Retirement savings gap a gender crisis – study says

Women need to save more for retirement while earning less, according to a recent study by Financial Finesse, which provides financial education programs to more than 600 organizations.

Although both men and women face big retirement-savings challenges, the hurdle is higher for many women. To have a decent standard of living in old age, women, who earn on average 78 cents to a man’s dollar, need to save $126 for every $100 men do, according to Bloomberg.

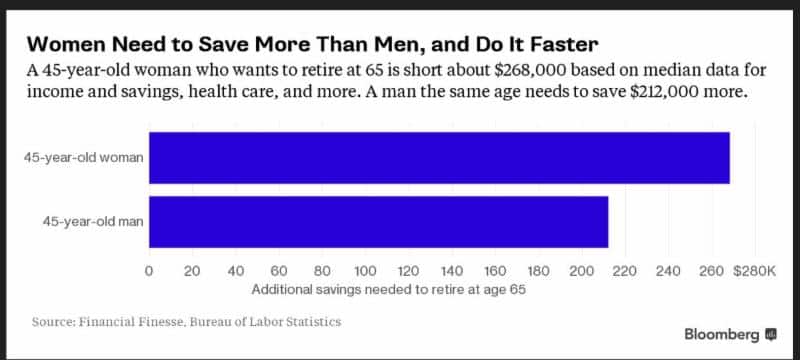

That’s the conclusion of the Financial Finesse report, based on data on median income, retirement savings, life expectancy, 401(k) salary deferral rates and projected health-care costs for a woman and a man, each 45 years old. The goal: Figure out how much each needed in order to retire at age 65 and live on 70 percent of his or her pre-retirement income.

The gap that emerged between the sexes: 26 percent. A man’s retirement shortfall was more than $212,000. A woman’s? More than $268,000.

“It is, in particular, a women’s crisis,” Sallie Krawcheck, a former wealth management executive at Bank of America Corp. and Citigroup Inc., said recently, speaking at a conference of the American Council of Life Insurers. “It’s a gender crisis.”

The 26 percent gap is just how to reach 70 percent of pre-retirement income. When taking into account what retirement will actually cost, the gap turns into a chasm. Financial Finesse figures that to fund projected average retirement expenses at age 65, the median 45-year-old man needs to save an additional $270,000 or so. The woman is short $522,000.

“Lower Social Security benefits, longer life expectancy, and lower retirement savings balances because of lower-paying jobs all compound into this incredibly large shortfall,” said Gregory Ward, a senior financial planner with Financial Finesse.