What’s stressing out American workers?

54% say it’s money matters or financial challenges. That’s why … More organizations are offering financial wellness programs as an employee benefit.

JOE GARDYASZ Sep 8, 2020 | 8:50 pm

12 min read time

2,828 wordsBanking and Finance, Business Record Insider

As Iowa heads into autumn and open enrollment season begins, benefits become top of mind as organizations and workers consider the choices they’ll be making for the coming year. This year, financial security and money knowledge have become more critical than ever for many families, given the economic uncertainty stemming from the ongoing pandemic. So it’s not surprising that financial wellness is becoming a sought-after benefit choice.

An estimated 53% of U.S. companies now offer some type of financial wellness program, compared with just 24% in 2015, according to Bank of America’s annual 2019 Workplace Benefits Report. The findings are based on a nationwide survey of 996 employees and 804 employers that participate in 401(k) plans.

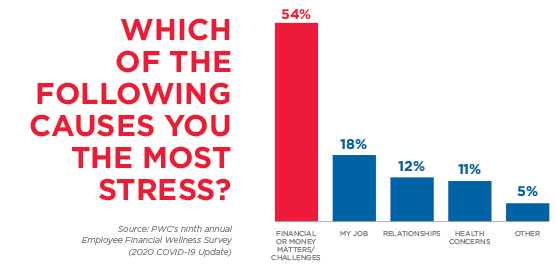

A separate survey conducted by PricewaterhouseCoopers in May found that financial stress was the top factor creating anxiety for Americans, with 54% saying that financial or money matters cause them the most stress, ahead of their job, relations and health concerns.

“I think employers are recognizing that employees need support [in multiple areas], with financial wellness almost being the tip of the spear,” said Ali Payne, president of ethOs, a Holmes Murphy affiliate that specializes in advising organizations on holistic benefit offerings. “In this pandemic year, how do you offer something that can support employers in that space?”

Among the offerings that Iowa employers have available is the Iowa Financial Fitness Challenge, a free program that has been offered for the past seven years through the Iowa Insurance Division, and was recently extended for an additional three years.

This week, hundreds of employees from 46 organizations across Iowa will begin the latest offering of the Iowa Financial Fitness Challenge. Offered twice a year to employers since 2013, the state-funded program provides a virtual series of one-hour, self-paced financial literacy instruction aimed at helping individuals improve their knowledge of basic finances and boost their confidence in making financial decisions.

Financial Fitness Group, a San Diego-based e-learning software company, recently extended its partnership with the Iowa Insurance Division to continue providing the financial education courses in Iowa for the next three fiscal years.

Needed: Better money management skills

Increasingly, organizations are finding that financial wellness benefits can serve as both a competitive advantage in attracting and retaining talent and as an important tool for reducing employees’ stress and thereby boosting productivity levels.

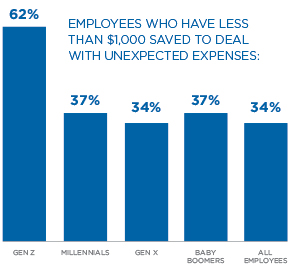

As highlighted in a recent national survey conducted by investment brokerage Charles Schwab, the COVID-19 pandemic and the resulting economic crisis have exposed how financially vulnerable many Americans are.

According to the survey results, 50% of adult working-age Americans said they would experience financial hardship if they had to cover an emergency expense of $1,000 or less in the next 30 days.

Respondents indicated they wish they had better money management skills. When asked what they would teach their younger selves about personal finance based on what they know today, Americans said the value of saving money (59%), basic money management (52%), and how to set financial goals and work toward them (51%).

“Financial illiteracy is insidious,” said Carrie Schwab-Pomerantz, president of the Charles Schwab Foundation, in a press release promoting the firm’s research. “The antidote is financial education, which gives people the skills they need to make smart money decisions and can help improve their lives.”

Consistent funding distinguishes Iowa’s program

Each course in the Iowa Financial Fitness series takes about an hour to complete and is accessible at any time from a laptop, tablet or smartphone. Users take the courses at their own pace and can take as long or as short a time as they want to complete it.

All of the funding for the program comes from the state’s Investor Education Fund, which is made up entirely of fines and fees paid by regulated entities within the insurance and investment industry and which are required to be spent on investor education. Over the past seven fiscal years the insurance division has invested more than $2.3 million, or an average of about $329,000 per year, in the program. The state’s renewed contract calls for a maximum allowable cost totaling $1.25 million over the next three fiscal years.

“We’re proud to help Iowans take steps toward a more secure financial future,” Iowa Insurance Commissioner Doug Ommen said. “I encourage all employers and affiliate organizations to join us in providing these resources to their employees and members. It’s free and easy to do, but can make a big impact to Iowans.”

In the past seven years that the program has been offered in Iowa, the Iowa Financial Fitness Challenge has engaged more than 450 employers and more than 30,000 Iowans to complete over 100,000 hours of online coursework to improve knowledge about money.

Those completing the program indicate significant gains, according to the Iowa Insurance Division. The average improvement has been more than a 70% increase in aptitude, behavior and confidence as measured through pre- and post-surveys and quizzes taken by participants.

The course content reflects more than two decades of experience from Financial Fitness Group, co-founded by

Joe Saari, a former University of Wisconsin professor of entrepreneurship who is also a registered investment adviser. In an interview with the Business Record, Saari said his company’s unbiased content and interactive, online format have made it attractive to businesses to offer their employees.

While he was an MBA student at UW in Madison, he and a faculty member began developing the interactive courses to help people to learn about managing money.

“Little by little, the popularity of the content began to grow, and we went from $10,000 to $25,000 to $50,000 to $100,000 [in revenue] and I decided I can actually make a career out of this,” Saari said. “So after about seven years I left the university and devoted myself full-time to helping teach people about money.”

Now in business for 22 years, Saari’s firm has provided financial literacy courses to more than 1,000 employers directly nationwide, among them state government programs in just under 20 states over the past decade. Also among its clients are about 100 financial services firms that use Financial Fitness Group’s unbiased educational content for their websites, including Morningstar and New York Life Insurance.

Among its state government clients, Iowa is relatively unique in having established a stable and consistent funding source for financial literacy education, Saari noted. In comparison, most other states will provide a financial literacy program only in years when funding materializes. For instance, Wisconsin has worked on and off with his firm in the past decade, but only as funding from occasional grants or settlements has allowed it, he said.

The number of Iowa organizations that participate has varied widely over the past seven years, as have the total number of participants, which can swing much higher when large organizations such as Genesis Health System or the Des Moines Public Schools sign on, Saari said. “The team has been very focused that they need to serve all employee groups, not just targeting large employers. It’s important to reach this half of the population that works in small businesses.”

This year, 19 of the 46 Iowa organizations enrolled have participated in a prior year, said Georgette Regan, director of marketing for Financial Fitness Group. “We have seen an uptick from past employers,” she said. “I think from the sense of urgency for 2020, I think we definitely see an uptick in interest in using the program or extending it out to other people.”

Principal: Improving confidence leads to positive action

Principal Financial Group has offered financial education resources to its clients for many years, and is constantly working to update and improve them, said Joleen Workman, vice president of customer care for Principal’s

Retirement and Income Solutions business.

“What really sits at the core of this is that many Americans are not confident when it comes to making decisions around their financial well-being, because it’s very complex,” she said. “I always think about it as a marathon, not a sprint. And you have some injuries along the way, right? COVID is probably one of those things where it’s definitely been a blip, and how do you recover from that?”

Surveys indicate that about half of Americans say they are stressed out because of their financial situation, Workman noted. Principal’s research points to ways to counter that, she said.

“From a lot of research that we’ve done over the years, one interesting nugget that comes out of that is about confidence,” Workman said. “Confidence is really the key to being able to understand and make decisions. And so everything that we have built over the decades really is around that confidence — how can we make sure that we continue to bring the right tools, education and content, so that individuals have the right conversations so that they can build confidence? That leads to more action, and ultimately that helps them with their financial future.”

Two years ago, Principal launched an expansion of its financial wellness resources by partnering with iGrad, a financial wellness company, to offer its Enrich platform as part of its Principal Milestones program. The program also includes a partnership with ARAG to provide participants with will and legal document preparation services as part of the planning process.

One example that points to the effectiveness of Principal’s financial education modules, Workman noted, is an average 39% gain in knowledge related to knowing how to establish and stick with a personal budget when post-course test scores are compared with pre-course test scores.

Principal has also addressed another stress-inducing financial need — finding money for college — by adding resources for parents with college-bound kids to search for scholarship opportunities.

“We now have aout 116,000 scholarships that are available that add up to about $200 million, and participants love this addition to the programs because they’re all faced with [the issue], what are we going to do when our kids go to college?” Workman said. “We have many, many individuals taking advantage of these scholarship opportunities, and they’re following up with us to share that they did get a scholarship through the program.”

Most recently, Principal has added content to the program related to navigating the COVID pandemic, such as home-schooling resources and stress-reduction techniques for staying healthy and sane while the entire family may be working and attending school from home.

While Principal’s financial wellness materials online can’t claim the same kind of popularity that shopping sites like Zappos or Amazon command, Workman said her company is pleased with the usage by client companies.

“We are definitely seeing an increase in [usage] of our program, and that would be captured by the number of individuals who are taking advantage of our webinars,” she said. “We’ve seen a 400% increase during COVID in the number who are taking advantage of our virtual one-on-one conversation — so that one is really significant.”

To put that number in perspective, that increase reflects a fourfold increase in activity by 100 Principal employees who deal exclusively with helping customers all day long, Workman said. “We’re very pleased with the increase that we’re seeing in our financial wellness services, and we’re continuing to expand those, given what’s happening in the world.”

Taking a holistic look at personal finances

Across the metro in Waukee, Payne said ethOs works with employers in building holistic benefits strategies that recognize needs of the multigenerational workforce.

Payne said she is aware of the Iowa Financial Fitness Challenge as one of the resources available to employers.

“Any of them really are helpful, because most employees haven’t done something like that,” she said. “I always think that if you can get someone an advocate, I do think it’s helpful. Some programs get you paired up with someone to talk to, which keeps you more highly engaged than if you were trying to do it on your own.”

More employers are recognizing that there are now more generations working together in the workplace than ever before, Payne said. “So there isn’t just one solution that’s right for every employee. A lot of retirement plan administrators have a lot of great education resources at their fingertips. But there are resources that go beyond retirement planning. So we’re even seeing things like student loan repayment programs coming into play.”

Among the tried-and-true options for financial education that Payne also recommends to clients, depending on their demographic needs, are the Dave Ramsey programs, which tend to apply better to older workers, and Pete the Planner, which takes a more lighthearted approach.

“We always recommend to first look at what you have before purchasing additional resources,” she said. “Many times those resources are focused on saving, but when you’re talking to someone fresh out of college with student loans or who has a lot of credit card debt, they’re not thinking about saving yet. We’ve found that a lot of programs are about helping them to learn how to spend better.”

Are younger employees more likely or less likely to desire financial education as a benefit?

“I think one thing about younger generations is that they’re looking at work differently, such as gig work,” Payne said. For instance, someone may decide to work for six months and then take the next six months off to travel.

“They are just thinking about finances very differently than when I came out of college. There is a big percentage of people coming out of college who are not looking for a career — they’re looking to fund a lifestyle. It’s interesting because employers are starting to get more creative about how they structure work and what they’re doing around their employee value proposition. We’re finding employees would often rather take a lower salary and have more flexibility.”

The pandemic is also helping to drive change in the desire for flexibility, Payne has found. With the shift to schools providing virtual learning, “people are saying, I’m going to take six months off at home, and if my job isn’t here when I get back, I’ll find something else.”

From Payne’s perspective, “the really cool thing about all the financial literacy stuff is how many resources are out there,” she said. “But it takes work to learn about those resources. Anyone who has a direct report should know about the resources in those buckets.”

Use of alternative financial services higher among millennials

The use of alternative financial services such as auto title loans, payday loans, pawnshops and rent-to-own stores is high among millennials. Forty-three percent of millennials resorted to the use of at least one type of alternative financial services (AFS) in the five years preceding the 2018 survey, with pawnshops being the most prevalent form. By comparison, only 25% of the older working-age population used one or more forms of AFS in the five years before the survey. Millennials’ AFS use was also more common in 2018 relative to their young adult peers in 2009. Steep fees and interest rates (sometimes over 400%) associated with these services can create and add to millennials’ financial distress. Among millennials, African Americans and Hispanics are more prone to AFS use, as are individuals who are divorced, separated or widowed.

Source: TIAA Institute (“Millennials and money: The state of their financial management and how workplaces can help them”)

Five steps to shore up personal finances

With millions of Americans out of work and the future of unemployment benefits uncertain, many people are questioning how best to manage their money right now. The Charles Schwab Foundation recommends five key steps every American can take to help shore up their finances during this period of uncertainty.

1. Start an emergency fund (or add more to it) to help protect yourself against an unexpected drop in income or expense shock. Set aside whatever you can – every little bit counts. Try to aim for $1,000 to $2,000 to get started, and then work your way up to three to six months’ worth of essential expenses over time.

2. Create a budget to help you prioritize and assess your financial resources. Self-isolation has led to different spending patterns for many people, including cutting back on what we may have previously thought of as “essential.”

3. Create a financial plan to help you navigate from where you are to where you want to be. You don’t need to have a lot of money to need a financial plan. Consider it a road map to reach your financial goals, whether that’s to pay off debt, build savings or make a large purchase.

4. Ask for help if you’re struggling. Given the scale of this economic crisis, the government, lenders and creditors are trying to work with borrowers through this difficult time. Don’t hide from creditors – that can make things worse.

5. Focus on what you can control. You can’t predict or control the market, but you can control how you manage your investments, your savings rate, having a financial plan and how you react to events.