University Research: Be careful what you bargain for

Mergers can be a quick way to grow the business, but there are hidden threats

Overview:

In mergers and acquisitions, some not-so-friendly competition from competitors can drive up costs and force the original suitors to rethink their plans for the future.

Examples abound. Meredith Corp. found itself in a similar situation when it attempted a merger with Richmond, Va.-based Media General Inc. A competitor stepped in and Meredith eventually backed out, taking $60 million in termination fees with it, but also facing new challenges in how it would continue to expand its operations.

Marriott International Inc. recently pulled off the acquisition of Starwood Hotels and Resorts, but the deal had its challenges. A Chinese insurance group made a competing offer and added a substantial amount to the cost of Marriott’s purchase.

David King, an associate professor at Iowa State University, and Svante Schriber of the Stockholm Business School in Sweden have researched the effects of competitive retaliation in mergers and acquisitions.

“Meredith has to come up with a new path forward and will have to repeat a lot of the work it did before the deal went bust,” King said.

The Method:

King and Schriber examined the effects of mergers over the last decade in the telecommunications industry.

Results:

Using their own research and other research on acquisitions, King and Schriber found that acquisitions do not always have a positive result for the acquirer.

“By developing a perspective of competitive dynamics surrounding acquisitions, we shift the dominant perspective in acquisition research that examines the potential and realized value from a combination of acquirer and target firms to considering the risk of competitor responses designed to lower the performance of an acquirer,” they wrote.

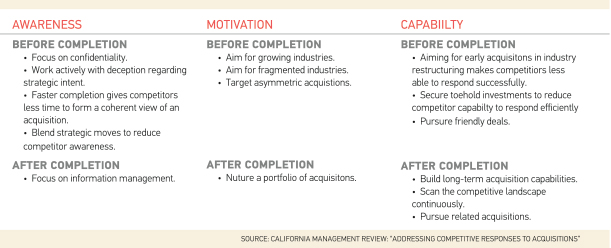

The researchers compiled 15 tactics that companies can use during different stages of an acquisition, from the time a firm selects a company to acquire, to final shareholder approval and after the deal is completed and the two companies are integrated.

See the table below for a summary of those tactics.

Conclusion:

“There are multiple options within the existing system to limit the vulnerability,” King said. “Companies need to be careful. It’s not just the firm’s public disclosures that can help the competition. Anyone who wants to research it can find the information.”

For example, researchers can look at records for private jets to track activity of corporate executives. King and Schriber talked with executives who learned of a deal after overhearing a conversation in public, and another case in which details outlining the merger were left on a whiteboard in a legal office.

King, a retired Air Force officer, said that in the military they discussed a sensitive deal to the accompaniment of white noise. That might seem extreme, but “it pays to be paranoid” when pursuing multimillion-dollar deals.

Resources:

For more information, contact David King at drking@iastate.edu or obtain a copy of the report here: http://cmr.berkeley.edu/browse/articles/58_3/5821/