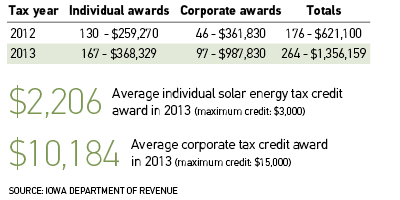

Solar Energy Tax Credit Awards Near Cap in 2013

The dollar amount of Solar Energy System Tax Credits awarded by the state more than doubled in 2013 compared with its initial year, reaching nearly $1.4 million in tax credits. Based on the dollar amount awarded, Iowans have installed an estimated $13.1 million in solar systems in the past two years due to the incentive. The tax credit, which is available to both individuals and companies in Iowa that place solar energy systems into service, was enacted by the Legislature in May 2012 but was made retroactive to Jan. 1, 2012. The Legislature authorized the Iowa Department of Revenue to award up to $1.5 million in tax credits each year through 2016. The state credit equals 50 percent of the federal tax credit, which provides a credit of 30 percent of a solar system’s cost. Because not all applications received to-date have been processed, it’s likely the 2013 cap will be reached, said Matt Hauge, communications and outreach director for the Iowa Environmental Council. “We will want to encourage the Legislature to raise the cap if we indeed exceed it,” he said.