Regulation grows, Iowa banks decline

More than 1,700 banks dotted the Iowa countryside prior to the passage of the nation’s first major banking law in 1913. At a relatively meager 31 pages, the Federal Reserve Act would have seemed a minor intrusion on a lender’s day-to-day operations. Still, 20 years later, when the Glass-Steagall Act added more banking rules, more than 1,000 of those Iowa banks had disappeared. Coincidence, perhaps. Banks come and go for a lot of reasons, not the least of which was the stock market crash of 1929 and the Great Depression.

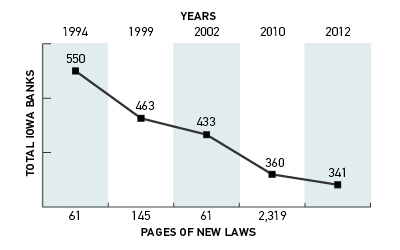

Even so, some folks at the Iowa Bankers Association decided to compare the number of Iowa banks in a given year to the number of new pages of banking regulations passed that year.

“In Iowa, we’ve been experiencing a decline of approximately eight community bank charters per year. This consolidation has an inverse relationship to the number of pages of new regulations written, as banks scale their operations accordingly to support the growing staffing and technology resources needed to comply. Dodd-Frank has only accelerated this trend. Regulators need to be more targeted in their approach and apply these rules based on the size, complexity and risk profile of the institution.” – John Sorensen, president and CEO, Iowa Bankers Association

Iowa banks and banking regulations

The Iowa Bankers Association compared the decline of banks to the runup in pages of banking regulations.

1994 Riegel-Neal Interstate Banking Act

1999 Gramm-Leach-Bliley Act

2002 Sarbanes-Oxley Act

2010 Dodd-Frank Wall Street Reform and Consumer Protection Act

Source: Iowa Bankers Association