Stock Watch 2018

REG focuses on its biodiesel roots

A mostly down year for Iowa’s public stocks.

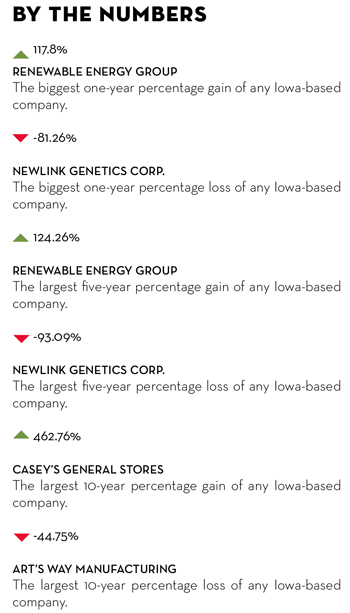

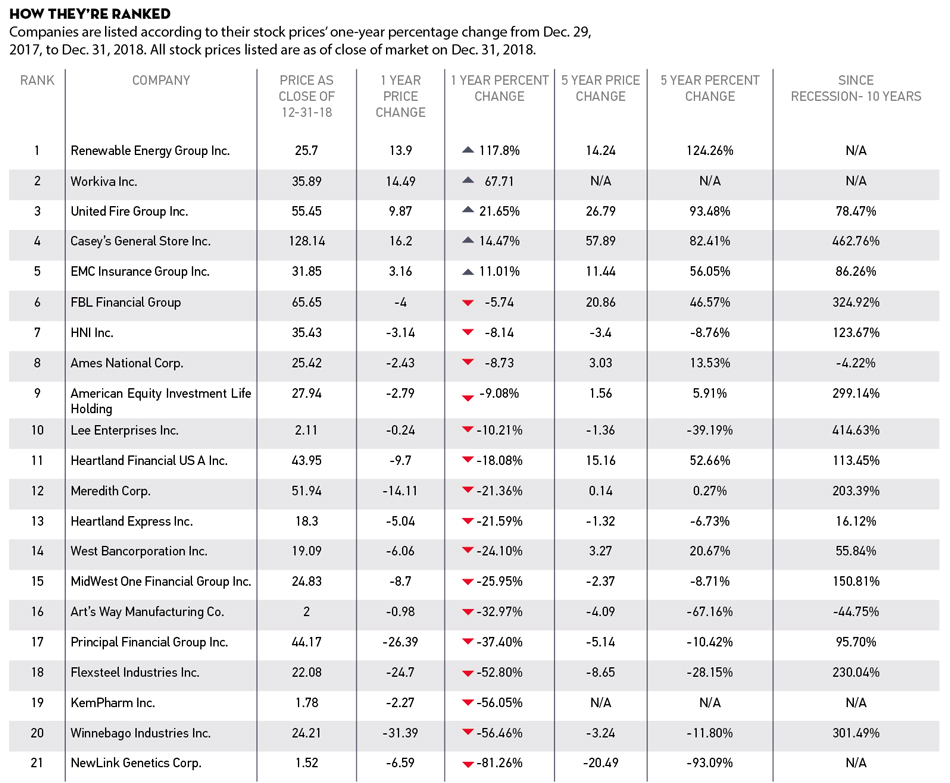

Just a half-dozen of Iowa’s public companies ended the year with gains in their stock prices, led by Ames-based Renewable Energy Group, with a 118 percent share price gain for the year. Also ending the year in positive territory were Workiva, United Fire Group, Casey’s General Stores and EMC Cos., each recording double-digit percentage gains in share price.

Arkansas-based network communications company Windstream Holdings, up 13 percent, was the only non-Iowa stock company with significant operations in Iowa to end the year with a share-price gain.

Notably, each of the top five gainers among Iowa-based companies for the year also displayed solid performance over the longer term. Leading the charge again was Renewable Energy Group, up 124 percent versus five years ago. Each of the other four companies had strong double-digit five-year price gains.

Ames-based Workiva, whose shares have trended up over several consecutive quarters, has maintained revenue growth of nearly 20 percent while continuing to increase gross profits and operating margins as many other tech companies’ performances have faltered, according to Seeking Alpha. In November, the company narrowed its third-quarter net loss to $11 million.

Interesting enough, the leading stock in 2017 turned out among the poorest performers in share price in 2018. After recording a nearly 76 percent price gain in 2017, Forest City-based recreational vehicle maker Winnebago Industries was down 31 percent in 2018.

Greater Des Moines’ largest home-based public company, Principal Financial Group Inc., ended the year with its share price down 26 points, a 37 percent decline for the year from an all-time high of $70.56 on Dec. 31, 2017.

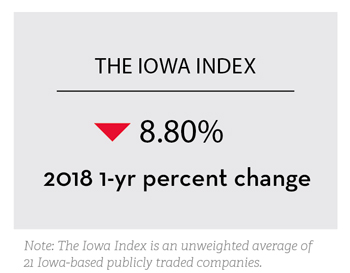

The Iowa Index, an unweighted average of 21 Iowa-based public companies, reflected the overall declining market, losing more than 21 percent for the year. By comparison, the Dow Jones industrial average lost 5.6 percent of its value in 2018 while the Nasdaq was down 3.9 percent.

Compared with a decade ago — the height of the Great Recession — the Iowa Index was up 103 percent at year-end 2018, underperforming the Dow Jones industrial average percentage gain of 166 percent for the 10 years, and well short of the Nasdaq’s 321 percent gain. Casey’s General Stores turned in the best 10-year performance among the 21 Iowa-based companies, more than quadrupling its price with a 463 percent share price gain.