Recession not slowing homebuilding in Central Iowa, nation

‘People spend their money where they are spending their time. Right now, people are spending their time at home,’ said one homebuilder.

KATHY A. BOLTEN Jul 20, 2020 | 4:32 pm

5 min read time

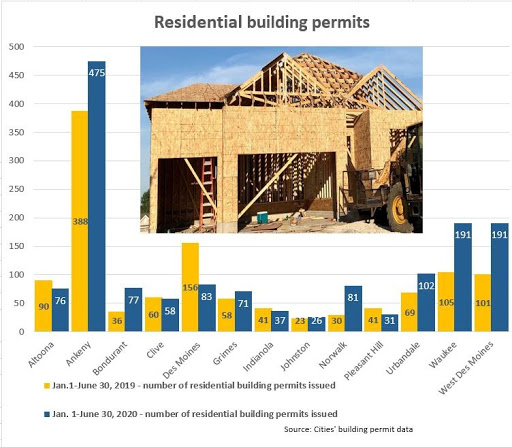

1,250 wordsAll Latest News, Real Estate and DevelopmentCities in the Des Moines metro area issued 1,499 residential building permits in the first six months of 2020, 25% more than the 1,198 issued during the same time in 2019, a review of cities’ building permit data shows. Residential building permits include single-family, duplexes, townhouses and apartments.

The first half of 2020 has been rife with turbulence: The pandemic pushed a booming U.S. economy into a recession. Millions of people lost their jobs. Social unrest blanketed much of the country.

Yet all of that turmoil has not put a damper on residential construction.

The number of residential building permits issued in the first six months of 2020 outpaced the number issued during the same period a year ago, both in the Des Moines metro area and in much of the country.

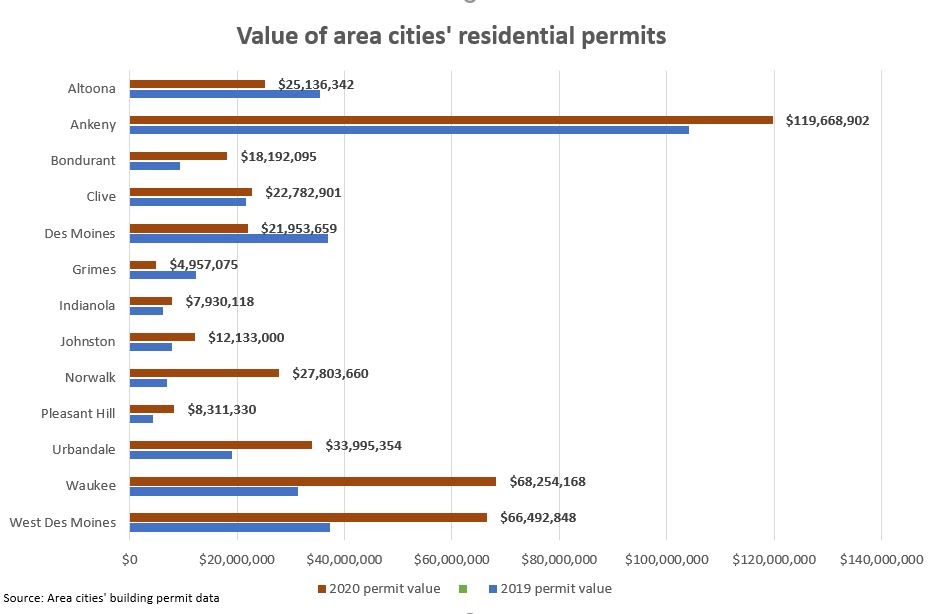

In the first half of 2020, 13 Des Moines-area cities issued 1,499 residential building permits, 25% more in 2019, a review of permit data shows. The value of the permits issued totaled $437.6 million, 31% higher than the $333 million value of residential permits issued in 2019.

Nationwide, 7.9 million residential building permits were issued during the half of 2020, 2.3% more than were issued during the same period in 2019, data from U.S. Census Bureau and Department of Housing and Urban Development reports shows. The increase in building permits for new housing has been fueled by record low mortgage rates, a shortage of existing housing for sale and demand for new housing in small metro areas, suburbs and exurbs, experts say.

Many believe demand for new housing will remain strong through 2020 and likely into 2021.

Many potential new homebuyers were sidelined in early March by the outbreak of the novel coronavirus, Hiner said. “March is typically a really big month for homebuilding. We’re coming out of winter and people area making their homebuying decisions.

“The pandemic got people a little scared and they put a hold on things. I think what we’re seeing now in June and July is our spring market.”

A year ago, the company had started construction on 35 single-family houses; this year, construction has started on 50 houses.

“People who have not been laid off from their jobs are saving more,” Kimberley said. “They are not eating out at restaurants; they aren’t going to concerts. They aren’t spending money on all the excess things that we all tend to spend money on. People are saving, which is giving them more money for a down payment.”

Interest rates for 30-year mortgages at historic lows

Historically low interest rates for home mortgages are helping push people off the fence on whether to buy a new house, homebuilders and others say.

Last week, the 30-year fixed-rate average sank to 2.98%, the first time in 50 years the rate has been below 3%, according to Freddie Mac, the federally chartered mortgage investor. In April, rates slipped to 3.23%, the lowest level at the time. Since then, the 30-year fixed rate has fallen to a new low seven additional times.

“Our forecast is that the 30-year fixed-rate mortgage will remain around 3% for the next couple years,” Robert Dietz, chief economist for the Washington, D.C.-based National Association of Home Builders. “If we get good economics news, interest rates may tick upward a little bit but not much.”

Currently, a large percentage of people who are unemployed are younger workers and those in the service sectors, many of which rent rather than own a home, Dietz said. “The people who are homeowners are in relatively better shape financially, so that is helping the market.”

Outlook for rest of 2020 and beyond

Since the Great Recession that ended mid-2009, the housing market has been underbuilt, creating a nationwide shortage of about 1 million houses, Dietz said.

The same issue exists in Central Iowa. Last year, a workforce housing study found that Polk, Dallas, Warren and Guthrie counties need to add 33,592 owner-occupied housing of all types before 2038 and 23,577 new rental units.

The pandemic has exacerbated the problem.

People who live in apartments in large urban areas are leaving the cities for smaller communities because of the pandemic and the civil unrest, moves that have accelerated the need for more rooftops, Dietz said.

“People are voting with their feet in response to the virus and unrest and seeking out lower-density markets like suburbs and exurbs,” Dietz said. Markets like Columbus, Ohio, Indianapolis, Kansas City and Des Moines are benefiting from the urban-area exodus, he said.

“These are relatively more affordable markets that offer that opportunity for homebuyers – and businesses – to consider locating in them,” Dietz said. “And when you consider that businesses have found their employees can work from home fairly easily, we’ll see even bigger changes in terms of where people are looking to live.”

The pandemic-related increase in the number of people working from home and educating their children at home has sparked the interest of residences with space for offices, study areas, work out spaces and larger kitchens, said Dan Knoup, executive director of the Home Builders Association of Greater Des Moines. “All of a sudden, those things have become more essential, causing people to reevaluate where they are living now and to consider a new house.

“We were already behind in building enough rooftops. This is accelerating that problem.”

Developments planned in the Des Moines area will help. This week, for instance, the Ankeny Plan and Zoning Commission is expected to approve two new plats that when built out would add more than 100 housing units in the northwest part of the city. West Des Moines city committees have approved plans for new apartments along Eighth Street south of Interstate Highway 235 and in Valley Junction as well as new single-family developments in the south and southwest sections of the city. A townhome project is planned along Fleur Drive in Des Moines, and land is being prepared for a large residential development in the northeast part of the capital city.

Kimberley said the demand for new housing has caused the company to hire additional workers. She said she doesn’t foresee the demand subsiding anytime soon.

“People spend their money where they are spending their time,” she said. “Right now, people are spending their time at home and that’s not going to change anytime soon.”

The value of residential building permits issued by 13 Des Moines-area cities in the first six months of 2020 totaled more than $437.6 million, a 31% increase over the value of permits issued during the same period in 2019, a review of building permit data shows. The chart shows 2020 residential permit values.