Settling into the lap of luxury

Developers are ready to test whether downtown des moines is ready for expensive rents

KENT DARR Jun 19, 2015 | 11:00 am

12 min read time

2,824 wordsBusiness Record Insider, Real Estate and DevelopmentWe’re going to start off with a dichotomy of styles and convergence of dreams.

On June 4, real estate developer Rich Eychaner bought 195,000 square feet of largely vacant office space. He was roundly praised for a show of faith in downtown Des Moines.

On June 8, the Des Moines City Council gave the OK for the city’s economic development staff to pursue a development plan for 10 floors of luxury apartments and upscale amenities that will sit atop a seven-level parking ramp at Seventh Street and Grand Avenue.

The Mike Nelson-led development group is praised for its show of faith in downtown.

We don’t want to confuse you. This is a story about the emerging market for luxury living in downtown Des Moines, not about office parks. But, in a way, recent events point to the same thing, and that is the belief that the city is on the verge of something big in its evolution to the dream of being a city that is on the go all day and all night, seven days a week.

It’s right there in the print of the vision plan Capital Crossroads: “Support the ongoing evolution of downtown Des Moines as a 24-7-365 district.”

It means that we have all the elements of a thriving urban area, including a business community that can fill those empty offices that Eychaner purchased, entertainment, fine dining, low-brow dining, bars, housing that fits all income levels, maybe even dancing in the streets.

Well, maybe not dancing in the streets, but certainly celebrating from rooftops.

“We’re at the tipping point; we’re there,” said Kris Saddoris, vice president of development for Hubbell Realty Co., who, by the way, offered some of that high praise for Eychaner, who bought the office buildings, and developer Mike Nelson, who put together a team of designers, other developers and lawyers who plan to build a $35 million luxury high-rise on top of the Seventh and Grand parking ramp.

“It finally proves what all of us have been working for for all these years,” Saddoris said. “We’re there. It’s just fun everyday.”

Path to luxury living passes through a parking ramp

Mike Nelson can’t be blamed for being plenty proud of the crew at his Nelson Construction & Development that turned around a plan in three weeks to build what is being pitched as the city’s first foray into the luxury, or premium, apartment market.

His crew — development analyst and project investor Alexander Grgurich, project managers Danny Heggen and Ryan Young, and director of process improvement Jacob Wolfgang — worked with St. Paul, Minn., developer Exeter Group LLC, Minneapolis designers Boarman Kroos Vogel Group (BKV Group) and Des Moines attorney Larry James of Faegre Baker Daniels.

Nelson and Exeter Group are not strangers. The two companies are partners in the rehabilitation of the historic U.S. Postal Service Customs House in St. Paul, with Nelson redeveloping five floors into a 149-room Hyatt Place Hotel and Exeter taking on the development of luxury apartments above the hotel. BKV Group has designed other Exeter projects.

Everyone worked at a quick pace to put the project in order. Nelson was pleased enough with the progress that was made on relatively short notice that he wanted everyone to gather for a photo shoot for this story. That didn’t work out, but you get the idea — Nelson liked the results.

The crew turned around a 60-page report full of observations about the evolution of the downtown housing market, artsy sketches of the proposed structure, lofty ideas about urban landscapes, illustrations intended to define the concept of luxury living, and a plan.

Nelson was under a tight timeline because the city is under a tight timeline.

As part of Principal Financial Group Inc.’s $238 million expansion of its downtown campus, the city agreed to demolish the Seventh and Grand ramp, build a new structure and restore a skywalk connection to Principal’s 801 Grand skyscraper. The ramp was due for replacement anyway. The air rights above the ramp would be a prize possession for a developer who could provide an elegant gateway to the north side of downtown.

Minneapolis-based companies Opus Group and Sherman Associates Inc. teamed up to provide a $71 million plan for a parking ramp, 104 market-rate apartments and more than 12,000 square feet of commercial space, with the potential for a 125-room hotel.

A market study indicated that developers could charge what would have been a premium $1.70 a square foot for apartment units, compared with the going rate at the time of $1.30 a square foot.

The City Council approved Opus as the preferred developer in February 2014. By the start of this year, that agreement had fallen apart because of a multimillion-dollar financing gap that forced Opus to seek a delay in the start of its project.

In January, after telling anyone who would care to listen that he was tired of messing with parking ramps, Assistant City Manager Matt Anderson told the City Council that attention should be directed to demolishing and rebuilding the ramp. That price tag was set at $22 million. In March, Substance Architecture of Des Moines was awarded a $1.9 million contract to design a ramp and provide consulting services for its construction.

During a City Council workshop on April 20, Anderson presented a plan to issue a request for proposals for a “general concept” for the air rights above the planned ramp. Designers needed to know how to shore up the ramp in anticipation of future uses. The RFP would not specify a product type, but “development team background and financial capacity” would be key elements to include in responses.

The City Council did not like that idea. Council members wanted a good estimate of the value of those air rights, at the very least. The RFP was rejiggered. It was issued April 24, with a May 22 deadline.

When the RFP was issued, city economic development staff had no idea what, if any, interest there was for the air rights project, said Erin Olson Douglas, an urban designer for the city.

As it turned out, there were three interested parties, two with ties to the city (Nelson/Exeter team and Sherman Associates) and one that wants to work here but hasn’t yet (Denver-based Linden Street Partners LLC).

But, on June 8 the city council selected the Nelson/Exeter team as preferred developers for the Seventh and Grand ramp, with a few recommended modifications.

The desire for luxury

Luxury living has been on the minds of city planners and developers for years.

As pointed out in the Nelson/Exeter proposal, it bridges a gap in the downtown market that is needed to bring a more diverse population to downtown.

Nelson’s Alexander Grgurich said the Seventh and Grand project should appeal to empty nesters, high-income millennials and corporate executives who might pass through town as they climb the corporate ladder.

According to the Nelson/Exeter plan, “Our proposal looks to balance the apartment stock in Des Moines by adding those premium rental apartments, allowing our companies and city to compete with the rest of the midwest. These types of anchors help ensure the long-term viability and success of our downtown.”

So why aren’t those “anchors” here already?

Hubbell Realty Co. President and CEO Rick Tollakson has said his dream project would be a luxury high-rise along the Des Moines River. He could supply such a plan if the company closes its purchase of the former Riverfront YMCA. He just has to figure out how make the numbers work.

As it is, Hubbell is pushing the upper end of market-rate rents, asking nearly $2,200 a month for units at its 7th Street Brownstones, and it plans luxury row houses for its planned 5Fifty5 development on Southwest Seventh Street.

Mike Nelson knows a little about top-end rents, with the terrace units at the Des Moines Building renting for $2,500 a month.

Tim Sharpe, who specializes in investment properties for CBRE|Hubbell Commercial, said one issue is the cost of developing land downtown. Those higher costs require higher density in taller buildings

“Several developers who looked at the Y site told me that they needed rents to be significantly north of $2 per square foot to make economic sense,” he said.

The other issue is that local developers tend to be a conservative group. They are not bothered at all when an outside developer takes a risk. If it succeeds, they will enter the market.

Linden Street’s Richardson said that will be the case in downtown Des Moines.

Kansas City developers stood on the sidelines when Linden Street took on a major downtown project there, until they saw the project work out. Linden Street’s Kansas City project is the first new residential construction in the city’s Crossroads neighborhood.

“We came in from out of town … and kind of rolled the dice because we had seen it work in Denver or Indianapolis,” he said. “Two years later, now there are five comps … everybody, including the local guys, want to do downtown projects, and so do the banks. It only took one or two projects to show a hint of success.”

Part of the problem is that, as with the Seventh and Grand project, there are no comparable developments to evaluate. The same was true of the Kansas City project, Richardson said.

Downtown Des Moines could support more upscale apartment projects.

“Des Moines is smaller, of course, so it won’t have the same depth, but it certainly has room for five or six good projects that are market-rate residential projects for the next few years,” Richardson said.

It should be pointed out that Richardson does not differentiate between what are considered luxury and market-rate projects.

“Luxury doesn’t really mean anything to me other than a marketing term,” he said.

Assistant City Manager Anderson agrees.

“Yes, we need a project to test the high-end of the market, then others will follow suit,” he said.

A look at the 7th & Grand proposals

The plan that did work out

The Des Moines City Council decided on June 8, a Monday, to select the Nelson/Exeter team as preferred developers for the Seventh and Grand ramp. Two days later, the crew was being asked to make some modifications.

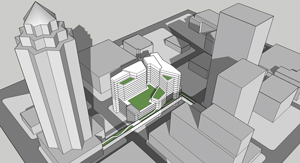

As proposed, the project called for two towers that would be built in two phases, with 150 apartments in the first phase and 112 in the second. Developers raised the possibility of wanting to own one floor of the parking ramp.

Amenities would include three rooftop courtyards, a restaurant, a lounge with rooftop seating and event space. Among the special features would be a $2 million elevated park above the skywalk connecting to 801 Grand.

The proposal did not provide an estimate of costs to rent an apartment.

“We would prefer to hold off on answering this question until we complete additional due diligence in the near term,” Exeter’s Rob Stolpestad said in an email.

The idea is to coordinate construction with the completion of the parking garage in 2017, so there is plenty of time for additional due diligence, and to make changes in the original plan.

City staff wants a project that is completed in a single construction phase, Anderson said.

In addition, city planners would like a structure that “changes the skyline,” Nelson’s Alexander Grgurich said.

By late last week, the Nelson team was working on new designs that could be presented to the city’s Urban Design Review Board on June 23.

What will not change is the desire to provide housing that will transform the downtown housing market.

Nelson and his crew have done a lot of thinking about the subject.

Here’s an excerpt from the proposal:

“New apartment projects have brought thousands of new units into the market and helped catalyze neighborhoods and districts of downtown that were once neglected and empty. These projects have helped fill market demand in not only market rate, but also income-restricted options. … The missing elements in that mix of apartment stock are premium rental apartments. All of the market-rate apartments in downtown Des Moines are focused on providing a rental-quality level of design, finish, appliances, amenities, and tenant experience. There are currently no projects dedicated to providing units for a tenant who desires a more contemporary, premium lifestyle found in Chicago, Minneapolis, or Kansas City.”

The two plans that didn’t

City staff received a proposal from Sherman Associates, the Minneapolis developer who has been in the Des Moines market for the better part of a decade, building new downtown housing, converting industrial properties to apartments and launching an ambitious plan to develop a community within a community in an area called River Point West south of Martin Luther King Jr. Parkway.

Sherman finished a close second to the plan from Nelson and Exeter group.

“It was a very tight race between the Nelson and Sherman proposals,” Anderson said. “Both teams are capable of executing this complex project.”

Sherman proposed a $51 million, 13-story structure with 195 apartments and up to 35 rooms that would have been rented to businesses for up to several months at a time.

The developer also provided some insight into the cost to rent high-end apartments: $1.80 to $2 a square foot.

Linden Street Partners LLC of Denver was a stranger on the scene. Though its proposal for a somewhat modest five-story structure did not fit the overall vision for a grand tower above the ramp, the company did pique the interest of city staff.

“We hope they come back,” the city’s Erin Olson Douglas said.

Linden Street is a two-year old company with development experience in the Midwest and California. It currently is constructing a ground-up, market rate housing development in downtown Kansas City, along the KC Downtown Streetcar line that is being developed by the city.

Scott Richardson, a managing partner with Linden Street, said his group is scouting other projects in Greater Des Moines — and why not?

“We are believers in the market,” he said. “We have looked at lot of the demographic and economic indicators that make us feel good about Des Moines. … The one big mismatch is between jobs downtown compared with housing. The city has done a great job of keeping corporate headquarters downtown, and it’s nice to have that mix.”

There is an imbalance between the availability of affordable apartments and apartments that are priced at a premium, he said. That shortcoming was pointed out in the Nelson and Sherman proposals.

Linden Street did come to the table with a commitment letter for financing from Great Southern Bank, and Richardson said it is probable that the firm could have carried out its project without public financing.

On the other hand, it would be foolish to ignore incentives that might be on the table, he said.

A premium transformation

Exeter Group offers some thoughts on luxury development in Des Moines

The Business Record asked St. Paul-based Exeter Group principals Rob Stolpestad and Herb Tousley to provide their thoughts on developing a luxury high-rise in downtown Des Moines. They asked us to “convey how excited we at Exeter Group are to be able to team up with Nelson Construction & Development on this transformative project in the heart of downtown Des Moines.”

Here are their answers, provided via email:

What are the elements that need to be in place to make these projects work?

Any development, but particularly larger mixed-use developments, require support from not only the development team but also from other key constituents including elected officials, city staff, business and neighborhood organizations, and many other groups. Additionally, larger developments require favorable market conditions relating to capital, construction costs, rents, etc.

What is a luxury apartment?

Our view of a luxury project is one that delivers condominium-level, market-leading amenities (both in-unit and in terms of shared spaces) and market-leading quality of finish in a prime location. Architectural design is critical, as is creating a presence for the project.

What is a luxury rent that makes sense from a developer’s point of view and that the market will pay?

We would prefer to hold off on answering this question until we complete additional due diligence in the near term.

What is the demographic you will target?

Our preliminary demographic target is focused on millennials and empty nesters who are looking for an upscale apartment lifestyle in an increasingly dynamic urban environment. One specific group we would plan to target includes people relocating to Des Moines for employment with one of the large local employers.

What is the lending environment for this type of project?

The lending environment is currently very favorable for multifamily development. One of the challenges with the Seventh & Grand development, however, is that the multifamily portion will not begin construction until after the city parking garage is complete. Forecasting and modeling the capital at this later date will be one of our key focuses in the near term.