Slowdown in commercial real estate activity occurred in 2022

But interest in multifamily, industrial properties remains strong

Polk County saw a decline in the number of commercial real estate transactions between January and November last year, although sale prices continued to exceed properties’ assessed valuations, a review of county data showed.

Between Jan. 1 and Nov. 30, 2022, there were 12.7% fewer commercial transactions in the county when compared with the same period in 2021. However, the average sale price of commercial property in the county was $1.9 million, 5% above 2021’s average sale price of $1.8 million.

The drop in the number of sales is an indicator that potential buyers are hesitant to pay sellers’ asking prices, commercial real estate market observers say. Yet potential sellers aren’t lowering their asking prices, they said.

“We’re getting to the point where sellers still expect the high prices for the properties,” said Bryon Tack, Polk County’s deputy assessor. “We’re starting to see a bit of pushback from potential buyers, and that is starting to slow the transactions. … No one is willing to lower their asking prices, but fewer people are willing to pay it.”

Like most other areas nationwide, Polk County experienced a decline in commercial real estate transactions during the Great Recession that began in December 2007. During that time, both the median and the average sale prices of commercial properties declined, the review found.

The drop in both the number of sales and sale prices typically is an indication that the economy is in a recession, Tack said. Polk County hasn’t yet experienced drops in both, he said.

“What I think is interesting right now, even with the increases in interest rates and tightening of capital markets, we really haven’t seen decreases in prices, yet we’re starting to see a decrease in volume,” Tack said. And even though the number of transactions is declining, “there’s still a very high volume of sales that has occurred.”

Interest in purchasing commercial property in Polk County remains high from out-of-state entities primarily because they are getting better returns on investments, especially when compared with the East and West coasts, Tack said.

The 273 commercial sales transactions that occurred between Jan. 1 and Nov. 30 in 2022 is the third-highest since 2006, the year before the start of the Great Recession, the Business Record review showed. (Not all of December’s transaction data was available when data for this article was compiled.) The highest was in 2021 when there were 313 commercial transactions; the second-highest was in 2015 when there were 293 transactions.

The review of Polk County sales transactions also showed:

Commercial and industrial sales volume totaled $523.3 million between Jan. 1 and Nov. 30, 2022. The sales volume was 8% lower than the record $569 million recorded during the same period in 2021. Sales volume had increased each year since 2016, the review showed.

The median sale price of commercial property reached $850,000. That was 21% higher than the same period in 2021, when it was $700,000.

The median sale price of industrial property was just over $1 million. In 2021, the median sale price was $1.65 million and included the sale of property ($75.9 million) in Bondurant that’s occupied by Amazon.

What’s caused the drop in transactions?

The decline in commercial real estate transactions can be directly tied to rising interest rates.

In early January 2022, the 10-year Treasury rate was 1.63%. The rate reached 4.25% in late October, and in early January 2023 it was 3.61%. Market interest rates for commercial real estate financing typically are tied to the 10-year Treasury. CBRE’s Agency Pricing Index in 2022’s third quarter showed average fixed mortgage rates at 4.61%. The rate was the highest it had been since the third quarter of 2018.

In early 2022 “our clients were buying properties and doing sub-4% commercial loans,” said Bill Wright, senior managing director of CBRE’s Des Moines-area office. “Now commercial loans are in that 6% to 7% range. … The first thing that happens in this kind of market is that there’s less buyer activity.”

Contributing to the slowdown in sales are potential sellers who are unwilling to lower asking prices, Wright said. “Sellers’ expectations have not adjusted as much as the debt market, and that’s why you’re seeing a slowdown. … The faucet hasn’t been turned off, but we’re certainly witnessing a slowdown.”

Richard Hurd, founder and president of West Des Moines-based Hurd Real Estate Services, offered a similar viewpoint.

“Interest rates drive our business,” Hurd said. “It’s a capital-intensive business. The larger the purchase price, the more capital costs matter because most people borrow money [to make a purchase]. When you double the cost of the money you have to borrow, it’s going to restrict the number of transactions.

“It’s pretty basic arithmetic.”

Interest in multifamily properties remained high in 2022, especially from out-of-state buyers, the review found.

Through Nov. 30, Polk County had 49 transactions involving multifamily properties — 16, or 33%, of which involved out-of-state entities, the review found. Between Jan. 1 and Nov. 30, 2019, there were 26 multifamily transactions in the county — six, or 23%, of which were bought by out-of-state entities, the review found.

“There still seems to be amazing interest in multifamily properties,” Wright said. “There’s still very aggressive cap rates and maybe cap rates in multifamily have not been reflective of the higher debt market we’re seeing right now.”

Another segment of the commercial real estate market is owner-occupied properties, Wright said. “If someone is going to be using a building themselves, they’re willing to pay a little more. That’s probably one of the reasons we’re seeing higher sale prices.”

Industrial properties are also continuing to attract buyers, said Marcus Pitts, managing director of JLL’s Des Moines office.

“There’s been no slowdown in demand on the industrial user side,” Pitts said. “Out-of-state buyers continue to be interested in Des Moines, and large-use tenants continue to lease space, which makes properties attractive to sell.”

Today versus the Great Recession

The current slowdown in commercial real estate transactions is not as severe as it was during the Great Recession that ended in June 2009. In 2007, there were 243 commercial sales in Polk County between Jan. 1 and Nov. 30, the review found. In 2008, there were 200 sales, a 17.7% drop. The following year, there were just 107 sales, a 46% decline.

The current decline in sales has occurred slowly, while the Great Recession – which was fueled by low interest rates, easy credit and lax regulation – hit suddenly.

“The spigot was shut off and there was no money available and no one could do anything,” Hurd said of the Great Recession. “This slowdown has been more gradual.”

How long the current economic slowdown lasts will depend partly on what the Federal Reserve does with interest rates, which have been increased to combat inflation.

Hurd said he anticipates continuing to see a slowdown in commercial real estate sales during the first half of 2023. The only transactions that are occurring are the ones that have been in the works for a while, he said.

“The metrics of the business are out of sync,” Hurd said. “For them to get back into sync, interest rates need to moderate or fall or cap rates need to increase.

“I think the second half of 2023 will be brighter.”

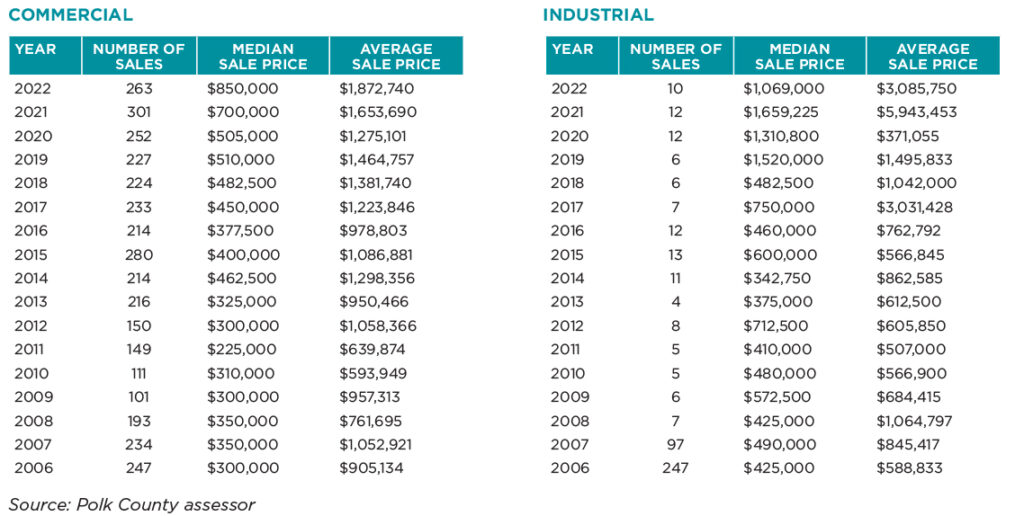

Median, average sale prices

The chart shows the number of commercial and industrial properties sold in Polk County between Jan. 1 and Nov. 30 each year from 2006 to 2022. Average and median sale prices are also shown.

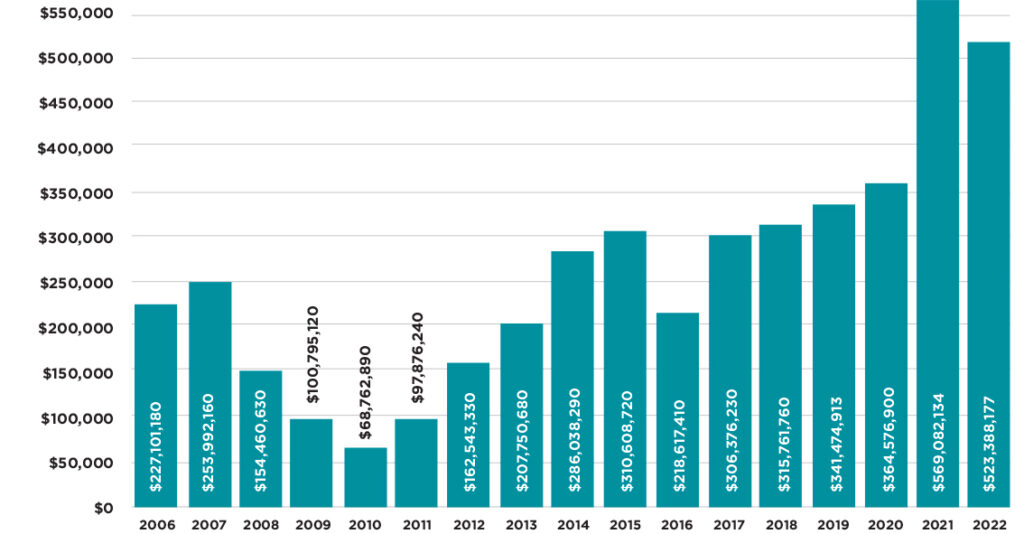

Commercial, industrial sales volume

Commercial and industrial sales volume totaled over $523 million between Jan. 1 and Nov. 30, 2022, 8% less than during the same period in 2021, a review of Polk County assessor data shows.

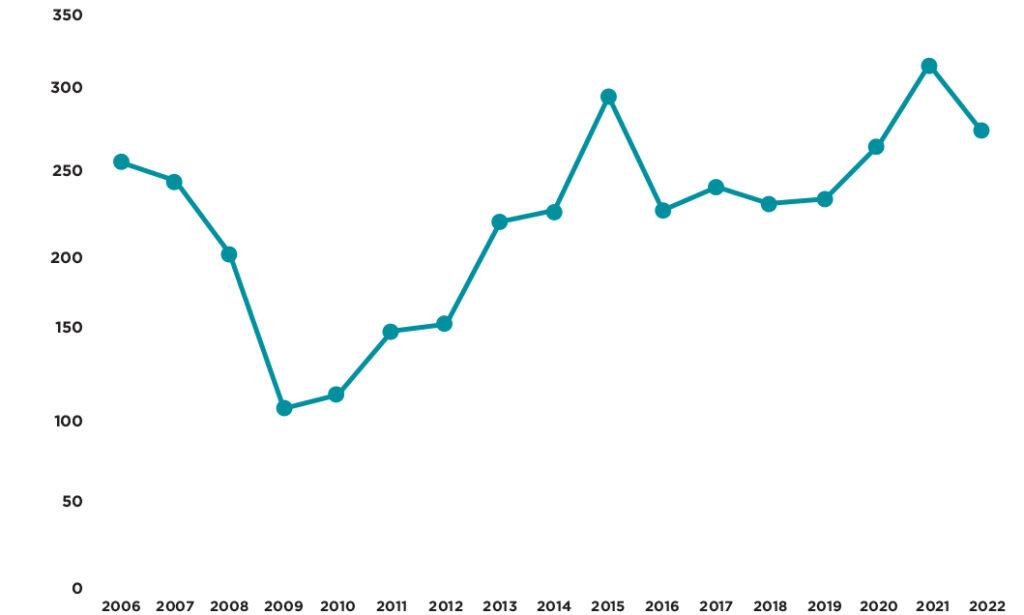

Commercial, industrial sales

The chart shows the number of commercial and industiral sales in Polk County between Jan. 1 and Nov. 30 each year from 2006 to 2022. The number of sales recorded between 2021 and 2022 has dropped 12.7%.

Kathy A. Bolten

Kathy A. Bolten is a senior staff writer at Business Record. She covers real estate and development, workforce development, education, banking and finance, and housing.