Study: Inflationary impact on rural telecom companies’ expenses growing

A study released Oct. 9 by rural telecommunications industry tax and accounting consulting firm FORVIS has found that the effects of inflation are cutting into profitability and could impact customer pricing in the near future.

FORVIS said in a news release that the study, which is based on data from 2016-2022 submitted by 167 companies in 19 states, is one of the largest studies of its kind in the telecom industry. The Springfield, Mo.-based consulting firm compared the data with more than two decades of financial and operation information and found operational expenses for rural telecom companies to increase by 5.1% in 2022, which is more than double the 2.4% increase in 2020.

The study says those cost increases were flat in 2018 and 2019.

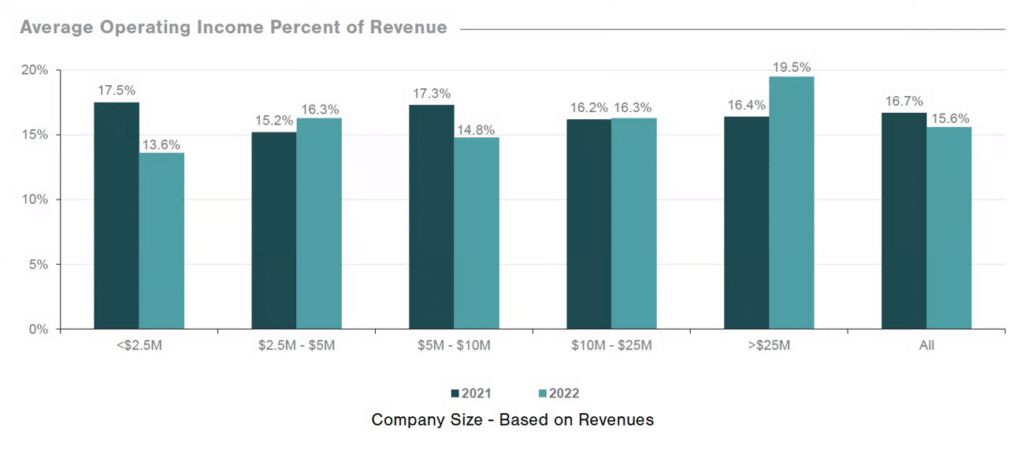

The study also shows the cost of infrastructure and materials, including fiber optics, as well as labor is rising, with smaller companies being hit the hardest. Operating income declined year-over-year among the participating telecom companies for all but the largest companies surveyed, those with more than 100 employees.

“The rate of inflation in 2021 and 2022 was dramatically increased over previous years and that’s having an impact on the overall profitability, bringing operating income down for the companies we surveyed,” study co-author Marty Fredericks said in the release.

One “relative” bright spot of rural telecom companies, according to the study, was growth in internet service revenue from broadband expansion, which helped offset the decline in voice and access service revenues.

As of May 2023, 85 participating companies accepted $600 million of federal, state and local government broadband grants compared to 69 companies accepting $336 million in 2021. The study says this represents a 23% increase in companies and a 79% increase in broadband grants over the amounts for 2021.

These grant programs include state-administered broadband grant programs using state funds, state-apportioned federal CARES Act funds, and American Rescue Plan Act funds, along with federal broadband grant programs.

Overall, the average operating income as a percentage of operating revenues was 15.6%, significantly higher than the 2010 low of 8.6%, although still less than high water marks of more than 20% seen in the early 2000s, the FORVIS report found.

According to Matt Macdonald, the study’s second co-author, companies will need to begin re-evaluating their pricing strategies in coming years.

“It’s the nature of rural telecoms that they hate to raise prices on their consumers because they live in the communities they serve,” he said, “but pricing broadband services at rates that provide the highest broadband speeds at the best value to the customer allows companies to continue fulfilling their mission and serving those customers.”

To read the full report, click here.