as a career.