Telligen says employee stock plan a success, not ESOP fable

Last month there was news of a lawsuit in which a former employee of a West Des Moines organization claims she was deliberately overcharged in an employee stock ownership plan (ESOP) that was established four years ago as an employee retirement plan benefit.

The article generated a lot of buzz — and surprised me quite a bit — as the complaint insinuates the ESOP was established not for the employees’ benefit, but to enrich some unnamed shady characters who allegedly profited by “unloading their shares at an inflated price.”

Telligen, a West Des Moines-based nonprofit that specializes in health management services, in 2014 formed an employee stock ownership plan that serves a dual purpose of providing an employee ownership vehicle while also enabling Telligen’s foundation, Telligen Community Initiatives, to provide substantial philanthropic grants to nonprofits in its multistate operating region.

The lawsuit, which is actually filed against the original trustee in the ESOP, Bankers Trust Co. of South Dakota, alleges that the transaction “allowed Telligen and/or its principal shareholders and/or other entities controlled by them to unload their shares in Telligen at an inflated price of $37.50 per share and saddle Plan participants with a loan to finance the transaction. Bankers Trust failed to fulfill its duties to the Plan and Plan participants, including Plaintiff.”

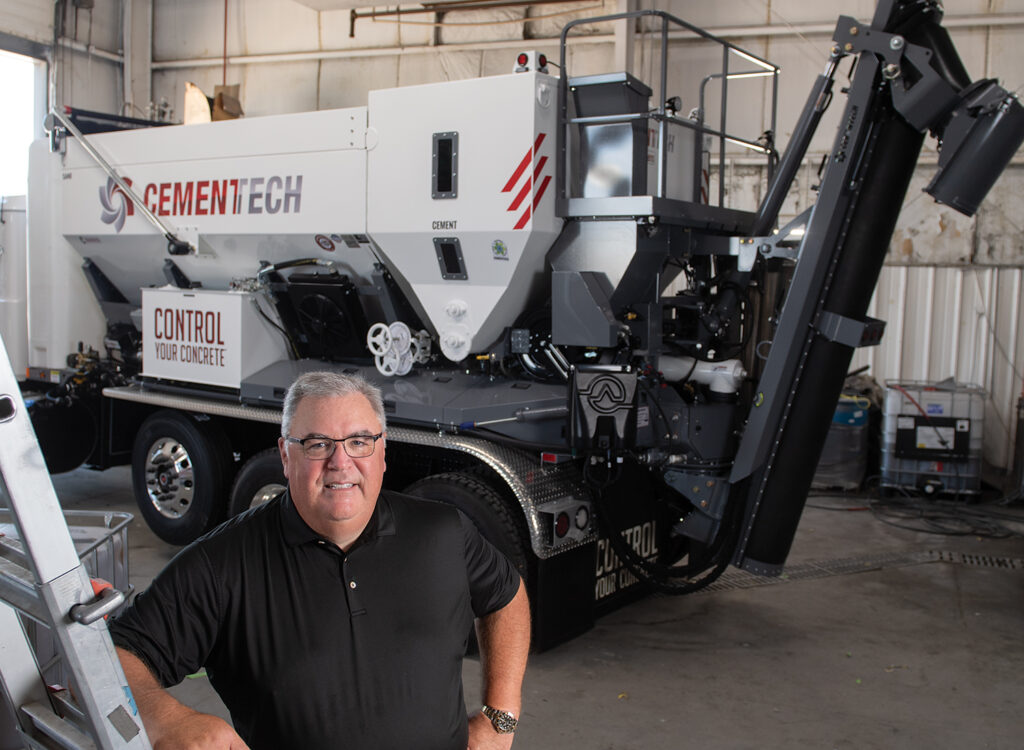

But Jeff Chungath, Telligen’s CEO, says Telligen’s employee-owners are faring extremely well with the ESOP and are “thrilled” with its performance. I sat down with Chungath recently at Telligen’s West Des Moines headquarters, joined by Matt McGarvey, who leads Telligen Community Initiatives. (I first wrote about the plan five years ago as it was being formed. https://bit.ly/2II4bfL)

Because Telligen isn’t directly named as a defendant in the lawsuit, Chungath declined to address any of the allegations directly. But he was happy to provide an update on the ESOP, which he said has actually outperformed initial expectations.

First off, Chungath noted that the ESOP transaction involved the nonprofit selling itself to the ESOP plan, so there were no majority owners that might have profited from a sale, as there could be in more common instances of a sale of a private owner to its employees. As for the loan taken out by the plan, that did nothing to diminish the value of Telligen’s assets, he said.

“I always use the analogy of a house,” he said. “If you buy a $100,000 home and take out a $90,000 mortgage, what you’ve put into the house is $10,000. The house is still valued at $100,000; I could still put that house on the market and get $100,000. That’s what happened with our ESOP transaction. Our company was valued at a certain amount. We took a loan to purchase the assets, and so on our balance sheet you see the value of the company minus the debt.”

Telligen has contributed funds from operating revenues to the plan every year as the loan has been paid down, and the net result is that the plan’s value has increased sevenfold since 2014, Chungath said. In terms of an equivalent benefit level, the annual ESOP contribution level by the plan is now equivalent to 4 percent of an employee’s salary, a level that Telligen’s leaders didn’t think would be achieved until the 12th year of the plan.

“The net increase in value of the [ESOP shares] is far better than any stock index you can think of,” he said. “So our employee-owners have done really well.”

Chungath said he and his employees have continued confidence in the plan’s current trustee, GreatBanc Trust Co., an Illinois firm that acquired the ESOP trust business of Bankers Trust in April 2016.

As with a retirement plan, Telligen’s ESOP allows employees to begin withdrawing funds when they reach 59½ years old. What’s interesting, Chungath said, is that many employees have chosen not to take distributions right away because they wanted to take advantage of the plan’s appreciating value. “That’s something that I never would have predicted,” he said.

The ESOP plan structure also enabled Telligen’s foundation to become a significant philanthropic force that is now benefiting nonprofits in four states. With an endowment of approximately $38 million to draw on, Telligen Community Initiatives has awarded nearly $6.5 million to about 180 nonprofits over the past four years, McGarvey said.

“When this began in 2014, we had historically given in Iowa and Illinois,” he said. “We subsequently grew that to Oklahoma and Colorado. In 2018 we’ll be approaching a $2 million distribution of funds throughout those four states.

“It’s growing in a way we couldn’t have achieved probably in our wildest dreams,” McGarvey said. “It’s really been a rewarding experience to see its growth over the past four years.”

ESOPs popular with construction companies

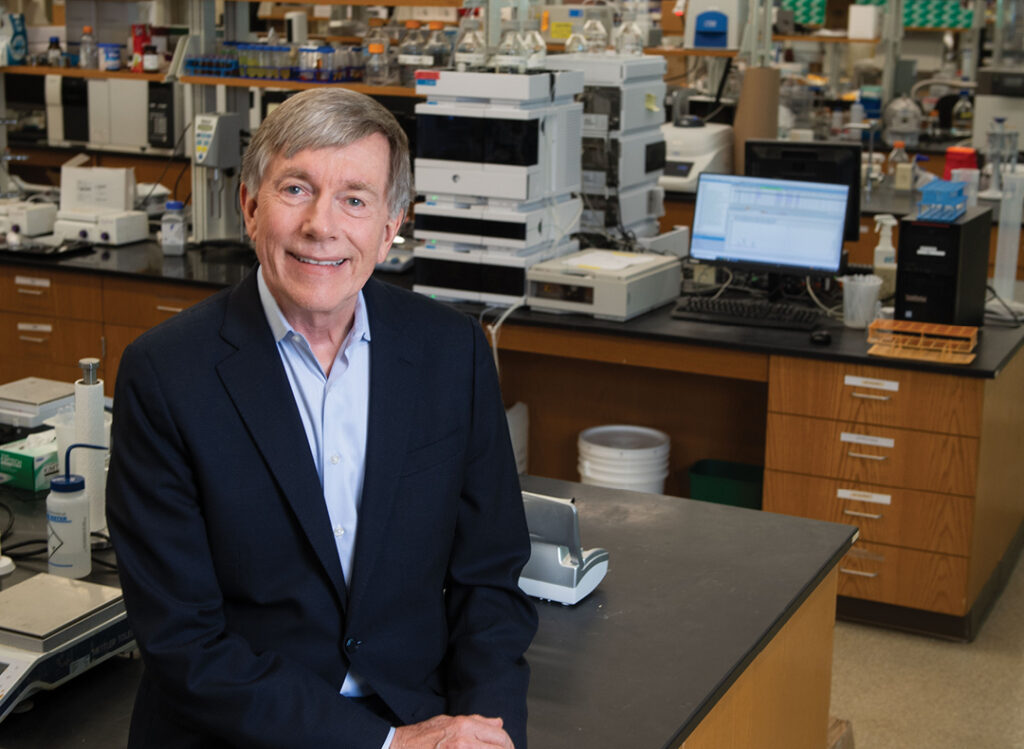

I spoke separately with Greg Weber, senior vice president of BCC Advisers in Des Moines, for a little insight into what’s happening with ESOP formation in Iowa.

Before hearing of Telligen’s ESOP, Weber said he had never seen an example of a nonprofit establishing an ESOP, though he has seen some examples of ESOPs set up by cooperatives.

Most ESOPs are typically funded with the seller’s money, or with a loan taken out by the selling owners.

“It’s pretty unusual, though not unheard of, for employees’ retirement savings to be at risk in an ESOP transaction, because in most cases, it’s the employer that’s funding the trust,” he said.

Generally, ESOPs fit very well with many service businesses, and they’re particularly popular with construction companies, he said.

“I think it’s because these employees are especially hard to retain, and because many of the owners that we work with recognize that construction work is hard on the workers, and that they may need to retire from the physical labor sooner than someone working in an office,” he said. “The ESOP provides additional retirement funds that might help them with a longer retirement.”

ESOPs can also play a significant economic development role in rural communities, Weber said.

“You can have one or two key businesses that are critical to the economy of the community, which if they were sold, would devastate the economy of that community. So they want to sell to the ESOP to provide that continuing support. ”