Two state agencies will work together to administer state historic tax credit program

KENT DARR Feb 3, 2016 | 10:36 pm

4 min read time

965 wordsBusiness Record Insider, Government Policy and Law, Real Estate and DevelopmentThe Iowa Economic Development Authority and the Iowa Department of Cultural Affairs are meeting to work out the details of how they will oversee the state’s historic tax credit program.

For the past two weeks, representatives from both agencies have met to work out details of the partnership as the registration window for an estimated $10 million in credits opens on Feb. 15 and ends Feb. 29 for projects of more than $750,000. Up to 20 projects could qualify for the funding, which would be awarded before the end of the current fiscal year. Gov. Terry Branstad has recommended a $45 million allocation to the program in fiscal 2017, which begins July 1.

First up are two important goals:

1. Clearing a logjam of projects waiting for funding.

2. Eliminating what one state official said was a false impression that some developers using the credits were attempting to defraud the program.

“There is no fraud in the program,” Iowa Department of Cultural Affairs Director Mary Cownie said. The department has been charged with administering the program and now will share that responsibility with IEDA.

Developers have said that pending projects have been put on hold because of uncertainty about whether they can receive the credits, while others say that in some cases, they have spent millions of dollars on finance fees as they carry loans that were supposed to be paid off after the credits were issued for completed projects.

After a series of meetings with representatives from the Department of Cultural Affairs (DCA), the Iowa Department of Revenue, the Iowa attorney general’s office and others, some developers have said that they have come away with the sense that they are suspected of defrauding the program.

That is not the case, said Steve King, who directs the DCA’s state historic preservation office.

“We can’t help what people hear, but we have never used the term fraud,” he said. “If there was fraud, we wouldn’t be issuing tax credit certificates, and I have signed enough of them in the last couple of weeks. We are continually refining our process to get the certificates issued.”

At issue were lengthy audits of historic preservation projects by the Iowa Department of Revenue. However, Cownie said the department provided a valuable service to the program by determining the proper methods for filing claims for tax credit certificates.

The controversy has been simmering since the end of May, when new rules were adopted to implement the changes to the state historic tax credit law approved by the 2014 Iowa Legislature.

That legislation initially drew mixed reviews from developers, as it eliminated a first-come, first-served process for approving projects for a program that gave priority to projects on which work was ready to begin. However, it also established a method by which the tax credit allocation would be determined during an early project review.

When the rules were adopted, the Iowa Department of Revenue replaced the Iowa Department of Cultural Affairs and its State Historical Preservation Office as the source of last review of projects before a final allocation of tax credits.

Some developers said they were caught off guard by the intense scrutiny of their projects by the Revenue Department. Prior to the implementation of the rules in May, developers would have their accountants review project expenses and determine whether they qualified for state historic tax credits.Read more about the issue >>>

However, developers, bankers and others involved in the program also said that the changes brought more predictability to the program. Cownie echoed that sentiment, saying that under older rules in which credits were awarded on a lottery system, projects that weren’t ready to cash in on the credits received them while other projects waited out their turn in the lottery queue.

King pointed out that a similar dust-up surrounded the federal tax credit program and said some of the uncertainty results from the “intersection” of the state and federal programs.

The Iowa Department of Revenue will now move to the back end of the tax credit review process, Cownie said.

The IDR review has “identified the need to provide better guidance, especially regarding the financials,” she said.

Tina Hoffman, a spokeswoman for IEDA, pointed out that her department has expertise with a range of economic development programs and that experience can be used to streamline the historic tax credit program.

“Ultimately, the review of applications and compliance will move to IEDA because we run programs like that already,” she said.

Cownie said both departments still have to determine the extent of the backlog of developers waiting for tax credits.

“We met for first time last week and we are meeting this afternoon,” she said. “We will focus on working through the transition. We have to understand what is under review, where it is in the process.”

The first public acknowledgment that a resolution to the controversy might be at hand came last week during the Business Record’s Economic Forecast Luncheon, when IEDA Director Debi Durham responded to a question from Des Moines City Councilwoman Christine Hensley.

After giving the historic tax credit program a strong endorsement, Durham said her agency and the DCA were working on breaking the impasse.

Hensley later told the Business Record that she gave Durham a heads-up before the luncheon that she was going to ask about efforts to deal with historic tax credit program.

Durham said “she wasn’t going to bring it up unless she got the question. I told her I was going to ask the question,” Hensley said.

Hensley has played the role of arbitrator during the controversy, urging state officials to find a solution.

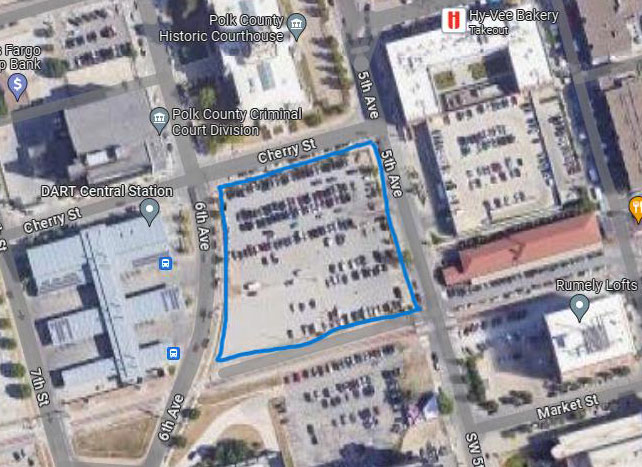

Meanwhile, work is expected to resume on the renovation of two buildings on Southwest Fifth Street as a result of anticipated improvements in the historic tax credits program.